Editor’s Note: Today, we’re sharing another insight from Brad Thomas, real estate developer and income specialist.

Below, Brad will share a shocking statistic about the real estate market and reveal what it means for investors looking to hedge against inflation.

And if you’re interested in Brad’s research, we encourage you to join him tonight for a special briefing. At 8 p.m. ET, Brad will lay out his full plan for thriving in today’s volatile market. All the details right here.

|

By Brad Thomas, Editor, Intelligent Income Daily

After the 2008 Financial Crisis, the bottom fell out of the real estate market.

I’m sure you don’t need me to remind you of that period. It wasn’t easy to watch the values of our homes fall so sharply.

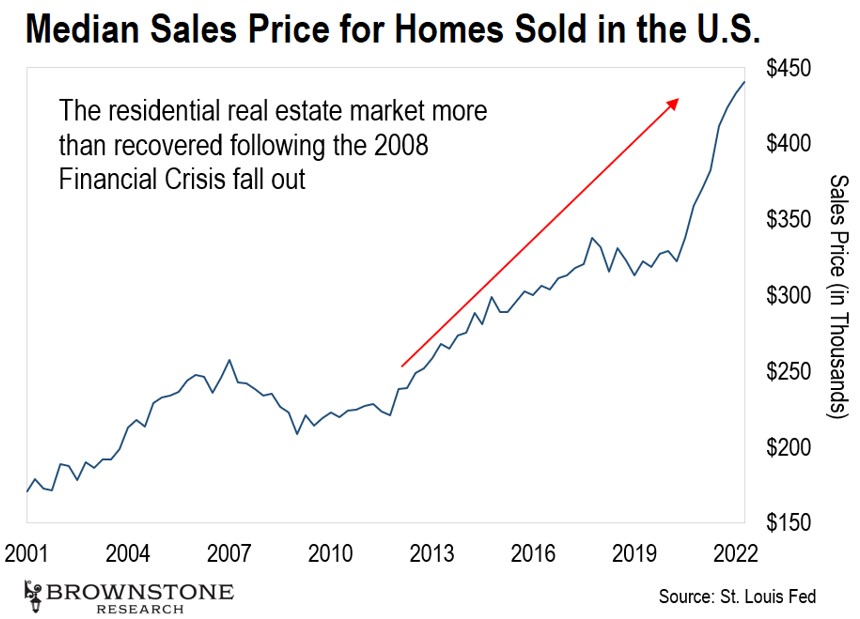

In time, however, the value of the residential real estate market came back. As the chart below shows, the median sales price for homes in the United States would eventually recover its 2007 highs and then some.

But here’s what few people know: There is one metric in the real estate market that plunged after 2008 and never recovered.

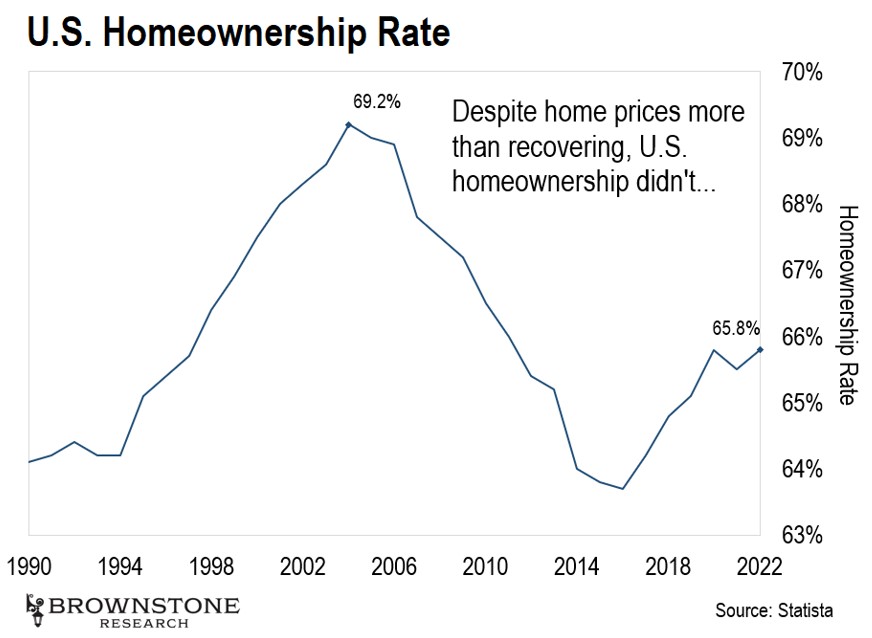

I’m talking about the percentage of Americans who own their own home. Have a look below.

As you can see, homeownership in the United States topped out at nearly 70% in 2005. That figure fell sharply during the Mortgage Crisis, and it has never fully recovered. And given what’s unfolding this year, I fully expect this to get worse.

In many ways, this is heartbreaking to see. Owning your own home has always been part of the American Dream. And more and more, that dream is unattainable for regular people.

But this dynamic does tell us something about the real estate market, and provides an opportunity for investors…

According to Pew Research, the percentage of Americans renting their homes was 31.2% in 2006. By 2016, that figure was 36.6%. On paper, that might not seem like a large jump, but it equates to millions of Americans that became renters during this time.

It makes sense. Plenty of people lost the chance at homeownership after the Financial Crisis. But we still have to live somewhere. So, what do you do? You rent.

And for us—as investors—that has important implications.

As a former commercial real estate developer, I’m aware of the allure of getting rent checks. For some, I know I’ll be preaching to the choir. But buying real estate can be a long, expensive process.

It often takes weeks – if not months – to do the legwork, figure out financing, and get the paperwork in order. Add in commissions and closing costs, and your purchase price grows by thousands of dollars.

Then there’s the task of managing these properties. You could hire someone to manage these responsibilities. But it’ll cost you – usually 8-10% of the rent you collect.

But there is a way to own real estate—and collect income—without the hassle that usually comes with it: real estate investment trusts (REITs).

Congress created REITs in 1960 to allow the “little guy” to invest in large-scale, rent-producing real estate… without having to actually manage properties. This way, getting exposure to real estate is now as simple as buying shares through a broker.

As I shared above, Americans are increasingly renting their place of residence. And rental properties tend to have several advantages in a high-inflation environment.

Rental properties—like apartments—can raise rent prices with inflation. In October 2020, the average rent on a two-bedroom apartment was $1,098. By September 2022, that same figure was $1,360.

Rising rents in inflationary environments is why apartment costs—for owners— usually rise at a lower rate or may not change at all. And that spells greater profitability for property owners like REITs.

And rather than going out and buying multimillion-dollar apartment buildings to take advantage of this setup, average investors can turn to REITs and get exposure to this part of the market.

For instance:

Mid-America Apartment Communities (MAA), which owns nearly 100,000 apartment units across the Sunbelt – particularly in cities like Atlanta, Georgia; Dallas and Austin, Texas; Tampa, Florida; and Charlotte, North Carolina.

AvalonBay Communities (AVB), which owns more than 80,000 apartment units along the East and West Coasts in cities like Boston, Massachusetts; New York, New York; Washington, D.C.; San Francisco and Los Angeles, California; and Seattle, Washington.

Essex Property Trust (ESS), which has around 65,000 units, mostly on the West Coast in Californian cities like Los Angeles, San Diego, San Francisco, and San Jose; and Seattle.

To be clear, I’m not recommending buying these REITs today. But there could be attractive opportunities opening in the coming months for apartment REITs.

And if you’re interested in this style of income investing, there’s one more thing I should mention…

Tonight at 8 p.m. ET, I’ll be holding a special event to share my complete strategy for thriving in this market. That includes my favorite REITs to own today.

When you join me, I’ll even give you the name of my favorite, recession-proof play that could double from here, for free.

So, go here to sign up for my event tonight, at 8 p.m. ET. I look forward to seeing you there.

Happy SWAN (sleep well at night) investing,

Brad Thomas

Editor, Intelligent Income Daily

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.