Van’s Note: Van Bryan here, Jeff Brown’s longtime managing editor. Welcome back to Jeff’s 2021 prediction series. Over the next few days, Jeff is sharing his thoughts on the year that was and offering a few predictions for the year ahead.

For today’s Bleeding Edge, I sat down with Jeff to discuss what a Biden administration could mean for the high-technology sector and the broader equities market. Read on…

Van Bryan: Jeff, let’s turn to the election. Other than COVID-19, it was likely the most talked about story of the year. You were on record predicting that President Trump would win reelection. Can you bring readers up to speed?

Jeff Brown: That’s right. When we talked in December of 2019, I predicted that President Trump would win a second term.

And as I said at the time, that wasn’t a political endorsement. I know the president can be a polarizing figure. This was just the conclusion I came to based on my analysis.

And what my analysis was showing was that the policies pursued by the current administration had created one of the most robust economies in recent history. Specifically, I think there were four key pillars:

Lowering corporate and middle-income taxes

Cutting unneeded regulation

Reinvesting in American manufacturing

Renegotiating unfair trade policies with America’s trading partners

We don’t have time to discuss each one of these in detail. I actually wrote an entire report on this topic earlier this year.

[Van’s Note: For paid-up readers of The Near Future Report, access your free research report right here.]

But I will say that these policies helped usher in a new age of economic prosperity. Before COVID-19, unemployment was at a 50-year low.

The U.S. wage and salary growth rate had roughly doubled from late 2016. And the administration was tackling some unfair trade practices and intellectual property theft that had been ignored for decades.

Investors had a lot to be thankful for. The three major indices saw incredible growth during the first few years of the Trump administration.

Van: But now election night is behind us. There are still several legal challenges being considered, but for now, it appears that Joe Biden will be the next president of the United States. What are the implications for the technology markets?

Jeff: You’re right. Legal challenges are happening right now. We’ll have to wait to see what happens there. But for now, let’s assume Joe Biden takes office on the 20th of January. What does that mean for the high-technology sector?

The message I want to deliver to readers – first and foremost – is this: No matter who is president, technology and biotechnology are going to have an incredible year in 2021.

I’ve spent 35 years as a technology investor and close to 30 years as a high-technology executive. And I’ve never seen the confluence of technologies that we are witnessing right now.

We have a combination of breakthroughs happening in artificial intelligence and machine learning. At the same time, we’re just starting to apply the most advanced computer science and information technology to the field of biotechnology. We have widespread, inexpensive, essentially unlimited computing power and storage.

And we also have the deployment of revolutionary wireless technology with 5G. This is going to kick off a suite of new technology applications that would have been impossible even just a few months ago. And this is all happening at the same time.

[Van’s Note: Be sure you check your inbox tomorrow afternoon. I’ll be speaking to Jeff about the biggest 5G stories of 2020, and I’ll ask him for his No. 1 5G prediction for 2021]

This confluence is accelerating the rate of technological change. Each of these technologies impacts the others. And the implications, in terms of investing opportunities in these industries, are almost impossible for most people to understand.

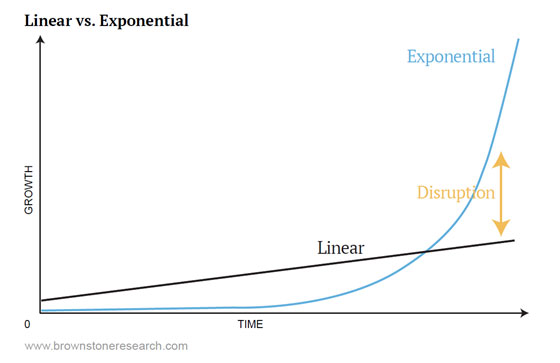

It’s not an intellectual shortcoming. It’s just that our brains are not wired to think exponentially. And that’s what we’re going to see in 2021.

Exponential growth is one of the most powerful forces in technology investing. This type of growth sneaks up on us. It appears linear at first. But then there is a sharp “elbow,” and the trend goes vertical.

And the speed at which that happens is why most don’t spot it until too late. In hindsight, though, it’s easy to spot. That’s why my goal is to help my readers invest in the most promising tech companies right before that elbow.

Van: What about the broader equities market? As a candidate, Biden said he would roll back the 2017 tax cuts. Could that have implications for stocks?

Jeff: Investors are probably familiar with the Tax Cuts and Jobs Act. It was the most significant tax reform law since the 1981 Reagan tax reforms. One of the biggest things the law did was lower the corporate tax rate from 35% to 21%. That made American corporate taxes the lowest they’ve been since 1938.

And one of the big consequences of this was that corporations had to decide what they would do with all the money they were saving. They chiefly did two things.

They invested in new equipment, facilities, and research and development. The other thing corporations did was reward investors in the form of stock buybacks.

[Stock buybacks are when a company purchases its own shares and reduces the number of outstanding shares, thus increasing the value of remaining shares.]

Both things were great for equity prices and investors in American companies.

But if President Biden can push through higher corporate and personal tax rates, that would have a negative impact. It’ll reduce consumption and negatively impact the stock markets. We’ll have to see if that happens or not.

But that’s why I’ll continue to focus on the world of high technology in 2021. Think about it. If a company offers a revolutionary product, service, or therapy, will it matter who is sitting in the Oval Office? It won’t. That stock is going higher.

And if the markets do experience a dip during the next administration, that may be a great buying opportunity for some of the exciting companies I have on my radar. I’ll be sure to keep my subscribers posted if there’s any action we need to take.

Van: Thanks as always, Jeff.

Jeff: Anytime.

Like what you’re reading? Send your thoughts to feedback@brownstoneresearch.com.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.