- Tesla’s Optimus is getting a lot smarter…

- Google is not going down without a fight

- A wolf in sheep’s clothing – Worldcoin

Dear Reader,

The $1 trillion club.

This morning, fabless semiconductor giant NVIDIA just eclipsed a $1 trillion market cap. This makes it the ninth company to have achieved such rare status, and the seventh technology company to have achieved this milestone. The two other companies, not surprisingly, were state-owned oil companies Aramco and PetroChina.

NVIDIA follows on the heels of Apple (consumer electronics), Microsoft (software operating system/productivity applications), Alphabet (advertising), Amazon (e-commerce & cloud computing services), Tesla (electric vehicles (EVs) & artificial intelligence (AI)), and Meta (advertising).

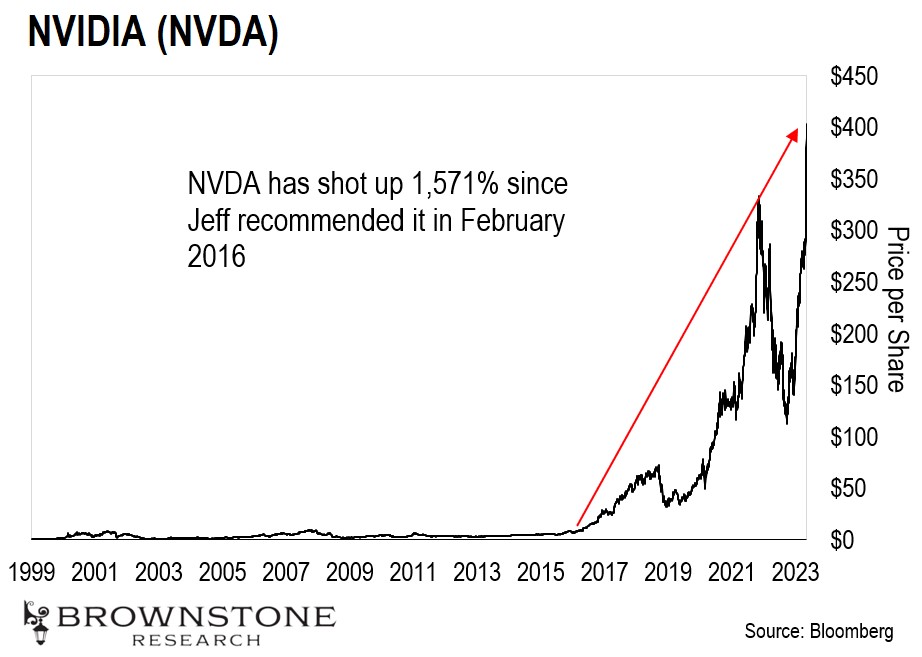

NVIDIA is an incredible success story and one that didn’t happen overnight. Just look at the chart below.

NVIDIA went public in January of 1999 during the dot-com boom at just $12 a share. And for its first 15 years as a publicly traded company, it was almost entirely known as a gaming-focused company. Its graphics processors were the best in the business for running graphics-intensive games and any kind of computer graphics and animation production. Even though it was the best in the gaming business, its share price didn’t do much during that time.

I recommended NVIDIA at $24 in February of 2016 because I saw something completely different and unrelated to gaming. I saw how NVIDIA graphics processors were being used as the workhorse for general purpose computing to power artificial intelligence. For anyone who understood what was happening in artificial intelligence, it was clear what would happen. And while it wasn’t a straight line to a trillion dollar market cap, what happened from 2016 until today is remarkable.

It’s hard not to succumb to the excitement and hype around artificial intelligence right now. I’ve never seen so much technological advancement in any sector compared to what we’ve seen with AI in the last six months.

As an investor, it’s easy to want to be part of the ride. It must go higher, right? Everyone wants more AI, don’t they? It’s the future.

But it’s a trap.

A valuation trap to be more specific. NVIDIA, as a semiconductor company, is now trading at an enterprise value (EV) to sales ratio of 39. Said another way, its current valuation is equivalent to 39 years of sales – not profits. And its EV to EBITDA (earnings before interest, taxes, depreciation, and amortization) ratio is also at nosebleed levels at 160. Unbelievable.

This is a ridiculously high valuation for any company. And it won’t end well for anyone buying at these levels.

For comparison, let’s look at AMD, NVIDIA’s largest rival in graphics processing units. The two companies aren’t perfect comparisons, but they are more alike than they are different, and the valuation of AMD is a good reference point.

AMD is now trading at an EV to sales of 8.6, and an EV to EBITDA of 42. AMD isn’t growing as quickly as NVIDIA, nor are its gross margins or free cash flows as strong. There should be a difference in valuations…. but nothing like what we’re seeing today.

It’s possible to be bullish on a sector, love a company and its products, and yet be bearish on its stock. That’s where I’m at right now with NVIDIA.

This is nothing but a momentum rally driven by hedge funds and large institutional investors hoping to suck those unknowing into the market so that they can sell.

This looks bad to me. Once that fast money starts dumping, it’s going to take the whole market down with it. As we saw on Thursday, eight tech stocks have driven the entire gains of the NASDAQ composite this year with NVIDIA having the largest individual impact.

The same will be true on the downside. Please don’t get burned.

The rapid rise of Tesla’s Optimus…

I suspect some readers may have caught Tesla’s 2023 Cyber Roundup event. The event centered around the radically modern electric Cybertruck. To the automotive industry’s surprise, the Cybertruck has already brought in an impressive 1.5 million preorders.

Tesla’s Cybertruck

Source: Tesla

But while most of the attention was focused on the upcoming Cybertruck, Tesla provided another development update that had nothing to do with the Cybertruck. For me, the most interesting topic at the 2023 Cyber Roundup event circled around Tesla’s humanoid robot Optimus. We’ve been tracking Optimus since the very beginning.

If we remember, Tesla unveiled the first Optimus prototype at its 2021 AI day event. And about nine months before that, Tesla had announced its ambitions for Optimus by parading a human, dressed as a robot, on stage. It was a hilarious way to say that Optimus was just an idea at the time.

That initial prototype was capable of walking on its own… but it still required a fair amount of assistance. As such, the pundits dismissed it. They said Tesla had a long way to go.

I felt differently. The fact is, Tesla had only spent seven or eight months developing Optimus. The prototype they demonstrated was remarkable given how little time had passed since the original product announcement.

My perspective was that if Tesla could produce a working humanoid robot in seven months, imagine what it would look like six or 12 months down the road. And that’s why the latest update on Optimus is so exciting.

Check this out:

Here we can see Optimus picking up and moving objects with incredible precision. Tasks like these might appear to be simple, but demonstrating these kinds of fine motor skills has been one of the biggest challenges in robotics.

To me, this is absolutely amazing progress. Optimus can now navigate its environment and engage in human-like tasks. I can’t emphasize enough how difficult this is.

And here’s the thing – Optimus may be the most undervalued project/product that Tesla is working on right now.

The market size for a humanoid robot capable of performing human-like tasks is massive. To start, I fully expect humanoid robots like Optimus to be deployed in manufacturing and warehouse settings to perform labor-intensive, monotonous tasks that humans aren’t well suited for.

Looking further out, we’ll likely see every household own at least one humanoid robot like Optimus. It will be the household’s butler – doing all the monotonous and time-consuming tasks around the home for us.

Plus, I can envision many office buildings employing multiple robots. They could perform any task from security, reception, to cleaning and even maintenance.

I believe that the market for Tesla’s Optimus will ultimately be larger than Tesla’s market for electric vehicles. The potential is for more than 1 billion units. If we make a simple assumption of $25,000 per unit and 1 billion units in sales, that’s potentially $25 trillion in future sales.

Most are underestimating the impact this technology will have, and they’re underestimating how quickly Musk and his robotics team will progress. I’ve been saying it for years, but it bears repeating. Tesla is not a traditional automaker. In reality, it’s one of the most advanced artificial intelligence companies on the planet.

And Optimus and its closest competitors are going to have a profound impact on the world in the coming years. I predict Tesla will command a market leadership role in the robotics industry much in the way that it has done in EVs.

Google’s pushing to make up lost ground…

We’ve been exploring how OpenAI’s ChatGPT caught Google completely flat-footed over the last few months. This is the first time in decades that Google has been forced to scramble to maintain its market share.

As a reminder, ChatGPT is a generative AI. It can answer questions, produce content, write software code, and even have intelligent conversations with people. This tech is so advanced that it will reshape all kinds of applications – including search engines.

To make matters worse for Google, Microsoft has been very proactive about deploying OpenAI’s technology across its entire product suite. That caused Google to issue a “code red.”

But Google isn’t going down without a fight. And the tech giant’s latest announcement suggests that it may be making up some ground.

Just a few days back, Google launched an upgraded version of Bard. If we remember, this is Google’s own generative AI. It has a similar level of functionality compared to ChatGPT.

Google initially launched Bard in the U.S. and the U.K. on a limited basis. But Google plans to roll out this new version of the AI in more than 180 countries. This clearly shows that Google wants to make up ground on a global level.

Furthermore, they’ve made Bard fluent in both Japanese and Korean. And their goal is for Bard to support more than 40 languages by year-end.

Achieving this would indeed be an exceptional feat. And it would almost certainly help differentiate Bard in the generative AI space.

And I have to say, the new version of Bard appears to be a big upgrade. Here’s a look at the AI in action:

Here we can see a user asking Bard about tourist sites in New Orleans… and the AI provides contextually relevant suggestions almost instantly.

I love this example because it shows us just how generative AI is primed to completely change how we think about online searches. The days of sifting through links to find what we are looking for are over.

So Google has made some strong improvements. And that’s not all. They have also empowered Bard with certain functions that have been a point of differentiation for ChatGPT.

Among these enhancements, Bard can now cite sources when providing information. Plus, it’s no longer limited to old data. Bard now has the capacity to scour the internet in real-time.

These are big upgrades in an effort to release a version of Bard that can compete directly with GPT-4. And Google is in the process of integrating Bard with its popular software applications. These include Gmail, Google Maps, and Google Docs, among others.

Google is also pushing Bard outside of its own ecosystem. It’s partnering with companies like Adobe and even OpenTable. This suggests that Bard will be able to make dinner reservations for users soon.

The very future of Google’s business depends on them implementing this technology into their products. If they fail, Google could one day be remembered “going the way of AOL,” a remnant of its former self.

But I don’t think that will happen. Google understands the stakes. It has the financial resources to train large language models, and the company is pulling out all the stops to be a competitor in the field of generative AI.

This creepy project just continues to get funding…

We’ll wrap up today with an update on Worldcoin.

I suspect readers will remember this one well. Worldcoin is the creepy project that’s a bizarre combination of biometric tracking and cryptocurrency. It uses a device called “the orb” to scan people’s faces and eyes – specifically the iris.

The idea is to create a unique biometric identity for everyone on the planet. That identity is then tied to a digital wallet for the project’s cryptocurrency, WDC.

Worldcoin hired “orb operators” to go around to major cities and perform eye scans on people. Here’s a look at the orb in action:

Source: Screenrant

Here we can see orb operators around the world “signing” people up for Worldcoin. They promise free cryptocurrency in exchange for scanning their irises. It’s quite disconcerting.

That said, Worldcoin continues to gain traction. In fact, the company is in the process of securing another $100 million funding round as of last week.

What’s strange here is that we’re currently in the worst environment for digital assets that I’ve ever seen.

As we know, the regulatory regime has been openly hostile towards blockchain companies. And private blockchain projects have had a very difficult time raising capital in this climate.

Yet, Worldcoin is raking in another $100 million. It’s hard to believe.

And we may be surprised to learn that Worldcoin has now registered over 1.7 million people. That’s over 1.7 million irises scanned.

Of course, this is all being done in the name of benevolence. The project is wrapped in a shroud of goodwill. Its messaging centers on the inherent value of every individual and its intent to distribute worldcoins freely to all on account of our unique individuality.

This rhetoric echoes the themes propagated by organizations like the World Economic Forum. Oddly enough, Sam Bankman-Fried (SBF) – the infamous founder and CEO of FTX – was a major investor in Worldcoin.

We can recall that SBF often espoused the notion of “effective altruism,” the idea of exploiting capitalist structures to accumulate vast wealth with the intent to redistribute it. However, it emerged that SBF and FTX were involved in grand-scale fraud, siphoning off customer funds for personal interests before being exposed. It was one of the biggest frauds in history.

So Worldcoin looks like a wolf in sheep’s clothing to me. I don’t believe that it’s a fraud, but I’m very suspicious about the fact that the regulators don’t seem concerned about it.

That’s very odd. If we think about it, Worldcoin is trying to create a global reserve currency. That’s exactly what Facebook wanted to do with its Diem project.

Of course, Facebook was met with so much regulatory backlash that it had to abandon the project. That begs the question – why is Worldcoin getting a pass?

The thought of a private organization adopting a role akin to a government, requiring our biometric data in return for “free” money, should sound alarm bells. Surrendering biometric data in this way is something I’d never endorse.

So I can’t help but wonder – who’s behind this $100 million raise… and what’s the endgame?

Regards,

Jeff Brown

Editor, The Bleeding Edge