Colin’s Note: Today, I’m handing the reins to Phoenix Van Zutphen, an analyst who’s been working behind the scenes at Brownstone Research since 2020.

He’s committed to researching emerging tech trends… and unlocking profitable ways of investing in them. Going forward, we’ll be sharing analysis from Phoenix from time to time in the pages of The Bleeding Edge.

With that said, I’ll hand things over to Phoenix.

Dear Reader,

In the world of high-tech investing, the “gold standard” for exponential growth is Moore’s Law…

The Law was initially hypothesized by Gordon Moore to predict the growth of transistors on a silicon wafer in 1965. But since then, Moore’s Law has also accurately forecast growth in computational power and computing efficiency, and forecast an exponential decline in costs for advanced technologies.

And now, it looks like Moore’s Law is in play for the AI market.

Let’s take a look:

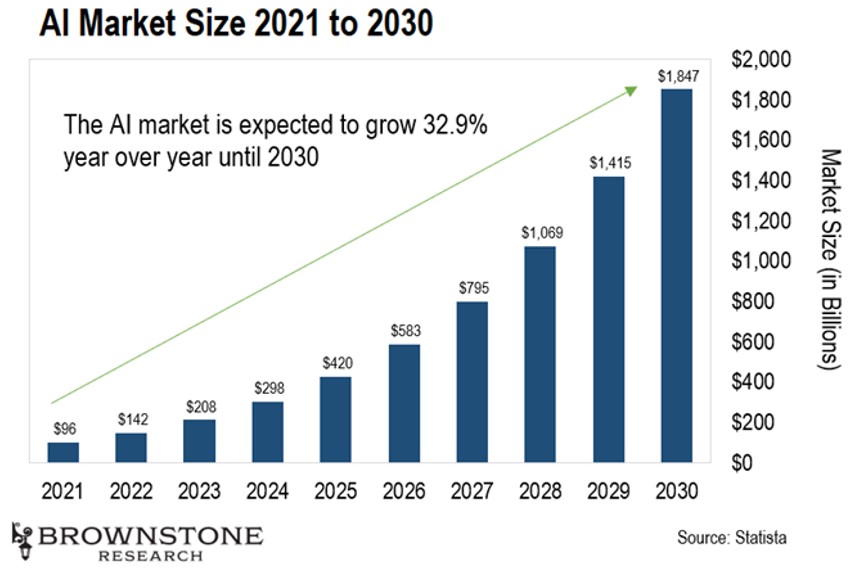

The AI market is slated to grow 8.9x its current value by the year 2030. If we compare that to 2021’s numbers, we see a growth of over 1,900% by 2030.

But here’s what’s most striking: the projected growth is following Moore’s Law, defined approximately as doubling every 18 to 24 months.

Notice how the figure from 2021 doubles by 2023. And from there, we roughly double again by 2025. And it continues in this fashion all the way to 2030.

Make no mistake. We are in the early innings of an exponential trend that will last through the decade.

And history tells us what sort of returns are possible when we identify the right exponential growth trend.

In the mid-2000s, cloud-based applications were in their infancy. But this was another example of an exponential growth trend. As the chart below shows, the size of the cloud computing market roughly doubled every two years between 2008 and 2014. From there, growth does slow. But early investors who recognized the impact of cloud computing had the potential for incredible returns.

During this period, Amazon – the market leader in cloud computing – returned 3,420%. Other cloud-based software providers like Salesforce and Microsoft returned 1,320% and 524%.

As Colin often says, finding an undeniable trend is one of the best ways to see outsized returns.

But here’s the kicker: Analysts have consistently underestimated the growth of the AI market.

Every time analysts issue new projections for how big the AI market will be, we smash right through that ceiling and soar to higher highs. For example, in 2021 research firm Tractica underestimated the size of the AI market at only $34 billion. And the firm Globe projected the market in 2021 would be $87 billion. The actual number came in at $96 billion in 2021.

And we have a similar story for 2022. Tractica projected a market size of $51 billion, and Globe expected a market size of $119 billion. Both firms fell short by far, with the actual figures coming in at a staggering $142 billion.

Estimates were continually outperformed. And 2023 has been reminiscent of the same trend with Tractica estimating $70 billion and Globe estimating $165 billion… We’re set to close the year with an AI market size of $208 billion. That’s an outperformance of 197% and 26%.

So, what we can see here is that the market continually outperforms these estimates. The current estimates are for AI to become a $1.8 trillion market by 2030. If the past is any guide, it’ll be even bigger than that.

It’s no secret that editor Colin Tedards is bullish on AI, and he expects these estimates from the big firms to continue to be exceeded. And that’s why he’s been hard at work lately developing an exciting new AI investment opportunity for all our readers.

Expect to hear more starting tomorrow.

Let’s build wealth together!

Phoenix Van Zutphen

Analyst, Brownstone Research

Like what you’re reading? Send your thoughts to feedback@brownstoneresearch.com.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.