I’ve been skeptical of cryptocurrency for a long time.

In the past, I’ve struggled with what it even is. Valuing it seems nearly impossible sometimes.

It’s why crypto is one of the most polarizing assets out there. Some people glorify it… while others think it’s worthless.

You see, I can value a stock. Behind a stock is a business with sales, earnings, tangible assets, and so on. At the very least, you know value exists because many of these assets can be liquidated if needed.

Currencies are harder to value, especially digital assets. Prices can swing swiftly in a market that’s always open.

For instance, bitcoin hovered around $3,500 per coin in 2019. Last year, it hit its all-time high at $68,990. Yet twice during that year, it dropped to about $30,000. Those are some big swings up and down.

Still, crypto has seen widespread interest and increasing adoption by major companies. The list includes PayPal, Block (formerly Square), Tesla, MassMutual, JPMorgan Chase, and more. This is a world that’s quickly becoming impossible to ignore.

And as a result, in today’s essay, I’ll explain why I’m finally changing my tune on this space…

Hi, I’m Jason Bodner, the editor of Outlier Investor. I spent nearly 20 years on Wall Street, handling some of the largest stock trades on the planet for hedge funds and other big players. During my time there, I got a front-row seat to many of the most important market dynamics.

It’s interesting seeing a lot of them play out in the crypto world now.

Individual coins often fluctuate in concert. There appears to be a high correlation across crypto for the most part. Plus, the entire space is immensely volatile. Drops in value of 50% or more in a year are commonplace.

But underneath the hood of the crypto world lies a fascinating financial ecosystem that’s funding new ventures and projects.

The space resembles private venture capital and alternative start-up financing. It’s still the “Wild West” in many ways, but through the use of blockchain technology, crypto is also proving to be a hub of innovation.

The days of crypto having a reputation for criminal money laundering are giving way to the dawn of what could be a new financial era. As I’ll point out, there is serious innovation happening with crypto, and there are huge values involved.

Let’s look at some facts and figures about the growth of crypto’s market capitalization.

According to TradingView, crypto has a total market cap of more than $2 trillion. Four years ago, it was about $700 billion.

Bitcoin, the most popular coin, is trading around $43,000 and has a market capitalization of more than $821 billion, as of this writing. Back in 2018, its price and market cap were about $16,200 and $276.6 billion, respectively.

Even more explosive growth can be seen in the sheer number of digital assets out there now.

For every popular coin like bitcoin and Ethereum – and every meme coin like Dogecoin or Shiba Inu coin – there are hundreds of others serving various purposes (or none at all). Investing.com lists almost 10,000 cryptocurrencies in circulation worldwide. In 2013, it was less than 100.

The use cases around crypto have grown at a frantic pace as well.

It serves as a currency. It’s also used with decentralized networks for applications and so-called “smart” contracts. Crypto can be part of the Internet of Things – the trend behind “smart” refrigerators, wearable health monitors, and other kinds of connected devices. It’s also pegged to precious metals and fiat currency.

You’ve probably heard Jeff Brown often talking about non-fungible tokens (NFTs), which can be thought of as crypto-based certificates of authenticity. There’s even a “play-to-earn” (p2e) market of NFT games, like the metaverse-based Drone Racing League, where racers compete for crypto and NFT prizes.

And more uses will emerge in the future.

So slowly, I’m changing my tune on crypto. Everything I just mentioned is worlds removed from crypto’s early days. There seems to be real innovation (and real market weight) within this ecosystem.

Despite my shifting views, though, I’m still not ready to recommend any coins directly.

As I mentioned above, cryptos are volatile assets. And while some investors may be comfortable with drastic swings, individual coins aren’t the way I’d like to help readers build a stake in this realm at present.

Rather, we can get crypto exposure the best way I know how, which is through high-quality stocks. There are companies in different industries engaging with crypto. So in this case, broad exposure makes sense to me, which means an exchange-traded fund (ETF).

One ETF I like, with broad crypto exposure across a range of high-quality stocks, is the ARK Innovation ETF (ARKK). This ETF currently has 43 holdings, all of them focused on “disruptive” innovations… including crypto and blockchain technologies.

A major reason I like ARKK as a crypto play is because it holds some major companies with big, broad-based crypto exposure. Investors in this ETF own a popular crypto exchange (Coinbase) and some major crypto investors.

Big Money institutional investors – those looking for the best-in-class outlier assets – have scooped up ARKK shares heavily since 2020. As the green bars in this chart attest, big buying in chunks tends to lift prices:

Big Money also likes some of ARKK’s top crypto-related holdings.

In the chart below, check out the Big Money activity since 2020 in Tesla. While it may sound odd to call this a “crypto” holding, consider that Tesla made a $1.5 billion investment in bitcoin early last year and has been one of the few companies that have accepted crypto as payment for its cars.

There are several Big Money buys in Coinbase too:

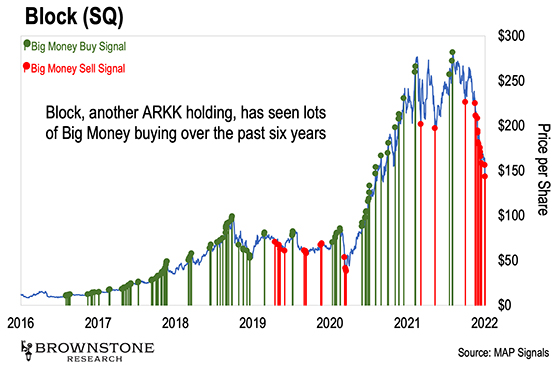

We can also see huge Big Money buying in Block (formerly Square) since 2016. As a reminder, Block recently rebranded to support its shift toward blockchain technology. And its Cash App has helped bring bitcoin adoption to the mainstream.

And with these and other ARKK holdings, we can gain exposure to the crypto trend in one simple move… with less risk.

Going the ETF route lowers risk compared with buying crypto directly.

ARKK and other ETFs are less risky than buying coins individually because ETFs generally invest 90% or more of their assets in a wider collection of stocks.

Additionally, a share of ARKK is a more diverse asset than a purely crypto-focused investment.

Besides crypto, ARKK has exposure to electric vehicles, streaming devices, telehealth, genetics, payment processing, integrated commerce, gaming, and more. Generally speaking, diversification mitigates risk.

For all these reasons, I like ARKK as an indirect crypto investment. There is substantial, broad-based crypto exposure with the added benefit of an even broader basket of innovative companies looking to rule the future (some are even possible outliers).

Plus, with ARKK on a pullback right now – it’s down more than 21% over the last three months and down almost 33% annually – this could be an attractive entry point to build a position.

Talk soon,

Jason Bodner

Editor, Outlier Investor

P.S. While the markets saw some volatility this week, I’m confident we have a lot to look forward to in 2022. And, as always, I’m seeing some exciting outlier stocks coming across my radar… stocks that outperform all the rest.

In fact, I believe investors should be planting a stake in right now several key outliers in one hot sector.

If you’d like to learn more about these outliers… and how to start this year’s investments off on the right foot… then please, click here for the full story.

Like what you’re reading? Send your thoughts to feedback@brownstoneresearch.com.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.