Van’s Note: Van Bryan here, Jeff Brown’s longtime managing editor. At the end of every year, I sit down with Jeff to discuss his biggest predictions for the coming year. Remember, you can always catch up on earlier editions in this series by going here.

Today, I sat down with Jeff to discuss the future of precision medicine. I asked him to share his biggest predictions for CRISPR genetic editing technology and reveal why biotechnology is having its “crypto winter” moment.

Read on…

Van Bryan (VB): Jeff, let’s talk a bit about biotechnology and precision medicine. To catch new readers up, could you just remind us of what you mean by precision medicine.

Jeff Brown (JB): “Precision medicine” is a term that describes a convergence of technologies that will help us live longer, healthier lives.

Precision medicine includes technologies like artificial intelligence (AI), genetic sequencing, and genetic editing. I typically contrast precision medicine to the healthcare we have today.

Right now, our medicine is very reactionary. We only seek help when symptoms present themselves. But with this new paradigm, our healthcare becomes proactive and personalized.

In the near future, it will be common for us to sequence our genome and spot disease years before symptoms present themselves. And personalized, genetic editing therapies could be used to address the problem right away.

VB: And when we spoke last year, you predicted that two or three genetic editing companies would go public. How did that prediction turn out?

JB: I got that one right. There were several, actually.

Some of the notable ones were Caribou Biosciences – a CRISPR genome-editing company – Verve Therapeutics, Decibel Therapeutics, and Graphite Bio. Another interesting one was Sana Biotechnology, which is a cell engineering company.

And when we spoke last year, I referred to these new companies as a “second crop” of genetic editing IPOs (initial public offerings). That’s because these companies are building on some of the foundational work that is already done for CRISPR genetic editing.

My longtime readers will remember this, but some of the very first recommendations I ever made were for CRISPR genetic editing companies Intellia Therapeutics (NTLA), Editas Medicine (EDIT), and CRISPR Therapeutics (CRSP). I usually refer to these companies as “the big three.” Some of these recommendations were as early as 2016.

Back then, the technology was not well understood. And I think I was one of the few analysts doing extensive research on it.

But I saw what was happening. These companies were building a “toolkit.” It was a toolkit that promised to do incredible things, cure diseases that had previously been untreatable.

And what’s happening now is that all these new entrants are taking this toolkit and making it their own.

VB: Could you give me an example?

JB: One example is a company called Prime Medicine. It was co-founded by a man named David Liu. He was one of the founding scientists of another genetic editing company, Beam Therapeutics. Beam had developed its own approach to genetic editing, what they called “base editing.”

And now there is Prime Medicine, which developed an approach called “prime editing.” This is one more form of genetic editing technology. The company has a “search and replace” technique with the potential to permanently cure disease caused by genetic mutation.

All of this has been built on the back of CRISPR genetic editing technology, this toolkit that has been created over the last several years.

When I look back at 2021, that’s what stands out to me. There was widespread proliferation of this genetic editing toolkit.

VB: And the goal of this technology is to find cures for diseases that don’t currently have a treatment?

JB: Yes, but it’s more than that. I’ve been researching and writing on CRISPR genetic editing for over half a decade now. Some of us who have been with me that entire time might think there’s not much left to the story. But we must remember that this is still largely a greenfield opportunity.

Companies are taking this toolkit, and they will target a disease that does not have a treatment. But they are also targeting disease that does have an existing treatment. Why would they do this?

It’s because precision medicine is not just a slightly better version of what already exists. It’s believed that genetic editing technology is far superior to existing methods. It represents an entirely new approach to healthcare in general.

This trend is very disruptive in that sense. It’s almost as if the entire scope of biotechnology and pharmaceuticals is a target for genetic editing technology. That’s why the opportunity is so exciting.

VB: In the past, you’ve said that the 2020s will be the “decade of biotech.” But biotechnology stocks have had a difficult year.

The Nasdaq Biotechnology Index is down about 2% year-to-date. Meanwhile, the broader Nasdaq Composite is up almost 20%. With that said, do you still believe the 2020s will be a golden age for biotechnology?

JB: I do. It may sound counterintuitive, but one of the biggest headwinds for early stage biotech right now is the public policy response to COVID-19. Early stage biotech companies live and die based on clinical trials. But with lockdowns and restrictions, it has been so difficult to conduct clinical trials.

Many patients avoided clinics and hospitals. Many didn’t show up for follow-up appointments. This environment makes it very difficult to conduct clinical trials. The entire industry was affected by this.

Fortunately, I think we’ll finally see an improvement in this area in 2022. We have this backlog of early stage clinical trials that are set to make announcements next year. And I’m going to skip ahead and make my next prediction.

I predict we will see at least two major therapeutic announcements around genetic editing technology. In other words, we will see two strong proof points that demonstrate that genetic editing technology works and that it is durable, safe, and effective in treating whichever disease it targets.

VB: That’s great, Jeff. Anything else you’d like to say before we conclude?

JB: Even though the industry has faced headwinds this year, I want readers to know that I haven’t “given up” on this technology and industry. I’m as bullish as I’ve ever been on precision medicine, CRISPR genetic editing, and biotechnology.

This year, we actually did a few important things to bolster our research capabilities in this area. First, Brownstone Research hired a full-time biotechnology specialist. This team member comes from the industry. And he’s been a great asset for our biotech research.

The other thing I did was do some “boots on the ground” research. Earlier this year, I went to South San Francisco, where many of the best biotechnology companies are headquartered.

Jeff at Atreca

Jeff in front of the headquarters of Atreca, a model portfolio company within Early Stage Trader

And while I was there, one thing stood out. The area is booming.

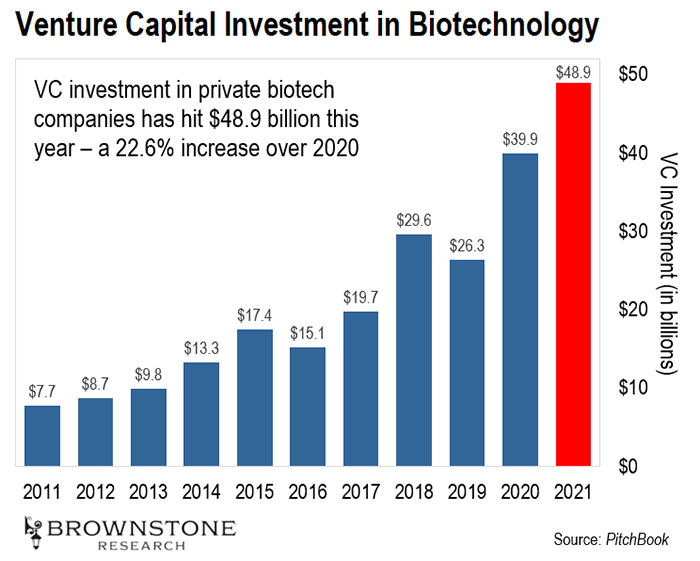

I couldn’t believe the amount of new construction. Cranes, construction, and new buildings were everywhere. And almost all of it was to support the incredible levels of venture capital investments pouring into early stage biotechnology.

That’s another important detail to remember. While asset prices for many biotechnology stocks underperformed this year, the level of venture capital into this space is at record levels. And we’re seeing record levels of biotech IPOs.

This reminds me of a dynamic we saw recently in the crypto markets.

VB: How so?

JB: Many of us probably remember the so-called “crypto winter” that lasted from the second half of 2018 to April 2020. From the January 2018 peak of $692 billion, the total cryptocurrency market capitalization fell to $93.4 billion, an 86.5% decline. That was a painful time for digital asset investors.

But the development of the industry never stopped. Venture capital into blockchain projects continued to increase during this time. Everybody continued to invest. The best projects went all-in on the technology.

And what happened as a result? Blockchain and cryptocurrency markets just had a year for the record books.

And it’s all because of what the industry went through during 2018, 2019, and the start of 2020. The total cryptocurrency market capitalization today is close to $3 trillion. There was a time not so long ago when an investor could have bought one bitcoin for around $3,000. Today? That asset is close to $60,000, an almost 20X return.

We are seeing the exact same thing happen right now in the biotechnology space. We could say that biotechnology is having its “crypto winter moment.” But it will come roaring back. I think we’ll have a lot to look forward to in 2022.

VB: Thanks for your time, Jeff.

JB: Of course.

P.S. Be sure to check your inbox tomorrow. I’ll ask Jeff for his biggest prediction around artificial intelligence in 2022, we’ll discuss the AI breakthroughs of this year, and you’ll discover why “conversational AI” will enter our lives faster than most think.

And as Jeff shared today, precision medicine and biotechnology are gearing up for an exciting year in 2022. If any readers are looking for Jeff’s top biotech and precision medicine recommendations for next year, go right here.

Like what you’re reading? Send your thoughts to [email protected].