I have a game for you to play.

I have a jar full of 1,000 candies. There are 960 white vanilla ones and 40 red watermelon ones.

But you can’t see the difference because each watermelon one is coated in white.

Now your job is to try to pick the red ones, and you must bite into them to find out the flavor. You get to try as many times as you like, but the winner must get at least one watermelon.

Ready, set, play!

Source: Pinterest

Who wouldn’t play that game?

But now let’s put a sinister twist on it.

The rules are the same… only this time, the 960 vanilla candies are poisonous. That’s right… You have a wickedly high chance of dying.

The trade-off is that the watermelon ones will make you a millionaire many times over.

Would you play now?

Considering you’d have better odds playing Russian Roulette… probably not. With a single bullet in a six-chamber pistol, you have an 83% chance of living. With the candy game… you’d have a 4% chance.

Neither seems very appealing to me. I like my games to have heavy odds of success and low odds of demise.

But if you’re a stock investor, you may just be binging on poison without even knowing it. The reason is simple. The odds of stock market success are as low as the candy game.

But today, I’ll show how you can stack the odds in your favor…

Stocks That Outperform

Hi, I’m Jason Bodner, the editor of Outlier Investor. Each day, I scan 6,500 U.S. stocks, looking for the best stocks being bought up by big professional investors. When they buy the best-quality stocks, we have a potential outlier on our hands – a stock that will outperform the rest.

I love playing with a stacked deck. And when it comes to investing in stocks, I’ve found that these “outlier” stocks are the best way to stack the odds in your favor.

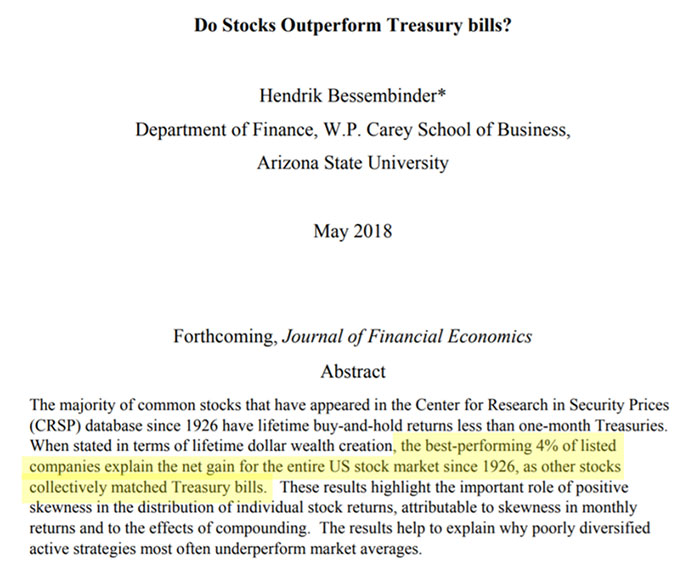

In fact, the real potential of outliers was hammered home by a professor back in 2018. He posed a simple question: “Do stocks outperform treasury bills?”

I’ll save you from reading the 100+ page study. The professor investigated approximately 25,000 listed stocks from 1926 to the present and found something shocking…

Here it is in his own words:

I’ll repeat that highlighted line for you: The best-performing 4% of listed companies explain the net gain for the entire U.S. stock market since 1926, as other stocks collectively matched Treasury bills.

That’s right. Only 4% of stocks – 1,000 out of roughly 25,000 – accounted for the entire net gain of the market above bonds. The other 96% together only matched bonds.

That means if you’re not in the 4%, you’re wasting your time. You might as well buy bonds for their meager yield.

He also found that just 1% of stocks (roughly 250) accounted for 50% of the gains of the entire market.

Think about that… How accurate do you have to be to win at that game? These odds are essentially the same as our poison candy game.

I don’t mean to depress you. Don’t despair, though, because there is good news to this story.

Finding the 4%

I’ve devoted the last 20 years of my professional career to finding the 4%. Better still… finding the 1%.

I’ve spent years, loads of money, and thousands of hours working on how to identify outliers. And in the process, I’ve developed software that can pinpoint them with impressive accuracy.

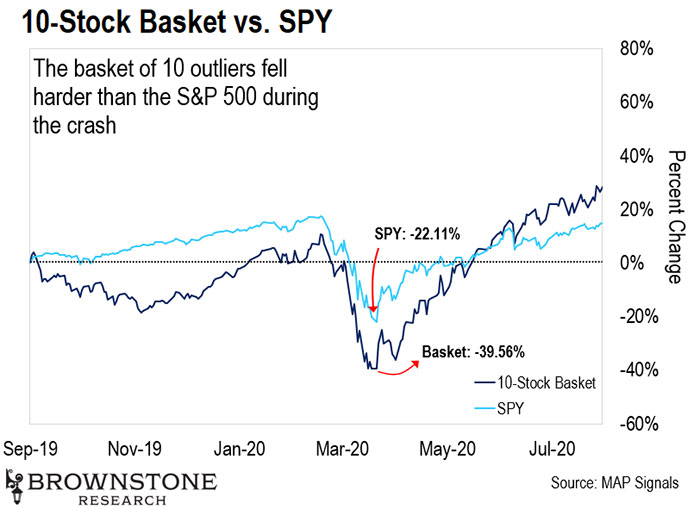

Leading up to the pandemic, I used my software to find a basket of 10 outliers.

I’ll tell you straight up, these stocks struggled to keep up with the S&P 500 for five agonizing months. Then the pandemic hit hard, and the pain got even worse.

The 10-stock basket fell -40%, while the SPDR S&P 500 ETF Trust (SPY) fell “only” -22%.

Let me show you…

At this point, many people would have doubted that these 10 stocks were really outliers.

But watch to see what happened next…

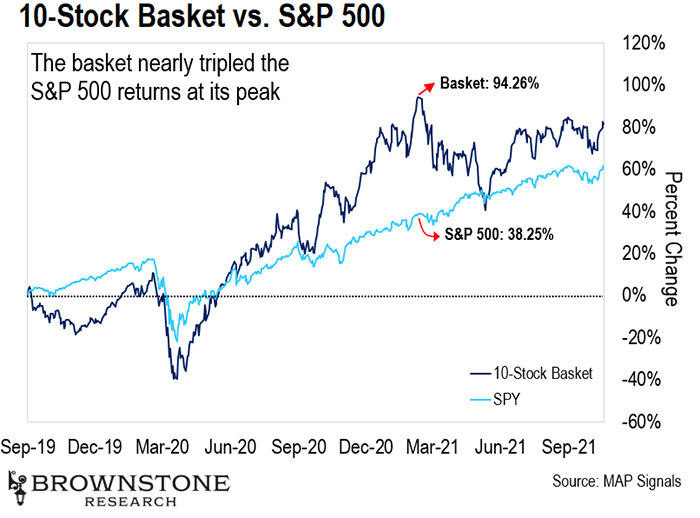

As many of us will recall, the market exploded following the crash.

How did our outliers perform? Less than a year later, they had nearly tripled the SPY at their peak:

That’s the power of outliers.

And this process for identifying outliers has worked for the 10 years-plus that I’ve been using it. The same even holds true through another 20 years of backtesting beyond that.

The results are frankly beyond belief.

In fact, let me show you how this strategy could bring investors more than a 500,000% return over time…

Beating the S&P Hands Down

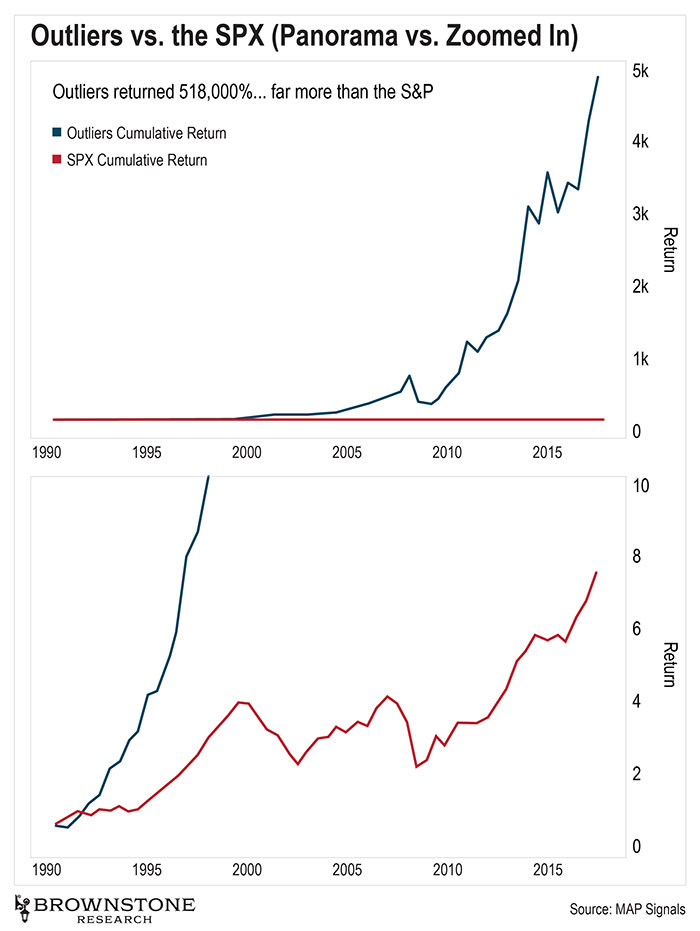

I did my own study of how a strategy using outliers compares to buying the S&P 500 from the mid-1990s up through 2017.

The outlier strategy was this: Every six months, I would rebalance my portfolio of 20 outlier stocks, replacing the companies with new outliers that had topped my list over the previous six months. These are the outlier stocks showing up in my research that I sell to hedge funds.

The portfolio only ever held 20 stocks at a time. It was a “twice-a-year trader” strategy.

During the time from 1990 to 2017, $1 invested in the S&P 500 would have become $7.56.

In comparison, $1 invested in the twice-a-year rebalance would have become $5,188.87. That’s a 518,887% return.

If that sounded like a mic drop… Well, it was.

This is just further proof of the 4% example above.

If you’re not in the outliers, you’re wasting your time. Worse still, you’re likely poisoning your portfolio.

Now, outliers are hard to come by unless you know where to find them. As I showed above, they don’t always go up immediately. But history shows they win more than lose… with wins bigger than losses.

And they outperform the broader market massively.

So how can regular investors find the 4%?

Here’s my recommendation.

Using my latest list of outliers, I picked 50 stocks that topped the rest. Then I went and looked up ETFs that hold many of those same stocks.

One jumped out. It may have more volatility than the S&P 500. But the simplest way to gain access to most of the outlier stocks on my list is to buy the iShares Russell 1000 ETF (IWB).

It holds 35 of the 50 stocks on my list. Of course, it holds 965 other stocks too.

On the other hand, if you’re wondering how you can benefit from handpicked outliers, I’d like to invite you to join me at Outlier Investor. For all the details, please go right here.

The media makes you think investing in stocks is easy and carefree. But the odds say that it’s more like fishing your hand in a bowl that’s 96% poison candies.

The flip side is, if you know which the 4% are, you’ll be tasting the sweetest flavors life has to offer.

As always, the choice is yours.

Talk soon,

Jason Bodner

Editor, Outlier Investor

Like what you’re reading? Send your thoughts to [email protected].