Dear Reader,

Novavax is a company that had gone almost nowhere during the last five years. In fact, it almost flat-lined in the last two years.

The company endured nearly twenty years of negative free cash flow, with one dilutive financing round after the next.

And then the pandemic hit…

The company had long been developing vaccines for seasonal influenzas and other respiratory viruses. In that way, it was well-positioned for COVID-19.

But I doubt the management team envisioned that its valuation would have eclipsed $10 billion when it was worth less than half a billion back in 2019.

The company’s share price largely ramped up on hype.

But the great news is that it just announced strong data from its COVID-19 vaccine, NVX-CoV2373. The vaccine was determined to be 90% effective against the airborne virus. This puts the Novavax vaccine on par with the results produced by Pfizer/BioNTech, Moderna, and Johnson & Johnson.

It also appears to be similar to Pfizer/BioNTech and Moderna in that the side effects are worse on the second shot, compared with the first shot. 40% of recipients reported headaches, muscle pain, and/or fatigue that tended to last two days or less.

Where it differs is in the vaccine design. Unlike the messenger RNA (mRNA) design of Pfizer/BioNTech and Moderna, Novavax uses a recombinant protein vaccine.

The vaccine is developed by growing the notorious spike protein of COVID-19 in moth cells. Then the proteins are formed into nanoparticles and mixed with a kind of booster to elicit a strong immune response.

The downside is that this kind of vaccine isn’t as easy to manufacture as an mRNA vaccine. It is harder to scale up production.

But the upside is that it can be stored at normal refrigeration temperatures. This will simplify distribution of the vaccine.

Novavax is ramping up production and will have 100 million doses ready by the end of the third quarter. And it will ramp up production to make 150 million doses a month by the end of the year.

While COVID-19 is largely endemic now in the U.S., this production will be helpful to other markets that will benefit from the simpler distribution characteristics.

I wouldn’t be surprised to see FDA approval within the third quarter.

And on a related topic, Regeneron also released some fantastic results from a trial conducted in the U.K. for its monoclonal antibody treatment for COVID-19. This therapy, REGEN-COV, is used as a therapeutic approach to administer to those patients who experience severe symptoms after having already contracted COVID-19.

REGEN-COV showed that it was able to reduce the risk of death by a fifth amongst the most severe patients, who are generally not very healthy at all. Their bodies were unable to mount an immune response after being exposed to the virus.

These are fantastic results from Regeneron.

Also of interest was that REGEN-COV was used in conjunction with the common and inexpensive steroid dexamethasone with great success.

What’s interesting is that throughout the pandemic, large swaths of the medical community were highly critical of using low-cost, off-the-shelf therapeutic approaches to treat or protect against COVID-19.

Perfect examples are hydroxychloroquine, azithromycin, dexamethasone, and even vitamin D.

Yet here we are with scientific research papers, one after the other, presenting overwhelmingly positive results for using these widely available therapies.

To be clear, these aren’t replacements for having vaccines; they are complementary.

But I can’t help but wonder how different the outcomes would have been had public health officials embraced the “tools” that already existed and were readily available at low cost during the window prior to vaccines being approved for emergency use.

Now let’s turn to today’s insights…

A big venture capital (VC) round in the blockchain industry caught my eye. A company called Ledger just raised $380 million in its Series C funding round. This puts the company’s valuation at $1.5 billion, making it a blockchain unicorn.

Ledger makes hardware wallets for cryptocurrency investors. We can think of these devices like USB drives.

When disconnected, hardware wallets allow investors to store their digital assets offline where they are 100% safe from being stolen or hacked. Then users can simply connect their hardware wallet to a computer when they want to sell their assets or make transactions.

This is by far the safest way to store digital assets. And the most sophisticated investors in the space prefer to use hardware wallets like Ledger’s.

Come to think of it, I’m sure that a bunch of Bleeding Edge subscribers are active users of Ledger’s products. I even have one on my desk as I write this.

Ledger has now sold more than three million hardware wallets globally. And it says that 15% of all digital assets are secured by its systems.

If true, that means investors are using Ledger’s products to secure about $240 billion worth of cryptocurrencies offline. Pretty incredible.

And this shows us how popular Ledger has become and how fast it has grown.

If we look back just two years to April 2019, Ledger raised a measly $2.9 million in a late-stage VC round. At the time, the company was valued at just under $275 million.

That means Ledger’s valuation has jumped 5.5 times in the last two years. That’s incredible growth that followed the dark days of 2018 and early 2019 known as the “crypto winter.” It is also an indication of where venture capitalists believe accelerated growth will come from in the near future.

And here’s what’s most interesting to me…

When investors use hardware wallets, they are doing self-custody. That means they are taking responsibility for their own digital assets. It’s the equivalent of storing your gold or silver coins in a safe at your home with a combination that only you know.

With respect to digital assets, we are securing the private “keys” to our cryptocurrencies rather than trusting an institution like Coinbase or Kraken to do it for us.

By doing self-custody, investors ensure that no one else has any control over their digital assets. The funds can’t be frozen or hacked. They are offline and cannot be accessed.

But there’s a trade-off. If investors lose the password to their hardware wallet, their funds could be lost forever. There is no simple “reset password” feature because there is no third party managing the password. There is literally no customer service to call if things go wrong. That’s the nature of self-custody.

For comparison, companies like Coinbase, Kraken, Genesis, Bitgo, and others offer custodial wallets. That means the company is responsible for securing the private keys to their customers’ cryptocurrency.

These companies employ strong security on customers’ behalf, and they can reset passwords instantly. However, they also have control over the digital assets held on their platforms. They could freeze accounts or restrict transactions if they were compelled to do so.

So the big question is… Which way will the industry go? What percentage of investors will choose to self-custody?

As more investors come into the digital asset space, will they prefer self-custody wallets like the ones Ledger provides? Or will they choose to trust companies like the ones mentioned above to secure their assets for them?

This is something I’ll be watching closely. The answer will go a long way in shaping how the industry develops from here.

We talked back in December about how Uber “sold” its self-driving division Advanced Technologies Group (ATG) to an early stage company called Aurora.

Of course, what really happened is Uber paid Aurora to take ATG off its books, and it received some equity ownership in return.

This strategic combination gave Aurora a boost both in terms of its team, technology, and funding. And I mentioned to readers that we needed to keep a close eye on Aurora going forward. It is one of the few players that now has scale.

And just a few days ago, news leaked that Aurora is in talks to go public via a special purpose acquisition corporation (SPAC) called Reinvent Technology Partners Y.

To bring new readers up to speed, SPACs – also known as “blank check companies” – provide private companies a route to public markets that sidesteps the traditional initial public offering (IPO) process.

So Reinvent Technology Partners Y is offering Aurora a faster and cheaper way to go public, which also enables it to raise additional capital to further invest and grow its business. This is very exciting, especially because of the primary executive involved in the deal – Reid Hoffman.

Hoffman is one of the giants in the high-tech industry who has founded and taken companies public before. His biggest success story has been co-founding LinkedIn, which was later sold off to Microsoft in a landmark deal. Microsoft grossly overpaid (as usual), and Hoffman made out like a king.

But what makes this business combination unusual is that Hoffman also sits on Aurora’s Board of Directors. He’s on both sides of the deal. That’s not normal, but it does happen.

And it should happen.

The best SPACs are led by successful entrepreneurs and operating executives like Hoffman. And when the executives have ties to the early stage technology company they are hoping to take public, it’s a recipe for major success. This is how the best business combinations happen.

So I’m very excited to see this deal taking place. Aurora is an exciting company that will be a great investment target at the right valuation. And the company will continue to benefit from having Hoffman on its board.

And that’s the only piece of the puzzle that hasn’t been determined yet. Reinvent Technology Partners Y and Aurora are still finalizing the valuation at which Aurora will go public.

Let’s keep a close eye on this going forward. One of the things I love most about SPACs is that they are able to disclose in much more detail future revenue projections and even timelines for product development.

This kind of forward-looking information is never shared in traditional IPOs. Of course, we have to look at these projections with a healthy dose of skepticism.

But they are still very useful data points that are helpful in building an investment thesis and determining if a valuation is reasonable or otherwise.

With yet another autonomous driving company going public, we are witnessing the next generation of the automotive industry coming of age right now.

And if readers want to learn my top ways to profit from the self-driving trend, just go right here for the full story.

We’ll wrap up today with an interesting development in the semiconductor industry.

Google just published a really cool article in Nature detailing how it is using artificial intelligence (AI) to design semiconductors built specifically for running AI-based applications.

That’s right – AIs are now designing the chips that are going to run AIs.

Up to this point, chip design has been a time-consuming, manual process. It often takes months for a team to lay out the “floorplan” for a semiconductor and then figure out how to connect all of the individual components, or “blocks,” in order to optimize performance.

The industry tends to develop highly structured semiconductors according to tried-and-true concepts that have in fact been used for decades.

But guess what? The AI seems to be throwing industry standards out the window.

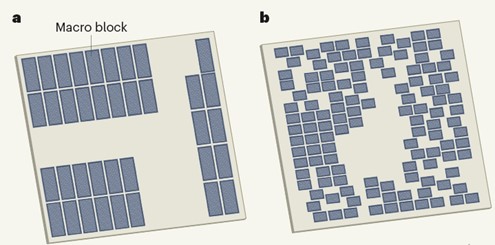

To illustrate this concept, let’s look at two semiconductor floorplan designs:

Semiconductor Designs

Source: Nature

These are two very different semiconductor floorplans. One was designed by a human. The other by an AI. Which one do we think is which?

The chip on the left is a typical design that us humans might create. It’s built row upon row, nice and neat. Blocks are often organized based on the specific functions desired from the semiconductor. Things tend to be grouped together in an orderly fashion.

Now look at the AI’s design on the right. It looks chaotic. No human would lay out a design like this because it doesn’t seem logical. To a human, it looks almost entirely random. We might even say that a child may have developed that design.

I doubt this comes as a surprise, but Google found that the AI’s design on the right significantly outperforms the human design on the left. The design on the right has been optimized for performance. It is the interconnections between the blocks that is so critical.

Think about this – the number of possible configurations of these floor plans is about 102500. If we compare that to the game of Go, for which Google’s DeepMind artificial intelligence division created AlphaGo to outplay humans, there are “only” 10360 possible game board layouts.

At 10360, that’s more possibilities than there are atoms in the known universe. It’s hard to even describe what 102500 is equivalent to. It is beyond exponentially larger than the Go game board.

So while the AI design looks random, it’s far more optimized than the human design. And that’s because the human mind simply can’t analyze all the potential design configurations… But an AI can.

And here is why this is so significant.

As AIs begin to design chips to run AIs, we are going to get dramatically more powerful chips every year. Once the feedback loop gets going – and it has already started – it’s going to accelerate technological development at an exponential rate.

As a result, five years from now, our world will be saturated by advanced artificial intelligence. We can’t possibly conceive some of the AI-based applications that are going to be everywhere in the near future.

This is both exciting and also scary at the same time. As with all technologies, they can be used for both good and bad.

The industry is working toward guidelines for the ethical use of this incredibly powerful technology. But from what I see, it’s not moving quickly enough.

We need to get ahead of these near-future developments. These are very hard problems to solve, and they are made even more difficult due to the nature of their exponential growth.

But there is one thing I am certain about. It is going to happen whether we are ready or not.

Regards,

Jeff Brown

Editor, The Bleeding Edge

P.S. Don’t forget to RSVP for my Silicon Valley “Unlocked” event, which goes live next Wednesday, June 23, at 8 p.m. ET.

As I mentioned yesterday, I’ve been doing “boots on the ground” research in Silicon Valley for the first time since COVID-19 hit last spring.

And my mission is singular: to compile a list of tech stocks that are currently trading at lower valuations than when their private venture capital (VC) backers invested in them.

I call these companies “Penny IPOs” because they are the best way for normal investors to gain access to tech companies that still bring explosive returns.

In fact, Penny IPOs are an “end-run” around the VCs and private equity sharks who have distorted the IPO markets. They are one of the few ways for everyday investors to turn the tables on the institutions that have rigged the game against them.

That’s why I’m so excited about our event next week. That evening, I’m going to share what I’ve learned during my time back in the Valley. And I’m going to talk about “the list” of companies I’ve been building…

For those who are serious about building a portfolio of explosive tech companies, please plan on joining me for Silicon Valley “Unlocked” next Wednesday night at 8 p.m. ET. You can go right here for all the details.

Like what you’re reading? Send your thoughts to feedback@brownstoneresearch.com.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.