Dear Reader,

Welcome to our weekly mailbag edition of The Bleeding Edge. All week, you submitted your questions about the biggest trends in technology. Today, I’ll do my best to answer them.

If you have a question you’d like answered next week, be sure you submit it right here.

Let’s begin with a couple of questions on what to buy now…

Hi Jeff, I’m an Unlimited member who’s doing his best right now to hang in there. I keep hearing people say that now is the time to be buying. If that’s true, do you think you could publish a list of your top 10 overall recommendations from among all your services that you would double down on? Thanks, love the service and all the updates.

– Frank B.

Jeff, I am currently in most of your recommendations, and I understand your recommended strategy to invest the same level of $ in each stock. However, assuming I had a few dollars to add to a few positions to downside average, it would be great if you could offer a short list of the stocks in the portfolio that you think have the best chance to outperform in the future – kind of a buy-first list if you will. Thank you.

– Gregory T.

Hi, Frank and Gregory – you both asked very similar questions, so I will address them both together. Thanks for writing in.

In this market volatility, it can definitely be difficult to determine the best places to put our capital.

Yet as I’ve written before, these kinds of pullbacks can be an excellent opportunity to buy over-punished stocks. Fears about interest rates and inflation have dragged down the markets… and many stocks have been sunk to irrationally low levels.

With the number of companies I recommend in my services, however, I know it can be a challenge to pick and choose which ones to allocate our extra money to if we would like to average down.

With that in mind, I’ll offer a few suggestions based on our Near Future Report portfolio. This service recommends large-cap technology companies appropriate for more conservative investors. They are blue-chip companies that will grow safely for years to come and dominate their respective fields.

And given the current volatility, these larger, more mature companies tend to be more resilient, which may be more comfortable for investors until the market restabilizes.

My top five large-cap growth picks, in this case, are the following:

Illumina (ILMN), the undisputed king of genetic sequencing technology

Corning (GLW), a high-tech powerhouse that makes everything from fiber-optic cables to the “Gorilla Glass” used in our phones

Advanced Micro Devices (AMD), a producer of semiconductors critical to artificial intelligence and machine learning, as well as graphics processing

Taiwan Semiconductor Manufacturing (TSMC), the largest and most bleeding edge semiconductor foundry in the world

Adobe (ADBE), a software company at the forefront of digital publishing and the creator economy

Each of these companies would be a great choice for allocating capital or averaging down. Opportunities to acquire shares at these levels are rare.

As always, please remember to position size appropriately. We never want to go “all in” on a single investment, and that is especially true at times like these, with high levels of volatility and uncertainty.

And if any readers would like to receive more specific guidance with timely buy and sell alerts, then please consider checking out the Near Future Report right here.

I know it can be stressful in these volatile moments. My team and I are working hard to provide regular analysis and updates to empower us to make good decisions, weather the storm, and take advantage of fantastic buying opportunities when they present themselves. Much better times are ahead.

Next, a reader wants to know more about private investments…

Hello Jeff and team, If you have time, I have a few questions for you.

Our investments in [Day One Investor recommendations] were valued around $10 to $35 million. You say that [our latest recommendation] at $80 million is “very attractive.” If the value cap is lower, doesn’t that mean there is more upside potential? Could you explain why you consider $80 million to be very attractive?

If I remember correctly, in your Crypto Placements Summit you said that for certain non-crypto companies, earlier investors had to wait 8–9 years to see the stratospheric gains shown in your examples. Your point was that crypto placements happen on a shorter timeline. My question is about our other (non-crypto) investments.

Is it likely that many or most of them could take 8–9 years? For some reason, I had the impression that it would be closer to 5 years or less. I’m 63 years old. I will be 68 when your year 5 recommendations come out. If we add 8–9 years for the investment to play out, well, I could be gone by then! For now, I will keep investing, but I’m not so sure it would be wise in a few years. Any thoughts?

And a related topic. Do you have any information on transferring these illiquid, unrealized investments to family members? Many thanks for all you do,

– Steve G.

Hello, Steve, and thanks for writing in. These are great questions for private investors to consider and understand.

I’m glad you wrote in with your questions. And first and foremost, I really hope that you stay in good health so that you can enjoy an even better retirement.

We’re about to enter what will be known as the golden age of biotechnology where most diseases will have cures. So if we can take good care of our bodies this decade, the doors will open to much longer lifespans well beyond 100 years old… and still in great health. 100 will become the new 70.

For your first question, yes, investing at earlier stages and cheaper valuations often gives us even better upside potential for promising companies. With that said, it really depends on how large and valuable any given company becomes.

The companies that I recommend in Day One Investor will almost always be valued at less than $100 million. This is purely a reflection of investing at the earliest stages of a company’s development. And this maximizes the future return potential of our investments.

The actual valuation that we invest at will always depend on a variety of factors. Some of the companies that we have been able to invest in, we’ve done so at the very first funding round. Others might be in the second or third round.

Some companies will be pre-product revenue, and others will already have a product in the market generating seven figures of revenue.

And valuations will depend on where the company is in its development, what the current and future revenue forecast looks like, the industry growth, and can even be affected by the overall market sentiment.

Also, there is a difference between a pre-money valuation which we would refer to as a “priced raise,” versus a valuation cap like our last crypto placement. A valuation cap simply sets a maximum valuation that our investment would convert at.

In that way, it protects our investment. That’s why I really don’t like uncapped raises using any kind of convertible instrument. And if the next raise happened at a lower valuation (highly unlikely), we would benefit from conversion at that lower valuation.

An attractive valuation depends on these factors. Certain companies will be attractive at $80 million and others will be attractive at $12 million. And while it may be an obvious thing to say, I would never recommend a company at what I considered to be an “unattractive” valuation.

I have passed on several prospective Day One candidates simply because I felt that the valuation was unrealistically too high for the company. I have seen this a lot over the years in the crowdfunding industry.

Many companies try and raise at inflated valuations at the expense of normal retail investors. This is a serious issue for me, as I believe that the company is taking advantage of normal investors who might not understand what valuation is appropriate for their company.

As for the timeframe, the honest answer is that it depends on the individual company. I’ve seen companies like Slack go from a small 8-figure valuation to $1 billion in less than a year.

Those kinds of compressed timeframes are possible, and we could be in and out of an investment in a matter of two or three years. That will happen, especially when a hot company gets acquired early.

Some will take a longer period of time to mature. On average, I’m expecting our best exits to happen within 5–8 years, and I know we’ll have a bunch that will exit sooner than that.

What I can say is, these timeframes have been contracting. The reality is that companies are able to grow far more quickly than ever before in history. This is very bullish for private investing.

I’ve been angel investing for two decades now and I can tell you that I’ve never been more excited than I am right now.

My crypto placements will likely be on the shorter end of the range of timeframes. This is a reflection of how quickly popular projects can grow in the blockchain industry. And some of my crypto placements will be convertible directly into tokens, as opposed to equity.

In this case, liquidity could come in less than a year. The decision then becomes, do we want to hold onto the token and let it increase in value, or do we want to take profits off the table? The answer, of course, is that each investor will need to make their own decision about what to do

As for transferring these investments to family members, I’d recommend speaking with an estate planner or attorney to ensure that we have a will in place to clarify our beneficiaries for these investments – and any others. A good adviser can help us ensure that we are prepared for any eventuality.

It’s great that you bring that up because I do expect that some of our investments will continue to grow in value and outlive their utility to us. They may very well be suited best to hand down to our children or grandchildren, and perhaps be placed in a trust for future generations.

I will have some more to say on this topic over the next couple of months. I’ve been tracking an exciting development that will actually provide some liquidity to some of our private investments. As soon as this is confirmed, I’ll provide a more detailed update in Day One Investor.

I’m excited about this because life always throws us some curveballs, and there may be times when exiting an investment early helps us deal with what has been thrown at us.

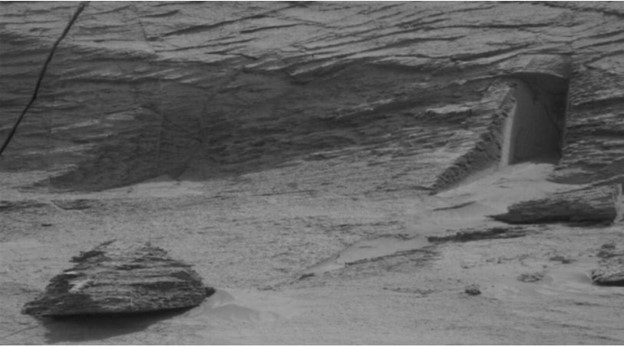

Let’s conclude with some questions about the mysterious “doorway” on Mars…

Even though it is 17×11 inches, the structure is odd. The whole rock/mountain looks like a shale type, going horizontal not vertical. So the sides (vertical) don’t look natural?

– Alice G.

I find it very interesting that the size of the “doorway” implies it is likely not one to so many people. What possible reason would they need to be taller than two or 3 inches? Truly, what is more curious is the fact that the angles are 90° or right angles. This is extremely unusual in nature… Curious to hear what others think.

– Adam Z.

Mother Nature doesn’t usually create rectilinear structures at the macroscopic level (e.g., squares, rectangles, cubes, container ships, cargo rail cars). That doesn’t mean it can’t happen. It just means that it is not likely on a probability level… So I would assume the object the rover has discovered is or was made by some type of intelligent agency, until proven otherwise.

– Dan B.

So are you saying that if there were Martians, they must be 6-foot tall? Why not 4-foot tall and intelligent? Just my 2 cents worth. We don’t know what we don’t know. Thanks for all of your insights; we do need to have fun.

– Joseph H.

Thank you to everyone who wrote in regarding last week’s story on the image that the Curiosity rover sent back from Mars:

Image From Curiosity

Source: NASA

It was a lot of fun reading everyone’s comments. It is such an interesting topic and I knew it would generate some excitement.

And Joseph, I really liked your comments because they highlighted that we naturally have a bias when we see something like this. It looks like a door, so we naturally think that it has to be large enough for us humans to walk through it. But to your point, other forms of life won’t necessarily be bipedal and upright, and mostly between five and six feet tall.

This is why thinking outside of the box and learning to think exponentially is so useful. It helps us break our natural tendencies and biases. It’s not natural, but it is a skill that can be developed.

While we don’t know much about the formation in the picture yet, this will be an interesting discovery to follow as the Curiosity and Perseverance rovers continue to explore Mars. We have so much to learn about the other planets in our solar system as we get closer to becoming a multi-planetary species.

And yes, I think it’s absolutely necessary for us to enjoy some fun, lighthearted stories in these pages – especially when the markets are this volatile. Rather than losing sleep, it’s good to remember that we do have a lot to look forward to and keep a wider perspective.

That’s all we have time for this week. If you have a question for a future mailbag, you can send it to me right here.

Have a good weekend.

Regards,

Jeff Brown

Editor, The Bleeding Edge

Like what you’re reading? Send your thoughts to feedback@brownstoneresearch.com.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.