|

I agree with Jeff Brown: Technology is one of the best places to invest for the near and far future.

That’s why I often focus on tech stocks.

But, man, they can seem expensive. Stalwarts like Apple and Microsoft are trading near all-time highs… And both Google and Amazon have nominal stock prices in the thousands of dollars. Even smaller companies outside of these top names can feel pricy compared to their fundamentals.

And it’s hard to force ourselves to buy expensive stocks. It’s even more maddening when we tell ourselves to be patient… only to watch them get even more expensive!

So today, I’d like to show readers how we can avoid falling into this cycle… and actually determine when tech stocks are going on sale.

Hi, I’m Jason Bodner, the editor of Outlier Investor. I spent nearly 20 years on Wall Street, handling some of the largest stock trades on planet earth for hedge funds and other big players. During my time there, I got a front-row seat to many of the most important market dynamics.

And one of the key things I’ve learned in my years as a professional and personal investor is this…

We’re all human; we fall prey to emotions and distorted perceptions. But emotions are tricky things when it comes to matters of the wallet. And when it comes to stock investments, our emotions can make it incredibly difficult to buy and sell at the best times.

When stocks are making new highs, greed often kicks in, urging us to buy more. Yet that’s how frothy tops are made.

After the last giddy buyer buys, the pain comes. When no buyers are left, prices can fall hard and fast. And the investors who got in near the top anxiously wait for prices to come back in order to not take a loss. Except their losses grow, and discomfort spikes. Eventually, despair sets in.

Investors begin to tell themselves: “Keeping something is better than losing everything, right?” When we’re feeling the pain, we just want to give up and throw in the towel, anything to make the pain stop.

The irony is… that’s usually the low. And when investing feels the worst is when the deals come.

So when we feel like it’s the end of the world, that’s often the best time to strike, especially in technology stocks…

Because that’s when tech goes on sale.

In fact, it’s actually not hard to recognize. Let me show you…

As regular readers will know, I’ve developed tech of my own that finds outlier stocks. Outlier stocks are a small handful of stocks that outperform all the other ones. You know the types: Amazon, Google, and Tesla, to name a few.

And one of the key signals I follow is Big Money. Big institutional investors are what really move stocks. When they want to buy more than is available, stocks go up. And when they buy the best-quality stocks, those are potential outliers.

I built my own software to find those stocks. But that’s not all it can do…

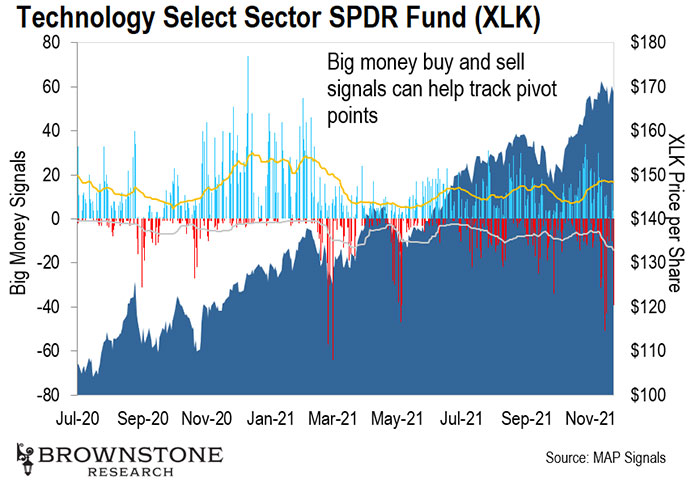

My software also helps identify market pivot points. We can train our sights on entire sectors to spot when they get overbought or oversold.

You see, when big investors buy stocks in an unusual way, it gives my software a buy signal. The same goes for selling. When buying or selling gets extreme, we can identify possible points of extremes.

So let’s look at what has been happening recently in technology:

This may look complicated. But here’s the important thing to note… Blue bars going up are stocks being bought. And red bars going down are stocks being sold.

We enjoy seeing buying. Buying tends to sustain and push a sector higher.

But selling can be an important signal, too. When selling is high, often a sector is nearing a low. We can see this in the example above using the Technology Select Sector SPDR Fund ETF (XLK).

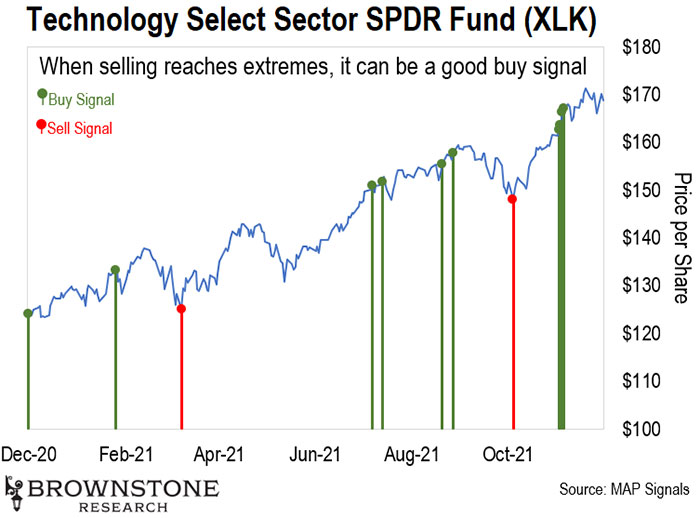

Let me show this another way to make it crystal clear:

XLK saw some strong buying in November when it was near a high. But look how the red sell signal lines often line up with major troughs.

That’s when tech goes on sale! Yet as I described above, that’s also when sentiment is lowest… and people believe things will only go lower.

Now, I know I often encourage buying what Big Money is buying. So buying when big money is selling may seem confusing… But here is the caveat: When others sell junk, you may not want it. But when others sell quality, that is a discount.

So it’s important to understand what you’re buying.

As a whole, tech stocks have the highest aggregate sales and earnings growth and strongest profit margins of any other sector. My system has spotted 249 tech stocks that big money can trade easily. And they boast an average three-year sales growth of 32%.

Contrast this to energy stocks, whose growth is just 2.8%… and most of the companies are not profitable.

While not every tech company is quality, our odds are much better than in other sectors.

So now comes the question: With the recent red days in the markets, is tech on sale right now?

Well, the real pain isn’t here yet for tech stocks. On the contrary, they’re still pretty lofty.

But the tech selling we’ve seen in the last few weeks does indicate that near-term lows are likely in for XLK. We haven’t reached despair levels, but if you’re eyeing tech, now still may be a decent time to buy.

While it’s not Black Friday for tech stocks, it could be a flash sale. Either way, now you know what to look for in the future.

When the really painful days do come, I’d grab with both fists. Buying on days that feel the worst will allow you to sell on days when everyone feels best.

Talk soon,

Jason Bodner

Editor, Outlier Investor

Like what you’re reading? Send your thoughts to feedback@brownstoneresearch.com.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.