|

By Nomi Prins, Editor, Inside Wall Street with Nomi Prins

Get ready for an “energy shock…”

Experts predict it could happen as soon as this winter.

But if you know where to look, you can protect your portfolio – and profit.

That’s why this Wednesday, August 31 at 8 p.m. ET, I’m holding an urgent strategy session.

I’m calling this event the Running on Empty Summit.

There, I’ll do a deep dive into the coming shock… and what you can do to prepare your portfolio.

Plus, I’ll share the details on a small, publicly traded firm that could hold the key to solving a major problem in the energy crisis.

You can reserve your spot for free here.

But first, some background. As you’ll see, this crisis could soon hit your wallet in subtle ways you may not see coming…

On June 3, the European Union (EU) adopted a partial embargo on Russian oil.

The sanctions will ban seaborne imports of Russian crude oil as of December 5, 2022. And they’ll ban petroleum product imports starting on February 5, 2023.

It’s all part of the EU’s harshest sanctions package against Russia to date. And that’s saying something…

The EU gets roughly a quarter of its oil and 40% of its gas from Russia. So this embargo could have a big impact on fuel supply and prices in Europe.

But it will also have a knock-on effect on fuel and energy prices globally. That’s because Russia accounts for 10% of the world’s oil. And it’s the world’s largest gas exporter.

Now, here in the U.S., energy prices are already up 33% year over year. That’s according to the July Consumer Price Index (CPI) data released by the Bureau of Labor Statistics.

If you look even closer at those figures, you’ll see gasoline is up 44% in the last year. And fuel oil is up nearly 76%.

If the EU goes through with its Russian oil ban this winter, we can expect fuel and energy prices here to shoot even higher.

The World Bank expects global energy prices to go up more than 50% in 2022.

But that won’t just drive up the cost of filling your car or heating your home. Rising fuel and energy costs have much bigger consequences…

In fact, the amount you spend putting food on the table is also closely linked to the cost of energy.

And that means you may have to look for further cuts in your household budget if the EU bans go ahead. Here’s what I mean…

When most folks think about fuel and energy price increases, they don’t think about the impact this will have on their grocery bill.

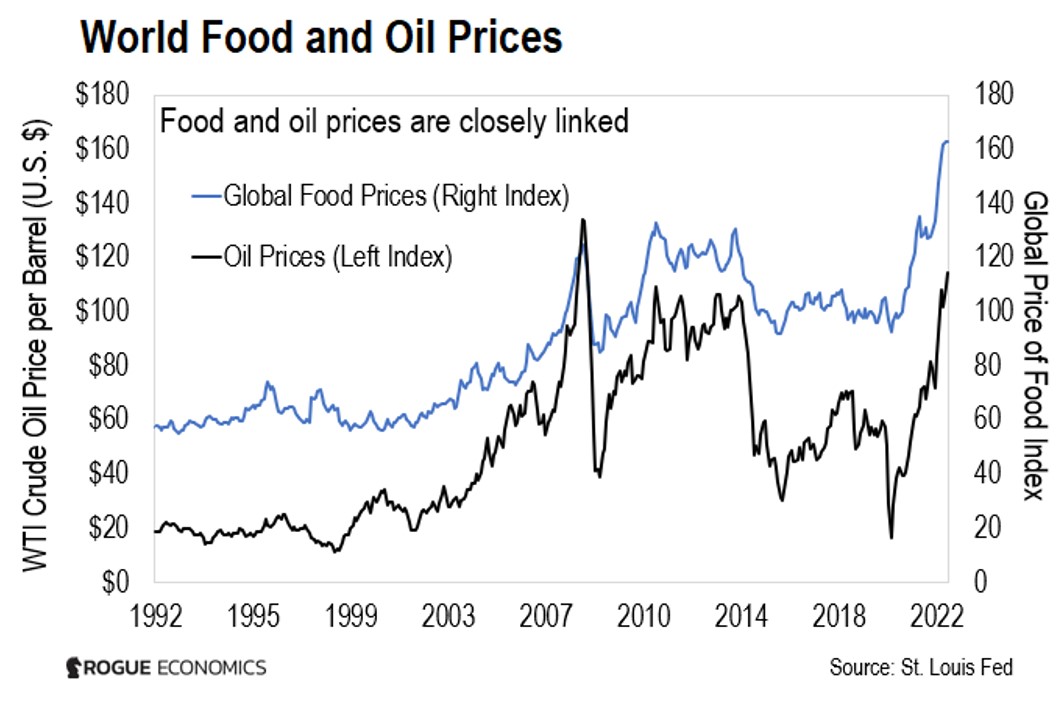

But food and energy prices go hand in hand. Take a look at the chart below. It shows global food and oil prices over the last three decades…

As you can see, the two are closely linked. In fact, over the last decade, they have moved practically in tandem.

And it makes sense. It takes energy – especially fossil fuels – to produce food.

Oil is used to make pesticides and food packaging. And natural gas is used to make fertilizer. Both are used to generate electricity for the food production industry.

You also need energy to transport food to the store. Trucks and trains run on diesel; planes run on jet fuel. There are millions of them crisscrossing the nation each day to get produce to the market.

So when energy prices go up, food gets both more expensive and less abundant.

Producers pass on their rising energy costs. Because of higher prices, consumers look for alternatives to cut down on their grocery bills.

In response, producers reduce their output – leading to shortages, which drive prices up even further.

That’s why when the price of energy rises, the price of food rises along with it. In fact, research shows that changes in oil prices can explain more than 60% of the variation in food prices.

Even before Russia’s invasion of Ukraine, prices were tearing higher as the world opened up after the 2020 lockdowns.

Remember, energy prices are already up 33% over the past year here in the U.S. And the cost of food is up 11%.

But energy and food prices here spiked when Russia started a war in Ukraine.

U.S. energy prices increased 11% from February to March 2022. And the cost of food at home rose by 1.5%.

In fact, according to the United Nations’ Food and Agricultural Organization (FAO), world food prices are at their highest level in decades.

In this next chart, you can see they haven’t been this high since the mid-1970s…

Let’s take a quick look at that historical context…

The fact that the last spike of this magnitude in food prices occurred during the oil crisis in 1973-1975 isn’t a coincidence.

That oil crisis began when the Organization of Arab Petroleum Exporting Countries (OAPEC) proclaimed an embargo on oil exports.

The embargo was targeted at nations that had supported Israel during the Yom Kippur War against the Arab states… most notably, the United States, Japan, and Western Europe.

The resulting 1970s Oil Shock knocked the wind out of the global economy. The price of oil went up nearly 300% globally. It set U.S. inflation soaring to above 11%.

And this led to food shortages. For example, there was a scarcity of bread in 1974, salt in 1975, and bread again in 1977.

Today’s parallels with the 1970s oil shock are unmistakable.

We have a war raging in a geopolitically important region. Oil is up 22% so far this year. Inflation in the U.S. is still out of control.

And thanks to the EU-wide oil embargo, things could get worse this winter. We could see substantially higher energy prices over the coming months.

And that will push up food prices, too.

Today’s energy crisis hasn’t resulted in food scarcity or empty shelves yet. But those could be on the horizon.

Speaking at a news conference at the EU headquarters in Brussels earlier this year, President Biden touched on the potential for food shortages.

He said that they are “going to be real… because both Russia and Ukraine have been the breadbasket of Europe in terms of wheat, for example.”

But it’s not just Europe that will feel the pinch…

Russia and Ukraine account for nearly one-third of the world’s wheat supply. And they produce 19% of the world’s corn.

Also, Russia is the fourth-largest producer of fertilizer. And Ukraine is the largest producer of sunflower oil, a key ingredient in lots of foods, followed closely by Russia.

Earlier this year, the World Bank said food prices will soar by more than 20% this year.

Here in the U.S., the Department of Agriculture’s Economic Research Service says poultry prices are predicted to increase between 14.5% and 15.5% this year.

Dairy products are predicted to go up by between 12% and 13%. Egg prices will go up between 19.5% and 20.5%. Fish and seafood will increase between 9.5% and 10.5%.

The world was already experiencing raw material shortages and supply chain issues as an after-effect of the pandemic. The war in Ukraine is intensifying those.

And considering we could see a deeper energy crisis this winter, food prices will likely keep rising throughout the rest of the year.

Now, I know this all sounds grim… especially if your investment portfolio has also taken a beating.

That’s why I encourage you to tune in to my urgent strategy session this upcoming Wednesday, August 31 at 8 p.m. ET.

At my Running on Empty Summit, I’ll do a deep dive into the energy crisis… and what you can do to prepare your portfolio.

Plus, you’ll get details on a small, publicly traded firm that could hold the key to solving a major problem in the energy crisis.

I look forward to seeing you there.

Happy investing,

|

Nomi Prins

Editor, Inside Wall Street With Nomi Prins

P.S. This winter, as the full force of European sanctions against Russia kicks in, experts predict we will see energy prices soar globally.

But what if you could eliminate fuel and gas costs altogether? One small firm has discovered a way to do that.

And right now, you could invest in this company for as little as $1…

On Wednesday, August 31 at 8 p.m. ET, I’m going to do a deep dive into the energy crisis… and what you can do to prepare your portfolio…

I’ll also give you details on the company I mentioned above, and show you how you can invest before the rest of the world catches on to its huge potential…

To reserve your spot for this free event, just go here.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.