Dear Reader,

Welcome to our weekly mailbag edition of The Bleeding Edge. All week, you submitted your questions about the biggest trends in tech and biotech. Today, I’ll do my best to answer them.

If you have a question you’d like answered next week, be sure you submit it right here. I always enjoy hearing from you.

Dear Jeff,

I just read the first article in the latest Bleeding Edge, where you decry the lack of initial public offerings (IPOs). Of course, I understand the situation and why this is the case.

Nobody wishes to IPO if valuations will go down. But what I find sad is the addiction of everybody to stimulus. What if the Fed stopped raising rates and left the interest at around 4%?

Would that be the end of the world? Then perhaps prices would not go speculative after the IPO, and prices would rise and fall on merit alone.

I do not hear you advocate for that. The Fed reducing rates and applying quantitative easing (QE) will increase speculation in the market because people are addicted. Many investors and traders are subject to the Pavlov syndrome and would salivate if they could. How did anybody IPO in the 1970s, 1980s, and 1990s?

Got to wonder. Did companies IPO before there was a Fed?

Best regards as always,

– Gordon E.

Hi, Gordon. I appreciate you raising this point as you’ve hit a “hot button” for me.

It would be fantastic if the Fed just stopped and paused for a few months to let the financial system and the economy catch up. After all, the economic adjustments to rate hikes lag by many months. And to your point, there are already some strong arguments to bring rates back to a reasonable level – 4% would be fine – and hold them there for a while. There would absolutely be less rampant speculation at that level.

The real mess started in the Clinton/Greenspan years when there was a stated political policy to make home ownership affordable for everyone. In order to make that happen, there was clear coordination to bring the Fed Funds rate down dramatically to make mortgages much cheaper.

That was coupled with government-backed policies that backstopped Fannie Mae and Freddie Mac buying up mortgages from lenders. This is what led to NINJA mortgages (no income, no job, no assets) and zero down payment mortgages.

We know how all of that ended… The subprime crisis and the near collapse of the U.S. financial system. The ramifications were global.

And yet, sadly, politicians didn’t learn their lesson. They turned around again and went even further, effectively to a zero interest rate policy (ZIRP) after the global financial crisis.

Naturally, there was a lot of speculation (to your point), and then the Fed suddenly ramped up rates in the second half of 2017 through 2018 and collapsed the market in the fourth quarter of that year. It was a devastating market crash and one that was very short-lived…

Why? Because the Fed turned right around and dropped interest rates right back to zero (25 bps) to stave off an absolute economic collapse. Here we are again. So much unnecessary pain and so much irresponsible monetary and fiscal policy.

And yes, the IPO market would function just fine at a 4% Fed Funds rate, as long as there is sound economic and fiscal policy to give institutional capital the confidence to invest in growth. Valuations would recover, as would the market, as long as there are policies in place that the market can trust and know will be consistent for the foreseeable future.

We have been living in absolute chaos for the last three years. It is self-inflicted and bad for just about everyone, with the exception of the “elite” class.

Putting all of that aside, let’s explore the final point that you raised which is how did we survive prior to the last 20 years. This is an important point because it adds context to what historically has been “normal.”

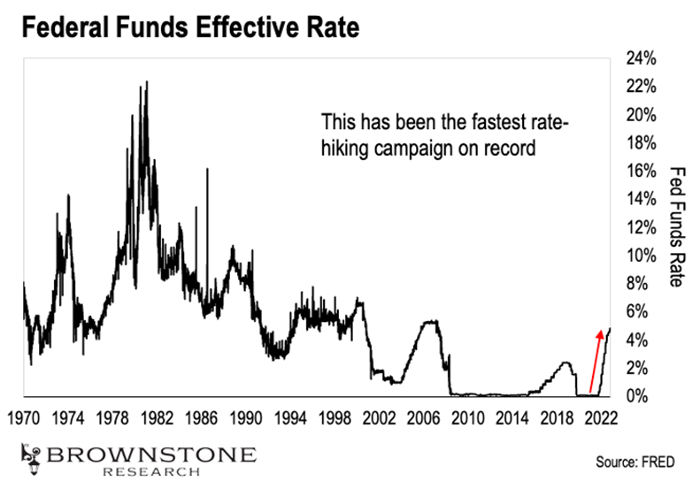

Today, the Fed Funds rate is around 4.75 and 5%. That doesn’t sound very high. After all, the Fed Funds rate was as high as 20% under Paul Volcker in 1981.

But for all the talk of the “Volcker Shock,” the then-Fed Chair “only” doubled rates over the course of two years. When Volcker took over in 1979, the Fed’s key rate was around 10%. By 1981, it was 20%.

That might sound dramatic, but it pales in comparison to what today’s Fed has done. The Fed has raised rates faster than it ever has before. Even Paul Volcker would blush at how aggressive this rate-hiking campaign has been. This chart paints the picture:

In 2022, the Fed’s rate was just 25 basis points (0.25%). Just over one year later, it is now 500 basis points (5%). This represents an increase of 20X in the Fed Funds rate… in just over a year.

It’s not just the level of the rate that matters. It’s the speed at which the rates were hiked that has caused so much carnage. There just wasn’t enough time for the financial system to adjust to those rapid changes.

We saw this very clearly with the collapse of Silicon Valley Bank (SVB) and Signature Bank. Both institutions went under in March. And they are now known as the second and third largest banks to collapse in history. And the Fed knew the banks were in trouble as far back as June of 2022.

To me, today’s Fed is not undertaking responsible monetary policy. A more gradual increase in rates would allow the financial system to adjust over time.

And it would be very normal to find a healthy range for the Fed Funds rate to exist, probably in the 3-4.5% range. This would be a range that would support affordable lending to borrowers, as well as decent returns on lending, and avoid excessive speculation.

The only major issue with rates at these levels is the national debt. Even at 4% the interest payments on the current national debt, which is approaching $32 trillion, become very problematic.

Sadly, I suspect that in time, interest rates will drop back down again below 3% to avoid a sovereign debt crisis. Lower interest rates will dramatically lower the amount of interest owed to holders of U.S. sovereign debt.

The U.S., the EU, the U.K., and Japan are all in a pickle right now due to very similar policies. I wish I had better news. But when countries dig a hole too deep, it is impossible to get out. They tend to just keep digging deeper.

Jeff: Do you know anything about “Operation Sandman” and the plan of over 100 countries to drop the dollar as the reserve currency?

Thank you.

– Eric P.

Hi, Eric. Thanks for your question.

To catch readers up, “Operation Sandman” is something of a rumor making its rounds on the internet. Supposedly, more than 100 countries are coordinating to dump their holdings of U.S. Treasurys at once and collapse the value of the U.S. dollar.

As far as I can tell, it’s just a rumor. And I’m skeptical of the claims. While not impossible, it’s highly unlikely that more than 100 countries could conspire to pull something like this off without the U.S. Federal Government finding out about it.

For another, such an action wouldn’t just hurt the U.S. It would negatively impact every single country on Earth. U.S. dollar-held assets are the most widely held assets around the world. Such a move would be devastating to the global financial system. And at a minimum, we’d see a deep global recession. More than likely, we’d see a global financial panic that would harm every single supposed “conspirator.”

I suspect that this idea is a gross exaggeration of the very real – but less dramatic – moves from other countries to slowly lessen their dependence on the dollar.

After the collective West launched its sanctions on Russia last year, it served as something of a wake-up call to other nations. In September of 2022, the Chinese government signed an agreement to purchase Russian oil and gas in rubles or yuan instead of dollars.

Earlier this year, Brazil and Argentina began discussions to create a “common currency” for all of South America that could be used for trade. In theory, it would be similar to the euro, which is accepted as a common currency throughout Europe.

And while it didn’t get much coverage, there are now talks between Russia and Iran to create a gold-backed digital asset as a medium of exchange.

Interestingly, central banks – especially China’s and Russia’s – are purchasing gold at a record rate. The chart below gives us some idea. It charts net purchases of gold by central banks in just the first two months of the year.

So, there is some truth to the idea that nations are collaborating to move at least a portion of their trade away from the U.S. dollar. It is not as dramatic as “Operation Sandman,” but it is happening.

A much larger concern that I have than the kind of global conspiracy imagined by “Operation Sandman” is why the U.S. government is implementing geopolitical policies that encourage other countries to transact in other currencies (or commodities). The current policies are hurting the United States, not making it stronger. Is that the goal? It seems that way.

The U.S. economy benefits greatly from being a reserve currency and the safest/strongest currency in the world. But the domestic monetary and fiscal policies are hellbent on making the U.S. dollar weaker.

In short, I’m far less concerned with these comparatively small trade deals happening around the world in non-U.S. dollar denominations, and far more concerned with why the U.S. is taking actions that damage the country and its currency.

Hey Jeff,

You asked us to share feedback on our experience using ChatGPT.

I took your advice and signed up for a short “prompt engineering” course, which I am still working through and finding fascinating!

I have now used the free version of ChatGPT to:

Be a travel agent & plan my next holiday.

Rewrite the advert for the marketing of my house that was written by a real estate agent – making it much better than what the agent had.

Write an investor prospectus for a startup family business we have recently launched.

Write formal letters for me to send out to clients on particular topics.

Numerous other small questions/jobs.

What a time saver!

Best regards,

– Daniel P.

(P.S. This email was written by me, but I was tempted to improve it with ChatGPT.)

Daniel, awesome! Just awesome!

Thanks so much for sharing your experience with generative AI. I’ve always said that the best way to understand a new technology is to take it out for a “test drive.” I can’t tell you how many times I’ve signed up for a service or product as part of my research. And I’m so excited that you took action and experimented yourself. Your experience is exactly what I hoped for all of my subscribers.

Your list is quite telling. As I’ve been saying for months, the promise of generative AI like ChatGPT is that it will act like a personal digital assistant. How many small, time-consuming tasks do we perform every day without even noticing? If we took an inventory of how much time we spend, it would be shocking.

But this is a perfect example of how a digital assistant would operate. Something as simple as planning our next vacation might take a human several hours or even days or weeks.

But by simply giving the AI a few parameters of what we want (options for destinations, dates, activities, etc.), it can take care of the rest.

What’s so exciting is that this is just the very beginning of what we’re in for. Today’s powerful chatbots are already incredible tools and assistants as you’ve described above. I’m sure you’ll find another 100 uses for ChatGPT.

And yet ChatGPT is trained on a large, general data set. Just imagine when “our” chatbots are trained on us as individuals. Imagine when they also ingest a body of knowledge about our lives, lifestyle, preferences, personalities, and so on. They will know us better than we know ourselves. And “our” personalized AI assistants will be able to proactively carry out tasks without the need for us to prompt them to do so. “They” will just get things done for us. It’s going to be unbelievable, and it won’t be expensive. The technology will be accessible to all.

This future is coming fast. We’ll start to see early versions of what I’ve described before the end of this year. And by next year, the capabilities will be extraordinary.

Thanks again for sharing your experience. I hope it motivates others to do the same.

Regards,

Jeff Brown

Editor, The Bleeding Edge

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.