Dear Reader,

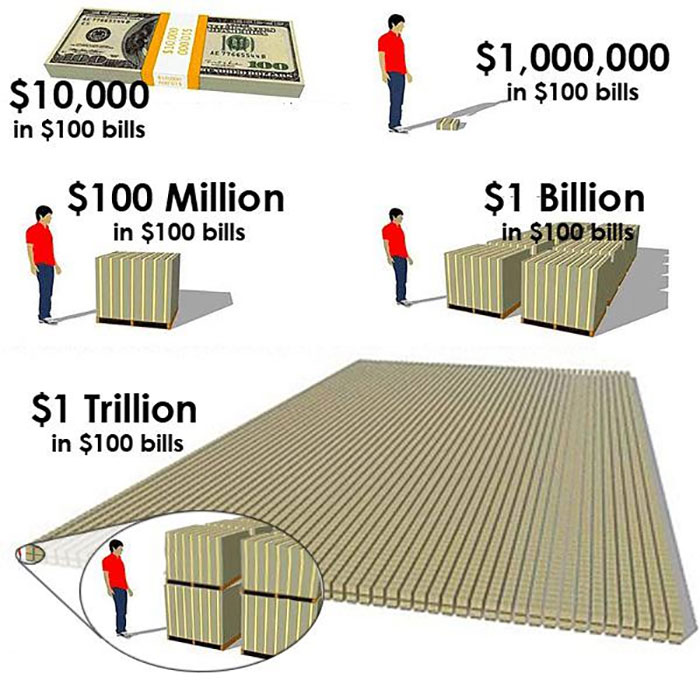

What does $1 trillion look like? It’s hard to imagine what even $1 billion would look like, let alone $1 trillion.

Which is why I had to find a picture:

Source: Reddit

It’s important to point out that the bills used in the example above are all $100 bills – not tens or twenties.

$100 million fits on a single pallet

$1 billion fits on 10 of those pallets

And $1 trillion?

$1 trillion fits on 10,000 pallets, with each pallet being worth $100 million ($1,000,000,000,000/$100,000,000 = 10,000 pallets).

The numbers are so large that the scale of the picture almost doesn’t make sense. It’s hard to believe, which is why the equation is useful.

But it gets worse… Let’s try to imagine the above picture multiplied by 13 times. Mind boggling, I know.

That’s how much money has been printed by the Federal Reserve since the onset of the pandemic.

$5.2 trillion on pandemic-related policies (which we now know were completely ineffective)

$4.5 trillion on quantitative easing

$3 trillion on “infrastructure” (most of that isn’t actually for infrastructure)

That totals $13 trillion.

With visuals like this, it becomes very easy to quickly understand why the U.S. dollar simply buys a lot less than it used to.

Gas prices are through the roof, and the cost of electricity is crazy now. Meals at restaurants and takeout food are now more expensive than ever. Labor costs have skyrocketed. The price of just about anything has jumped.

$13 trillion of money printing = inflation. And no, this is not good.

Clearly, it is not transitory inflation. We’re not stupid. I don’t care what any talking head or government official tells us. We “feel” the inflation every single day… in everything.

As a result, we are in a completely different kind of investing environment than we were back in the first quarter of 2020, before things got out of hand.

And the direction that the Federal Reserve takes this year is critical to understand. It will have direct implications not only for the public equity markets, but also for the housing markets.

I explored these topics in a special event that I held last week. It won’t be available for much longer, so if you’d like to learn more, please go right here to learn about my forecasts for the coming year.

We just had another major breakthrough with nuclear fusion technology. This time, it comes from the U.K.-based Joint European Torus (JET) laboratory.

As a reminder, nuclear fusion is essentially the power of the Sun. It involves taking two separate nuclei and combining them to form a new nucleus.

This produces an enormous amount of energy that’s 100% clean. And unlike nuclear fission, forms of nuclear fusion produce no radioactive waste.

Many experts are saying that nuclear fusion is still decades away. But they are wrong.

Nuclear fusion is coming much faster than most people realize. And what just happened with the JET lab’s tokamak reactor demonstrates this.

First, the reactor maintained a super-hot plasma for five seconds. That may not seem like a big deal at first. But this reaction occurred at over 100 million °C. That’s nearly seven times hotter than the Sun.

Maintaining it for five seconds is quite the feat. For comparison, most fusion reactions to date have lasted in the millisecond range.

What’s exciting here is the proof of concept. Right now, it’s five seconds. With the next breakthrough, it will be five minutes. Then five hours. Then five days… and so on.

Here’s a visual of the JET lab’s nuclear fusion reaction – pretty awesome:

JET’s Record-Setting Nuclear Fusion Reaction

Source: YouTube

Here we can see the magical moment where the fusion plasma formed.

And get this – the reaction produced a world-record 59 megajoules of energy. This beats JET’s nearly 25-year-old world record of 22 megajoules set in 1997.

It’s not a lot of energy, but that wasn’t the point. This is a great proof of concept for the tokamak nuclear fusion reactor design that will lead to even more progress.

JET’s experiment paves the way for an even larger tokamak reactor under construction – ITER (“The Way” in Latin).

A group with members from 35 nations around the world is building ITER in southern France. It has scheduled the first reaction for December 2025.

This reactor will contain 10 times the plasma volume of the largest tokamak design today. And it seeks to produce 500 megawatts (MW) from just 50 MW of input. This is enough energy to power 500,000 homes.

The bottom line here is that nuclear fusion is the future of clean energy. There is no other form of clean energy with little or no radioactive waste capable of providing base load energy requirements on a global scale.

Most of today’s solar panels only convert 15–18% of the Sun’s energy that hits the panel. And that’s on a sunny day. Plus, solar panels have a useful life of 20 years or so and are made with some toxic chemicals. Right now, they are being hauled off to the dump to sit for centuries.

Solar is great, and I’m planning on installing a solar roof on my own house. But it will only provide supplemental clean energy. And hopefully, the industry will be able to better recycle used solar panels and tiles so that they don’t end up in landfills.

ITER’s goal, on the other hand, is to produce multiples of energy from its inputs. That will put us on the path to limitless clean energy… something our world desperately needs.

ITER is just a prototype. It’s far too expensive and large to be put to use around the world. But it will still be an important step towards proving the capabilities of a tokamak design.

The future is in dramatically smaller fusion reactors that can fit roughly on the back of a semi-trailer, which can be manufactured at a fraction of the cost.

My vision for the future of energy production is a decentralized power generation architecture powered by compact fusion reactors all around the world.

And if you’re reading this, we’re going to experience the excitement of watching this all unfold in real time over the next few years.

Intel is historically known for overpaying for acquisitions. It has failed for years to keep up with the pace of innovation in the semiconductor industry and has fallen woefully behind.

Rather than building in-house, it reverted to acquiring other semiconductor companies in an attempt to make up for its own deficiencies.

The result was that Intel was a place where acquisitions went to die. Smothered in the bureaucracy built over decades, smaller, nimbler acquisitions tend to suffocate in an environment like this. And the best people quickly leave.

Intel has been reluctant to let its acquisitions prosper, which is why its recent plans to spin out Mobileye and take the company public this year came as such a big surprise. This is something I’ll be watching very closely…

As a reminder, Mobileye focuses on mobility semiconductors primarily for the auto industry. It first developed chips for advanced driver assistance systems (ADAS). The company has also been testing out its self-driving technology in New York City.

Intel had very little exposure to the auto industry. That’s why it drastically overpaid for Mobileye. It acquired the company for $15.3 billion back in 2017 specifically to get access to this sector.

Yet Mobileye isn’t a big revenue driver right now. It has only generated just over $1 billion for Intel. At this rate, Intel will likely never generate enough profits from Mobileye to justify the original deal.

It wasn’t that the acquisition was a bad one. Mobileye was a very interesting company back in 2017. It’s just that Intel paid a ridiculous amount at the time.

And that’s what this announcement is all about. By spinning out Mobileye and taking it public, Intel hopes to recapture at least a portion of its original acquisition costs.

We can tell that Mobileye is gearing up for an initial public offering (IPO) based on the recent announcements.

Mobileye is partnering with Benteler EV Systems and Beep to launch Level 4 autonomous “last-mile movers” in the United States. This is an interesting take on autonomous vehicles.

The “Last-Mile” Mover

Source: Benteler EV Systems

As we can see, these last-mile movers are basically self-driving shuttles. They can operate autonomously in a geofenced area at a max speed of 35 miles per hour. And these companies designed them for both enterprise use and public transport.

These shuttles will be perfect for short-distance transport. I immediately think of the Bay Area Rapid Transit (BART) system as a great example.

BART connects San Francisco with Silicon Valley. But the problem is the system stops about a mile from where the office buildings are in San Francisco.

This forces passengers to wait for the bus, catch an Uber, or even ride their bike the rest of the way into town. That’s incredibly inconvenient. And it takes a lot of extra time.

These shuttles would be a perfect extension of the BART system. They could cart passengers across that last mile into the city. This is a less expensive approach that would be far more efficient to move passengers from point A to point B.

Rather than waiting for one large bus to arrive (that is rarely on time), there can be a fleet of these smaller electric vehicles on standby to shuttle arriving passengers quickly.

And because they are autonomous, these fleets can be repositioned throughout the day based on normal commute patterns.

To me, this shows that there will be multiple segments within the autonomous driving space. There will be different types of vehicles for different services. This will be an interesting launch to watch. Mobileye expects the first shuttles to go live in 2024.

We should expect more announcements from Mobileye leading up to the IPO. And, of course, we’ll be tracking Mobileye’s IPO closely this year. We don’t know what the valuation will be yet.

But if it’s reasonable, Mobileye could make a good investment target…

We are now seeing the rapid emergence of non-fungible token (NFT) lending platforms. These are platforms that allow NFT holders to borrow money using NFTs as collateral.

And perhaps, ironically, this is another sign that NFTs represent the next generation of the collectibles industry. I’ll explain with a little context…

Wealthy individuals have owned high-priced art collections for centuries now. And that persists to this day.

Every now and then, we’ll read about somebody paying millions of dollars for a piece of art. And I suspect most of us see this and we wonder why on Earth anyone would spend so much money on something to look at.

But there’s a method to the madness…

Individuals buy art because they believe the asset will increase in value over time. That value becomes an asset that can then be collateralized. This is done by borrowing against the art… not selling it.

That’s because selling any asset creates a taxable event. It also gives away future upside.

However, borrowing against an asset is always a tax-free event. And it allows holders to also benefit from future appreciation.

High-net-worth individuals and family offices have been borrowing against fine art collections in some form for centuries. It’s one of the “secrets” of the extremely wealthy class.

And it’s a massive business. We might be surprised to know that Bank of America has more than $10 billion in loans against art outstanding as I write.

And that’s why a new NFT lending platform called Arcade caught my eye. It’s bringing the same services to NFT investors.

Arcade has already loaned more than $20 million against NFTs. And most notably, it just issued a $3 million loan to a single investor less than two weeks ago.

Think about that…

This is an individual who put up two rare Zombie CryptoPunks as collateral and received a $3 million loan in exchange. The idea is that they can put that $3 million to work in other investments, generate a return, and pay back the principal of the loan at some future time.

There would be no taxable event (other than any profits earned through the investment of the $3 million loan), and the owner maintains ownership of the rare digital collectible.

For example, if they can make a 50% return on the $3 million, that’s a total nest egg of $4.5 million. They can then pay back the $3 million loan and keep the $1.5 million in profits, less the interest costs.

So, this is a noteworthy development. Lending against these digital assets is an entirely new industry. And as the size and scale of the NFT market grows, so will the financial services and lending targeting the industry.

If you’d like to begin investing in this space, simply go right here to learn more about my top recommendations right now.

Regards,

Jeff Brown

Editor, The Bleeding Edge

Like what you’re reading? Send your thoughts to feedback@brownstoneresearch.com.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.