Editor’s Note: Today, we’re sharing an insight from colleague Stephen Hester, equity analyst with Wide Moat Research.

As Stephen shows below, most investors make a common mistake… and you could be making it too. Read on for his full analysis and to discover a better path through the volatility.

|

By Stephen Hester, analyst, Wide Moat Research

It was one of the most common mistakes I saw investors make…

And chances are, you could be making it in your portfolio right now.

I’m talking about the 60/40 model. That’s 60% stocks and 40% bonds. We’ve all heard of it. Odds are you or part of your family’s retirement savings use this strategy.

The idea is stocks are for growth and bonds provide principal protection and income.

Put another way, the idea is that stocks provide upside in bull markets. And bonds help protect us when things are rough.

Many people, even licensed financial advisors, call U.S. government bonds “risk free.”

But they aren’t risk free. Far from it.

That’s the mistake I saw clients make time and time again.

Years ago, I oversaw alternative investments for two $100 billion firms. It was my job to analyze and select the best alternative investments.

But I couldn’t advise clients that they were making a mistake. That was their financial advisor’s job.

And so, again and again, I’d see clients put “risk-free” bonds in their 60/40 portfolio. I couldn’t tell them that was a mistake.

But I can tell you…

Today, I’ll show you the true risk of these “risk-free” investments. And I’ll share a better strategy to protect your portfolio in today’s market.

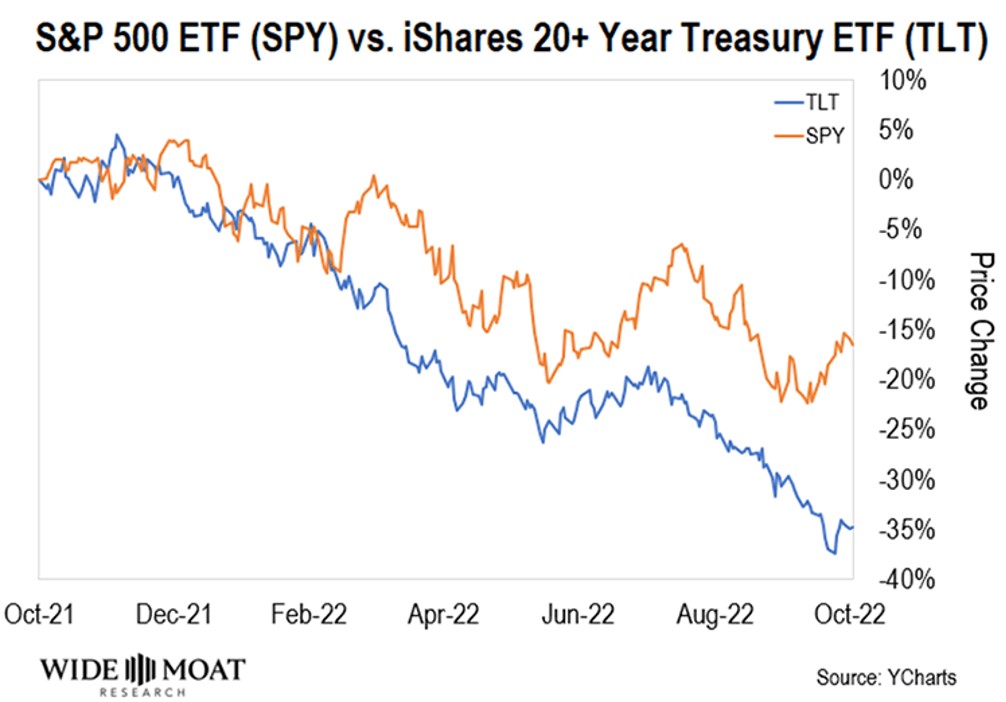

The chart below shows two popular exchange-traded funds (ETFs) over the past year: the iShares 20+ year Treasury Bond ETF (TLT) and the SPDR S&P 500 Trust ETF (SPY).

One is down 15.3% and the other 34.9%. Guess which exclusively owns “risk-free” government bonds?

And if you think nearly 35% losses are bad, consider that TLT is down nearly 45% from its highs in Q3 of 2020.

Millions of investors believed their government bonds would “save them” in a stock market correction, like we went through over the past couple of years. Instead – as you can see above – they declined in value more than stocks. A lot more.

That’s because bonds are priced based on simple arithmetic. As interest rates rise, a fixed-coupon bond must decline in value to compete in the marketplace with new bonds offering higher interest rates.

Let’s say you own a 20-year bond with an annual coupon rate of 2%. That’s how much income an investor can expect every year while holding a bond.

Two years later, rates have risen, and bond prices have moved in the opposite direction. So that same bond commands a 4% coupon.

What’s your bond worth now? Exactly $0.74511 on the dollar, or just under 75% of the original value.

So, you see why long-dated bonds and the ETFs that own them are suffering.

Now, our team at Wide Moat Research have recommended government bonds in the past at Intelligent Income Daily. Specifically the Series I Savings bond.

Those are different because they can be redeemed at any time after one year for full value, so there is no risk of loss due to price changes. There are also strict limits on the amount of Series I Savings bonds investors can buy.

But the TLT ETF only yields a little over 2% today, and that’s after the share price has declined by nearly 45%. And you can’t swap it out with a different investment. Do that, and you’ll have to absorb all those unrealized losses just like a bond ETF or mutual fund investor.

If you own the bonds outright instead of through an ETF or mutual fund, you can choose to hold to maturity.

Very few people do that, however, as they lose diversification and transaction costs may be high.

So, if you don’t want to purchase individual bonds, avoid bond ETFs that decline in the face of rising inflation. And there is still a way to make income in the markets…

Fortunately, there’s a way to protect against inflation and obtain reliable income. Many of our current top picks not only paid steady dividends but increased them throughout the pandemic and the Great Recession.

The first company we recommended in the Intelligent Options Advisor, for example, has increased its annual dividend for 29 straight years.

There are other solutions to this problem within the broader fixed income bucket. That’s what the wealthier clients did at the large firms I used to help manage.

They avoided long-term bonds and allocated more to certain types of stocks and “alternative income” investments.

Ares Capital (ARCC), the largest company in its sector, currently yields 9.8%. And this is no sucker yield. ARCC is a $10 billion market cap company and managed by the best of the best. When others were struggling, ARCC paid that sky-high dividend throughout the pandemic.

ARCC is one of many “alternative income” investments that many investors have never heard of, but we’ve been following for many years.

And we’ll continue to target investments like that to boost our income streams and outperform the broader markets… with a lot less risk than traditional “risk-free” investments.

Happy investing,

Stephen Hester

Analyst, Wide Moat Research

P.S. If you’d like to see what income-producing investments we’re recommending now, I’d encourage you to hear from our founder, Brad Thomas. As Brad explains, there is a special type of investment that can deliver regular income through good times and bad. Learn more right here.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.