|

We’ve all heard crazy investment promises like:

-

You could double your money in a year!

-

… In a month!

-

… In a day!

It’s frustrating for those who don’t hit those crazy paydays. We all want unbelievable returns in as little time as possible. I’m no different than you…

But there’s a reason we call claims like this “crazy.”

Since 1990, had you invested $1,000 passively in the S&P 500 Index, you would have done well. Buying and holding since 1990 would have netted a 9.29% average annual return. The $1,000 would have been worth $10,442.50 at the end of 2020.

As good as that sounds, had you chosen the Nasdaq Composite instead, you would have averaged just shy of 15% a year since 1990. That’s a 28x return. Your $1,000 would have been worth $28,058.87 at 2020’s year-end.

And that’s using the simple return – not reinvesting dividends. Had you done that, you could have compounded a 34x return, turning $1,000 into $34,139.96.

Those returns are great, but 30 years? C’mon! When it comes to stocks, few are that patient.

The hard truth is we don’t always want what’s good for us. It’s like going to the gym – I feel great after exercise, but I never want to go to the gym. I want all the returns and none of the work.

And I certainly don’t want to do it every day for 30 years. But I know it’s good for me and will help me when I’m old(er).

Investing is the same.

But what if we could book monster gains… and not wait several decades for it?

Of course, we’ve heard of speculative options winners or the rare cryptocurrency overnight jackpot. Those would be awesome to hit, but it’s really hard to do predictably.

But there is a real way to book big gains in as little as a couple of days… No need to wait a third of your life to get there. It’s also far more predictable.

Let me explain with a real example that happened just this week…

Monster Outliers

I’m Jason Bodner, the editor of Outlier Investor. What I do is simple: I cast a huge net into the ocean of stocks. I analyze thousands of them. My computers rank them daily from strongest to weakest.

I look for technical strength and fundamental power. I also look for Big Money investors buying stocks. When they buy the best ones, I have a potential outlier on my hands.

We see outliers everywhere. A few outlier athletes shatter all the records. A few outlier businesspeople make billions. A few outlier actors star in all the blockbuster movies.

And outliers exist in the stock market too. It has been my mission to find them since 2001.

Finding outliers is how I built and continue to build my wealth. That’s my secret to making monster one-day gains: outlier stocks.

Here’s the trade-off… Once I find a potential outlier stock, I grab it and generally never let go. Of course, aside from Warren Buffett, most people don’t share my holding time of “forever.” But that’s how you can reliably make thousands of percent.

The trade-off is time. Just like investing in the S&P 500 would have given you a 10X on your money in 30 years, the longer you invest in an outlier, generally, the better you do.

Of course, you can sell an outlier after a big gain.

But I’ve found that patience pays off. And it certainly paid off big time for my followers this week…

Holding on to a Winner

On July 27, 2018, I told readers of my research service to buy a little-known stock called The Trade Desk (TTD). It was a small company disrupting the digital advertising space. It was only worth $3.8 billion at the time. I wrote:

What we have here is a company that executes and over-delivers. It’s a small, growing player disrupting an industry. It has low debt and massive growth. It’s small compared to its peers, which means that it can be snapped up at any time. These are the setups I love…

We added it to the portfolio at $89.50. By September, the stock had risen to $150. I could have told everyone to sell for a fat 68% gain in mere months. It was tempting… But I believed it was a true outlier and worth holding on to.

Imagine my dismay when by December, it had fallen back down to $106.55. Our 68% gain melted to only 19%.

Readers were mad, but I was resolute: I was sure it was going up.

And go up it did. By February 2020, TTD had risen to $305.30. We were now sitting on 241% whopper. Readers wanted to know when to sell. I told them to keep holding.

Along came COVID-19… and TTD sank along with everything else. By the end of March 2020, it cratered our 241% gain to “only” 79.8%.

Readers were mad again: “Why didn’t you take profits?!”

But once more, I told them to hold… We just needed to give this outlier more time.

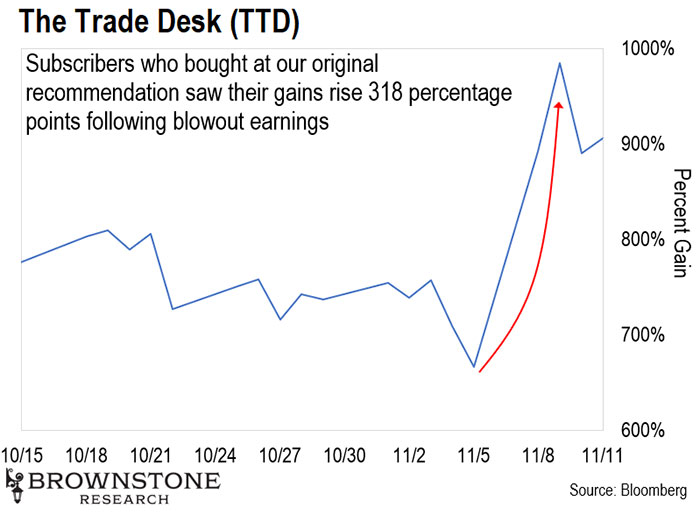

And as we’ve seen over the past year, I was right. TTD hit its lows in March and took off running. As of Monday, November 8, we were up 666%.

Most readers would probably be more than satisfied with that kind of gain. Surely, most of the stock’s upside was gone, right?

But I encouraged my followers to be patient… and this week, we’ve seen exactly why…

Big Moves in a Short Time

This week, TTD reported blowout earnings. It beat earnings expectations by 20% and blew away sales estimates too.

And the stock exploded 29.5% in a day as a result. It closed at $88.75 on 11/8/2021 – an absolutely monstrous return from our entry.

(Note that the stock split 10-for-1 on June 17 of this year. That made our effective entry $8.95 per share.)

So in a single day, the stock price rose an astonishing $20.20. Then, the next day, the stock rose another $8.34. That’s a total move of $28.54.

Compare the size of that move to our $8.95 entry price…

Our returns this week grew from 666% to 984% at the peak. That’s a 318% increase on our initial investment in just two days.

The downside is we had to wait a little: three years and four months. But that’s honestly a short time in the stock world.

Over the same period, the Nasdaq gained an awesome 106%. But TTD beat that handily with a 10X return. Remember – it took 30 years to 10x our money with the S&P 500.

TTD did it in about one-tenth of the time.

So could we sell now for a fat 10x gain? Sure, we could.

But if we hold another few years, imagine how much higher TTD could go. That’s the power of outlier companies.

Outliers hold the key to beating the market. TTD is a real, prime example.

And despite their grumbles in the past, my readers are thanking me for it too.

TTD isn’t the only outlier I’ve found either. I’m regularly hunting for the latest ones to pop up on my radar. And if you want to learn more about my latest recommendations… and how I uncover these stocks… you can find out more right here.

Talk soon,

Jason Bodner

Editor, Outlier Investor

Like what you’re reading? Send your thoughts to [email protected].