Dear Reader,

The first deep field image of space has finally arrived!

We’ve been closely tracking the progress of the James Webb Space Telescope (JWST), even well before it was launched. Over the last several months, the telescope has gone through the process of calibration in order to produce images like the one below:

Galaxy Cluster as Captured by the JWST

Source: Webbtelescope.org

The resolution and detail are mind-blowing. There are literally thousands of galaxies captured in this single image alone.

What makes this image so unbelievable is that it represents only a tiny sliver of sky. This image is the equivalent of looking at an area of space, equivalent to that of looking through a single grain of sand held at arm’s length. It represents just a pinpoint in the sky.

Also worth noting is that this image only took 12.5 hours to produce using the JWST. The telescope takes images at different wavelengths and then creates this detailed, rich composite image. This is in stark contrast to the Hubble Space Telescope, which requires weeks to produce a single image at a dramatically lower resolution.

For comparison, we’ve created a short GIF below that shows the dramatic transformation of what we used to see for the same area in space, and what we can see now with the JWST:

Images from the JWST in Action

Source: Worldwidetelescope.org

We’re about to experience an explosion of discoveries in astronomy and astrophysics. This telescope is going to immediately transform the world of space and planetary sciences. I can’t wait to see what will be discovered in the years ahead.

ARCH Venture Partners, one of the most successful venture capital (VC) firms in the biotech space, just raised a $3 billion fund. It will focus entirely on early stage biotech companies.

This is both exciting and encouraging.

As we know, the biotech industry has gone through what I call a “biotech winter.” The industry as a whole has sold off – to the point where it’s unbelievably undervalued. Many fantastic companies have been trading at or below cash value… which is crazy.

Large institutional capital stepped away from the industry during the pandemic, which is largely behind us. Given the irrationally low valuations, it was just a matter of time before large amounts of capital started to flow back into the market.

Needless to say, ARCH Venture Partners raising $3 billion of institutional capital, for the purpose of investing in early stage biotech right now, is a very bullish sign.

This company is about as deep of an industry insider as there is. ARCH Ventures has been behind some of the best biotech companies of all time. Sequencing giant Illumina immediately comes to mind.

So ARCH Ventures has had a long history of making well-timed investments into the biotech industry. It wouldn’t be pouring $3 million into biotech now if it didn’t see attractive valuations and strong therapeutic development taking place.

In fact, ARCH Ventures cofounder Robert Nelson was quoted as saying that this fund’s goal is to take advantage of a “massive and accelerating wave of innovation that is really going to change health care for the better.”

This is exactly what we have been talking about in The Bleeding Edge for the last couple of years. Despite the slowdown in clinical trials due to pandemic policy, the pace of therapeutic development has actually accelerated.

The confluence of artificial intelligence (AI), machine learning (ML), and incredible computational power – combined with bleeding-edge therapeutic approaches – is set to enable some of the most unbelievable biotech breakthroughs in history.

It seems ARCH Ventures is seeing what we see in the industry.

So this is just another sign that we have turned the corner in the biotech markets. I remain confident that biotech share prices will be trading significantly higher by year-end.

Gaming legend Atari just had its 50th anniversary. To celebrate, the company announced a brand-new product release. This is something Brownstone Unlimited subscribers will be hearing more about in our next quarterly update…

I’m sure many readers will recognize Atari as a pioneer in the gaming industry. This is the company that marked the very beginning of console gaming. I suspect plenty of readers, like me, grew up playing Atari games.

Well, Atari is marking its 50th anniversary by launching a bundle of 90 games. The bundle includes some of the most popular Atari games that many of us played all those years ago – except they have been updated and remastered for modern gaming consoles.

That’s right – some great Atari classics are coming to both the PlayStation 4 and PlayStation 5, Xbox consoles, the Nintendo Switch, and even personal computers (PCs).

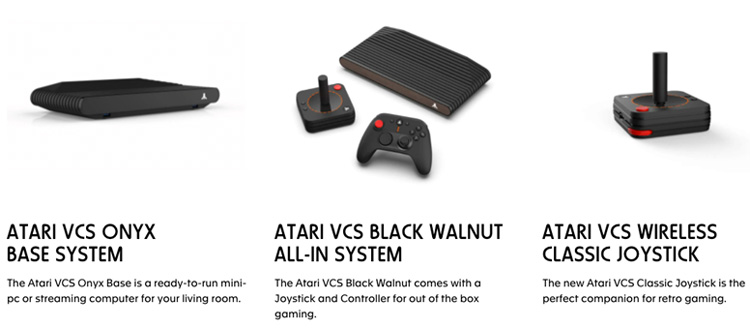

And get this – Atari is even launching its own new console called the Atari VCS.

Here it is:

Atari’s New Console

Source: Atari

What a fun release. And there’s another layer to this story that makes it especially interesting to us.

There is an early stage company behind all this, called Digital Eclipse.

Digital Eclipse raised the funding to remaster these old Atari games. And it will receive a significant portion of the revenue generated from all sales.

And guess what? Brownstone Unlimited subscribers invested in Digital Eclipse’s capital raise that made this new product release possible.

In other words, we are ultimately behind Atari’s 50th-anniversary launch. How cool is that?

What’s more, Digital Eclipse will begin paying dividends to investors based on the revenue it generates from the launch. Unlimited subscribers should expect to receive cash payments later this year.

In fact, I wouldn’t be surprised if investors recoup their entire original investment, in the form of dividend payments, by year-end or early 2023. The capital raise is also being used to fund the development of some other well-known game franchises that will be released later this year and into 2023.

This investment will return multiples of the original investment for those that invested in this Regulation A crowdfunding deal. These are the kinds of private investment opportunities that I focus on in Day One Investor.

It’s stories like this that make early stage investing so much fun and fulfilling. And for those Atari fans out there, this new offering should be available this November, just in time for the holiday season.

We’ll wrap up today with big news from Starlink.

As a reminder, Starlink is SpaceX’s satellite constellation and satellite internet company. With its premium tiered service, Starlink provides satellite internet connectivity that’s roughly on par with average cable internet in terms of speed and latency.

And Starlink just announced that it finally received regulatory approval to install its satellite system on moving vehicles. This is something that’s been in the works since last March.

With approval from the Federal Communications Commission (FCC) finally coming, Starlink’s tech can now be deployed on cargo ships, semitrailers, recreational vehicles and boats… and even commercial airplanes.

In fact, Starlink has already signed deals with Hawaiian Airlines and a regional jet service called JSX.

Hawaiian Airlines will offer Starlink’s services on its flights between the Hawaiian Islands and the U.S. mainland. And JSX will equip 100 of its planes with Starlink’s tech.

Because Starlink operates in a different band compared to traditional satellite internet providers, it can provide better performance than what was possible before.

In addition, Starlink revealed that it now has more than 400,000 individual subscribers. This business is off to a fantastic start.

So this is an exciting development.

And I should point out that with Starlink’s expansive satellite coverage, it can provide internet connectivity to nearly anywhere in the world. Travel enthusiasts could install this tech on an RV and have high-speed internet access even in the most remote, off-the-grid places out there.

Starlink is the next generation of satellite internet that is better than anything else out there. It works in a different frequency band connected to a dedicated SpaceX-owned satellite constellation. There is nothing else like it.

High-profile deals with airlines are just one more step in preparation for SpaceX ultimately spinning out Starlink into a separate company and taking that company public.

And for subscribers whose work critically depends on internet connectivity, Starlink is a fantastic backup “network” to have, almost like an insurance policy, in the event that our CATV internet or fiber optic connects get taken down during a storm.

Regards,

Jeff Brown

Editor, The Bleeding Edge

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.