- How geopolitics affects the semiconductor shortage…

- Could the U.S. make cryptos illegal?

- Tech is solving the organ transplant need…

Dear Reader,

Welcome to our weekly mailbag edition of The Bleeding Edge. All week, you submitted your questions about the biggest trends in technology.

Today, I’ll do my best to answer them.

If you have a question you’d like answered next week, be sure you submit it right here.

Will Chinese aggression affect the chip supply?

Let’s begin with a question on the semiconductor industry:

Jeff, with China’s recent aggression towards Taiwan, and Taiwan Semiconductor Manufacturing (TSM) being one of the major semiconductor manufacturers, do you think this will affect the already strained chip supply situation?

– Mark J.

Hi there, Mark. Thanks for sending in this question. You’ve got good instincts for spotting potential trouble.

As many readers are aware, the world is facing a monumental shortage of semiconductors like we’ve never seen before. And while it’s easy to ignore or overlook semiconductors, we shouldn’t make that mistake. Our own government has referred to computer chips as “essential to modern-day life.”

That’s because semiconductors are used in many different industries. They are the “brains” of all electronics.

And as technologies like artificial intelligence (AI), robotics, and 5G networks become more prevalent and complex, the demand for semiconductors increases. That’s why the recent supply shortage has been causing so much trouble.

We’re experiencing shortages of the essential chips that power our gadgets like smartphones, TVs, and computers… as well as even more critical items like microwaves, air conditioners, laundry machines, cars, and medical devices.

I call this a “tech shock” – a moment in time when things are changing so quickly and demand is so high, it’s difficult for production to keep up. Right now, semiconductor manufacturers are playing catch-up… and spending billions to expand their production capacity.

And this situation makes your question even more pertinent, Mark. What would happen if Chinese aggression against Taiwan escalated? Worse yet, what would happen if China took control of Taiwan entirely?

The answer is… nothing good in the short term.

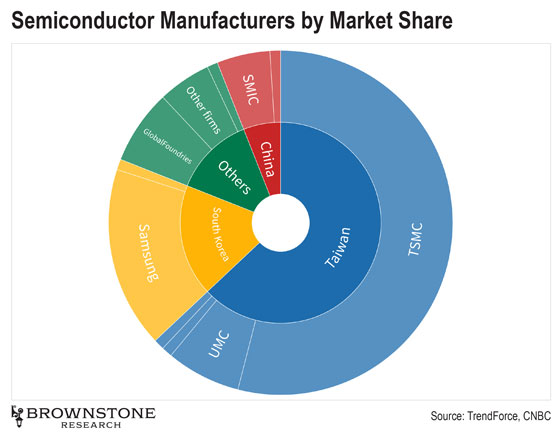

Many readers may not realize it, but the U.S. only makes about 12% of the world’s semiconductors despite leading in chip design and intellectual property (IP). Most manufacturing is offshore. This was done historically because of lower labor costs in Asia.

Taiwan’s TSM makes about 92% of the world’s most advanced semiconductors. And it makes around 60% of the less advanced chips our cars need.

In total, TSM accounted for over half of the global semiconductor foundry revenue in 2020.

TSM and Samsung are currently the only foundries capable of making bleeding-edge, 5 nanometer (nm) chips. In fact, TSM is already gearing up to produce 3 nm chips in the near future.

One research firm estimated that other countries would have to fork over $30 billion a year for at least five years to even have a chance of catching up to TSM’s technological lead.

If we think logically, China likely recognizes the huge impact a disruption of TSM’s business would have. Taiwanese leaders have referred to this deterrent as the “silicon shield” – its critical role in the semiconductor industry has protected it thus far.

That said, there is no guarantee that China will make decisions in the best interests of the global economy. It’s possible irrational decisions will be made that are entirely politically driven.

If China’s government wanted to damage an economy – whether a specific one, the global economy, or even a specific company – it could simply choose not to ship the semiconductors.

Imagine what would happen to Apple if China restricted the shipment of any of its A15 chips that power its iPhones? Apple would have no products to sell. Doing so would be an incredible benefit to companies like Samsung, Huawei, and other China-based smartphone manufacturers.

This is precisely why countries around the world are racing to expand their production capacity. They understand the political and economic risk right now.

In the current environment, I do not believe the U.S. government would do anything to stop the takeover of Taiwan. If there were ever a perfect time for China to strike, it is right now.

While the current geopolitical situation is definitely scary, I do see a tremendous opportunity. This is the catalyst that the world needed to begin the process of decentralizing manufacturing again.

The dramatic labor cost advantages simply don’t exist anymore. And with the employment of advanced automation technology and artificial intelligence, the net cost of manufacturing onshore is dropping quickly.

Bringing manufacturing back onshore in developed countries is not only good from an economic perspective, it is also good for the environment.

Instead of shipping goods halfway around the world only to assemble them and ship them back again, why not just manufacture them locally? Far less carbon will be emitted due to the reduction in shipping and cargo flights.

Distributed manufacturing is also good for reducing supply chain shocks. I experienced this myself when I was working in Japan for NXP Semiconductors. When the tsunami caused by the massive earthquake hit, numerous manufacturing facilities related to the semiconductor industry were damaged and went offline for weeks and, in some cases, months.

The whole industry suffered as some Japan-based companies had 80% global market share for key materials required for semiconductor manufacturing. If the industry wasn’t as centralized, the impact would have been far less.

I’ve recently put together a presentation to show investors how to profit from this dynamic. The chip shortage has massive implications for many important technology trends we’re following… and it’s creating a unique opportunity for investors to profit. If you haven’t yet checked it out, I highly recommend going here to watch.

Are cryptos really immune from interference?

Next, a reader wants to know more about government action against cryptos:

Hello, Jeff – as a subscriber to several of your letters, I’m hoping you’ll clarify something for me. I see it as virtually in every government’s interest to protect their national currency.

Given the success the U.S.A has had with bludgeoning the world’s financial industries into adopting know-your-customer (KYC) and anti-money laundering (AML) policies, shutting down tax havens, coercing information exchange treaties, and creating global standards, it doesn’t seem unlikely that the same hammer will be brought to bear on the threat cryptos pose to government control of money.

What happens if the U.S.A follows China’s lead and makes it illegal for any person or business to hold, use, or facilitate the use of cryptos within the U.S.A?

I’ve been hearing for years that cryptos, due to being decentralized, are immune from government actions, but I find that suspect.

We are already seeing the extent to which China has decimated the mining industry and just recently has apparently made it illegal for anyone or any institution to even touch cryptos.

The response of the crypto enthusiasts has been to move to more hospitable jurisdictions, but what happens when the crypto industries run out of hospitable jurisdictions? I do hope you’ll write on this matter, as I suspect this will be meaningful to many readers.

– Al R.

Hi, Al – thanks for being a subscriber and for sharing this question. I’m sure you’re not the only reader wondering about this… especially given China’s recent escalation of its anti-crypto policies into an outright ban.

The answer to your question has some complexity. Theoretically, yes, the U.S. government could pass legislation outlawing the use of cryptos. However, to truly put this into effect, it would likely have to take additional steps.

Due to crypto’s decentralized structure, the main way for any government to “shut down” crypto would be to remove citizens’ internet access. That’s a fairly drastic step from where the situation currently is.

Of course, as we discussed a few weeks ago, projects are currently in place to enable crypto transactions even without internet access.

Plus, some people are designing alternative ways to provide online anonymity by building on The Onion Router (Tor), which is open-source communication software that is state-actor resistant. This means not even governments can know what website you are visiting or your location.

Another “simpler” move would be for the government to shut down the cryptocurrency exchanges. This wouldn’t stop transactions entirely, but controlling the entrance and exit ramps would make it enough of a challenge to discourage many people.

But I foresee an even more likely option…

If our government decided to put pressure on the crypto community, all it would have to do is create an extremely unfavorable tax rate for cryptocurrency gains.

This move would be similar to the government’s response to the “wildcat banking” of the 1800s. Risky banks in this period were chartered without any federal oversight and would issue their own currencies. But following the creation of the National Banking System, Congress effectively taxed these private banknotes out of existence.

This would likely only happen following the release of our official central bank digital currency (CBDC) or “Fed Coin.” The Federal Reserve would begin issuing its CBDC… and removing “wildcat cryptos” from the system by heavily taxing their use.

Those are all the worst-case scenarios. And I don’t think that they’ll occur. The most likely outcome is that the U.S. government, and most other governments, will maintain strict control over their own national stablecoins (CBDC).

By doing so, it gives the government the power that it wants, which is the ability to print as much of the national currency as desired and to also “see” every transaction made using the digital dollar. This will provide the government the power to tax each transaction accordingly.

A stablecoin is a cryptocurrency, and when used by a nation-state, it will be centrally controlled. There already are stablecoins managed by third parties backed by fiat currencies and other commodities. In many countries, these will be allowed to persist. When managed well, they are a very useful asset that can be easily used to invest and trade.

The reality is that the internet won’t be shut down. The economic repercussions would just be too severe for any country that would try to do it. And much of the world already understands the potential that blockchain technology brings.

The movement has so much momentum. Some of the most talented executives and technologies are building the next generation of the internet and financial services.

Former regulators are flocking to join these projects because they understand their potential. The big difference between the internet we have today and the one that blockchain technology enables is that there are economic incentives built in – cryptocurrencies.

This accelerates technological development. And we have already reached the point of escape velocity.

Creating organs for transplantation…

Let’s conclude with a question about organ transplants:

I read Jeff Brown’s emails about 3D printing. I would like to know if they have 3D printed a heart or a liver for transplant. I also would like to know if they are going for FDA (U.S. Food and Drug Administration) approval. I read it somewhere about the above. I just do not remember the details of the article. Thank you.

– Alice L.

Hi, Alice, and thank you for writing in. This is a very interesting topic that I’ve been following for some time. Creating organs for medical use is a critical issue.

After all, more than 100,000 people in the U.S. are currently waiting on organ transplants. And about 20 people die every single day because they didn’t receive an organ in time. There just aren’t enough transplantable organs available for those who need them.

And 3D printing is one method we’ve been experimenting with to solve this problem.

As far back as 2019, for example, a SpaceX mission delivered a 3D printer called a BioFabrication Facility (BFF) to the International Space Station (ISS). It uses human cells to print human tissue – the first step toward printing functional organs we could use for transplants.

It’s been a challenge to 3D print organs here on Earth. Under gravity, the tissue isn’t stable and often collapses.

But as of 2020, the BFF successfully printed a meniscus – a piece of cartilage that acts as a shock absorber in our knee joints. And the BFF is due for another upgrade this year.

I’m excited to see where it goes from here.

In fact, in June of this year, we saw some additional progress. After six long years, NASA finally announced the winners of its Vascular Tissue Challenge. Two teams from the Wake Forest Institute for Regenerative Medicine successfully used 3D printing to create liver tissue that could survive for 30 days (a competition requirement).

The first-place team will have the chance to send its research to the ISS as well.

And equally as exciting, other options are being developed in parallel with 3D-printed organs. We’re seeing incredible innovation in this area.

Another technology we should pay attention to is called xenotransplantation. That is the transplantation of cells, tissue, or organs from one species to another – typically from animals to humans.

And eGenesis, a company founded by Harvard geneticist George Church, is working on engineering pigs to create human-compatible organs. It’s starting with kidneys, which could be a game changer for those suffering from kidney failure. It’s also working on cells that can help treat Type 1 diabetes.

It’s not the only company working in this space either. An early stage company called XenoTherapeutics is testing skin grafts from edited pigs to treat burn victims in a Phase 1 clinical trial right now. The FDA approved these genetically engineered pigs for both food and medical applications.

We’re seeing some great examples of how bleeding-edge technology can be used in unconventional ways to save lives. And I’m sure we’ll continue to see great progress in the coming years.

While there’s still a lot of work to be done, the companies that succeed will make strong investment targets as well. So I’ll continue to update readers as more developments are revealed…

That’s all we have time for this week. If you have a question for a future mailbag, you can send it to me right here.

Have a good weekend.

Jeff Brown

Editor, The Bleeding Edge

Like what you’re reading? Send your thoughts to [email protected].