The building looked like any other bland, concrete commercial center. The parking lot was only half full. And when I walked into the reception area, no one was there – just a phone with a marquis of extensions to dial.

After reaching the operator, someone came out and directed me to a standard conference room with a plain wooden table and better-than-average chairs.

At this point, I was half convinced I was in the wrong place.

But this was no ordinary business complex… In fact, inside these walls, billions of dollars moved around markets all over the world every single day.

And there I was, in the belly of the money-making beast, getting ready to sit down with a portfolio manager of one of the world’s biggest hedge funds.

That day, I got a glimpse of how intense this shadowy world can be…

Revealing What’s Behind the Curtain

I’m Jason Bodner, the editor of Outlier Investor here at Brownstone Research. For nearly two decades, I worked on Wall Street at prestigious firms like Cantor Fitzgerald. There, I got to see how the world of finance really works.

Hedge funds, institutional players, and venture capitalists simply operate on a different playing field from Main Street. Effectively, they have a different ruleset than you or me when we log into our brokerage accounts.

That’s one reason I finally left Wall Street behind… And now work alongside Jeff Brown to give regular investors a glimpse “behind the curtain.”

My goal is to give my readers an insider’s view of how the Street really works… And show how we can achieve life-changing gains by following the trail of these “big money” buyers.

And at this meeting back in 2015, I learned just how different the worlds of Wall Street and Main Street can be…

Many, Many Pennies

After leaving my job running a trading desk, I spent hundreds of thousands of dollars and more than 10,000 man-hours perfecting a system to spot when “Big Money” players were moving in and out of a stock.

This, combined with an analysis of a company’s fundamentals, technical patterns, and a total of 120 different data points on thousands of stocks, allowed me to determine the best investments on any given day.

And that’s why I was sitting there in the nondescript office in rural Connecticut. I was pitching my system to this $500 million portfolio manager.

The manager, Brad, traded a sophisticated strategy called “statistical arbitrage” – or “statarb” for short.

This meant he would buy one security while simultaneously selling other similar securities to capture price inefficiencies. For example, he might buy an international stock while selling its U.S.-listed equivalent. If there was a penny difference between the prices, it would be a “free” penny of profit.

Of course, for that to be meaningful, he would have to trade many, many pennies.

In fact, many hedge fund managers like Brad would lever their portfolios by 10-to-1. By pledging $1 as collateral, they’d be able to borrow an additional $9 to use.

Typically, these kinds of arbitrage strategies employ a lot of leverage. And they can afford it because of the perceived low risk of correlated securities breaking down. In other words, foreign and U.S.-listed versions of the same company shouldn’t diverge much in price for long.

As long as there was a minor difference, however, a portfolio manager could lever up and exploit it.

And Brad was excited to hear more about how my system could help him trade. After shaking hands, he announced, “Well, I never expected to say this, but your signal is the strongest off the shelf I’ve ever tested!”

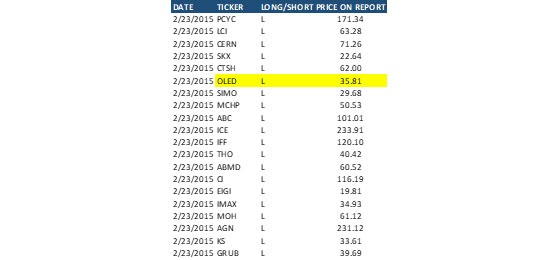

I quickly shared an overview of how my system worked and offered my list of top 20 stocks from that week, highlighting Universal Display Corporation (OLED) in particular.

Brad was intrigued. “I know a lot of these tickers. It’s so interesting that you’re isolating them.”

I was getting excited, thinking we were surely close to making a deal… But then the other shoe dropped.

A Fundamental Difference

I shared with Brad that my system showed peak returns with a nine-month holding period – sometimes longer.

And the smile dropped from his face.

It quickly became clear that there was a fundamental difference in how he traded compared to everyone else. Very rarely, he would hold positions for a few days… But most of the time, his holding period was much less. He was slinging around half a billion dollars several times a day – if not a minute.

And he wasn’t alone – at last count, there are 10,000 hedge funds like his managing a whopping $3.2 trillion… Before leverage.

Brad reiterated that my system was the strongest he’d ever seen… But it wasn’t right for his time horizon.

The meeting was over, and my spirits sank.

But it wasn’t long before I began to recognize the bright side to this meeting… Hidden in Brad’s evaluation of my life’s work was a clue… And a new direction.

Even if my algorithms weren’t his cup of tea, they were tracking his actions. When he said he knew the tickers I showed him, it was because he had positions in them. I was picking up on his buying – and that of many others like him.

And while Brad and his ilk had the resources to make money on such short-term trades, I knew my system could be a big help to people for whom nine months or longer is a perfectly reasonable time frame.

In fact, the stock I highlighted for him during that meeting, OLED, has risen over 550% in the time since. And if someone had bought a position in every stock on the top 20 list I showed him and held until now, they’d have an average return of 108%.

So rather than using my system to improve a hedge fund’s performance, I knew that I could use my system to help regular investors instead.

And in the years that have followed that meeting, I’ve followed through on that vision. For the past seven-plus years, I’ve helped readers make more from their investments by tracking Big Money moves.

That’s how we’ve achieved gains like 418%, 333%, and 829% sitting in our model portfolio right now in my Outlier Investor research service.

So while regular investors don’t have hundreds of millions of dollars at their fingertips… And few of us are capable of the kind of high-frequency trades a hedge fund can make… We can still use “insider” knowledge of how the Street works to rack up big gains.

Peeking behind the curtain gave me huge insight into how to make ordinary people into stock market whizzes.

And if you’d like to learn more about how my system works… and the stocks currently hitting my buy list, then you can go right here for the whole story.

And be sure to tune in next Saturday, when I’ll share another glimpse of what really goes on behind the scenes on Wall Street…

Talk soon,

Jason Bodner

Editor, Outlier Investor

Like what you’re reading? Send your thoughts to [email protected].