Van’s note: Van Bryan here, Jeff Brown’s longtime managing editor. At the end of every year, I sit down with Jeff to discuss his biggest predictions for the coming year. Remember, you can always catch up on earlier editions in this series by going here.

Today, Jeff and I talk about non-fungible tokens (NFTs). Jeff will explain why he saw the potential for NFTs early, why this isn’t a passing fad, and where NFTs are going in 2022. Read on…

Van Bryan (VB): Jeff, let’s talk about NFTs. It’s been one of the biggest stories all year. But for the sake of new readers, could you just remind us what an NFT is?

Jeff Brown (JB): NFT stands for “non-fungible token.” And really the most important word is “fungible.” If something is “fungible,” it simply means it can be easily exchanged for something of equal value. A perfect example is fiat currency.

So let’s imagine I ask to borrow one hundred dollars from you, and you give me a one-hundred-dollar bill. Then, sometime later, I pay you back with two fifty-dollar bills. Would you be upset that I didn’t return that exact hundred-dollar bill you gave me?

VB: I wouldn’t.

JB: Right, that’s because the U.S dollar is fungible. It doesn’t matter which dollars you have, as long as you have any dollars in the appropriate denominations. That’s fungibility.

Non-fungibility simply means that something can not be easily exchanged or substituted. Earlier this year, I gave the example of the Mona Lisa…

Let’s imagine I walked into the Louvre in Paris and offered to exchange a recreation of the Mona Lisa I bought online for the original painting. They’d think I was crazy.

That’s because the Mona Lisa – and all original artwork – is non-fungible. It’s unique and can’t be readily exchanged or substituted.

When we look at NFTs, it’s the same idea. Each NFT is unique. And ownership for that NFT is conferred using blockchain technology. It’s a fascinating application.

VB: You made the case for NFTs earlier this year. Can you tell us what you saw in the market at that time?

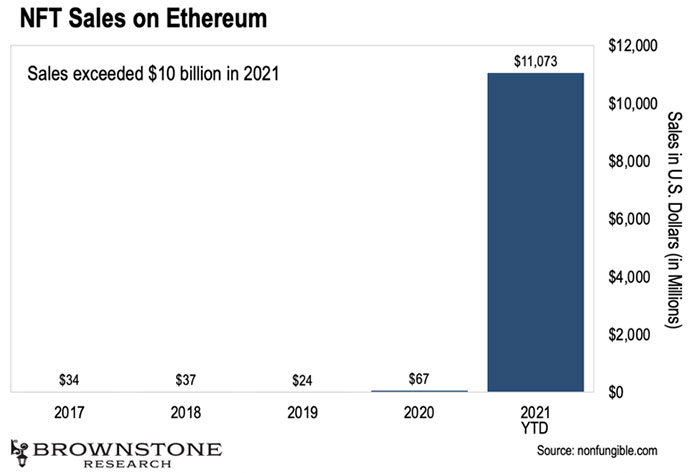

JB: I’d actually been following this market in 2020, but in March of 2021 I was invited onto Glenn Beck’s podcast and made the case there. At the time, I predicted that this would become a multi-billion dollar market. And that’s precisely what happened.

At the time, the biggest use case for NFTs was digital collectibles. And what I saw was the next generation of art and collectibles, powered by blockchain technology.

VB: Some NFTs are now valued for hundreds of thousands or even millions of dollars. I recently saw a CryptoPunk NFT sell for more than $700,000. What would you say to a skeptic who sees that and thinks it’s crazy?

A CryptoPunk NFT

Rare NFTs regularly sell for hundreds of thousands of dollars.

JB: Well, I would probably never spend that much on a single piece of art.

It seems like a lot of people get hung up on the fact that these pieces of art are purely digital. But we should appreciate that we are now in a world where purely digital assets are valued and sought after. Bitcoin, a purely digital currency, is a perfect example.

And in many ways, digital art would be more appealing to some collectors. If somebody buys an original Picasso, it’s difficult to show it off to your friends and colleagues. And you always run the risk that it could be damaged or destroyed.

But an NFT collectible? It goes with you everywhere. You can share it on social media or display it on your phone. It’s even becoming common for celebrities to use their NFTs as avatars on platforms like Twitter.

NFT Avatars

And we should remember that digital collectibles and artwork are just one application for this technology.

VB: What’s the bigger picture here?

JB: NFT artwork is part of a larger technology trend known as “tokenization.” And the easiest way to think about tokenization is to compare it to the process of securitization.

When a company is securitized, the value of that company is represented as public shares. This is the entire basis of global equities markets.

It’s a similar idea with tokenization. It’s a process of substantiating a claim of ownership on an underlying asset. The first difference is that this process is accomplished by using blockchain technology. Also, virtually any asset in the world can be tokenized and traded.

Let’s imagine a piece of property like our house. Typically, one person would be the sole owner of that asset. Maybe your spouse is also on the title, but that’s usually where it stops.

But if we were to tokenize that home, fractional ownership could be conferred to hundreds or even thousands of token holders. The value of the tokens would fluctuate just like any other security.

That’s just one example. Now imagine tokenizing commercial property, rare cars, jewelry, or even racehorses. Anything of value can be tokenized and traded.

I’ve referred to this idea as “World IPO Day,” because anything of value in the entire world can be tokenized and open for trading.

Tokenized assets – whether they are digital collectibles or real-world assets – are not going away. This is not a fad. This will be a massive story in 2022.

And I’m going to make a specific prediction for this topic: I predict the NFT market will be valued at $100 billion sometime in the next twelve months.

VB: That’s great, Jeff. But I’d like to get your view on a related topic, something referred to as “The Metaverse.” Could you bring us up to speed on that?

JB: A metaverse is a virtual world that allows us to do many of the things we would do in our normal lives. We can shop, meet our friends, entertain ourselves, own property, and even open businesses.

There are two big misconceptions I typically see when people talk about metaverse technology…

The first is that most assume that there’s just one metaverse. That’s not the case.

There are many metaverses, and they are incredibly diverse. Some will mirror the real world, complete with Earth’s geography and major cities. Some will represent fantasy worlds created by the users themselves, and others will allow us to “live” in space as a multi-planet species.

The other big misconception I hear is that this is “just a video game.” What makes that not true is the economic component of metaverses. These virtual worlds have property rights for starters. We can buy land – represented as an NFT – and develop it as we see fit. This is already common in one metaverse known as The Sandbox.

The Sandbox Metaverse

Source: The Sandbox

These worlds also have active economies and their own currencies. The currency for The Sandbox is the digital asset SAND. In the Decentraland metaverse, it’s the digital asset MANA. And of course, you can always exchange these assets for others like bitcoin, ether, or even fiat currency.

What we are going to start to see is more and more people transitioning to these metaverses to conduct many of the activities they would typically do in the real world. One example is where we choose to work.

There are some who are quitting their jobs so that they can play Axie Infinity, which is a play-to-earn metaverse game, full time. This metaverse rewards winners with the native currency, AXS.

We’re entering a world where a person’s full-time job could be managing a storefront in a metaverse. We’ll be able to attend conferences, go to meetings, and catch up with our friends and families here.

VB: When talking about the metaverse, we have to mention Facebook. This year, the company changed its name to “Meta,” short for “metaverse.” What do you make of that development?

JB: A lot of people assumed that Facebook went forward with this rebrand to get away from some of its past indiscretions. But that’s not the case. Facebook is one of the largest, most dominant businesses in history. It didn’t need to make any sweeping changes.

What Facebook/Meta is trying to do is “claim” an entire domain for themselves, as if there will only be one metaverse. And the reason is actually very simple…

Many of the metaverses I mentioned above could draw users away from Facebook’s platforms. If we can connect with our friends in a metaverse like Decentraland or The Sandbox, what use would we have for Facebook’s social media platforms?

The company sees the potential for the metaverse, and it knows it needs to catch up. And it will use its new metaverse to collect even more data on its users to inform target ads.

And it may surprise us to hear, but I don’t think it will work.

Facebook intends to create a metaverse, collect all of the user data, and capture 100% of the revenues and profit. This is a very old-school way of thinking.

The most successful metaverses will incorporate monetary incentives and economies into their worlds. We’ll be able to engage in productive activity – activity that can result in income.

It’s actually a little overwhelming when we think about how much will change in the years ahead.

VB: Thanks for your time, Jeff.

JB: Anytime.

P.S. Check back tomorrow for Jeff’s next 2022 prediction. I’ll be sitting down to ask Jeff about the global semiconductor shortage, the “American Manufacturing Renaissance,” and why semiconductor manufacturing is coming back onshore.

And as Jeff shared today, we’re still in the earliest stages with NFTs, tokenization, and the metaverse. This will be one of the biggest investment trends of the next year. If you’re not prepared, go right here to learn about Jeff’s full “World IPO Day” profit plan.

Like what you’re reading? Send your thoughts to [email protected].