Dear Reader,

Looking at the quarterly results of JP Morgan Chase (JPM) released earlier this month, we’d never suspect that there was a massive banking crisis and credit crunch happening in real-time.

The numbers were stunning. JPM announced a 52% increase in first quarter profits, as well as record revenues for the largest bank in the U.S.

Even more dramatic was JPM’s 49% jump in net interest income. This is the interest that the bank makes on its loans less what interest it pays to its depositors. The result – a record $20.71 billion.

It doesn’t feel right, does it? Given the economic chaos and calamity that we’re all experiencing, how is this possible?

Earlier this month, I wrote about how the national average for deposit rates offered by banks is 0.24%. And one major bank that I used as an example was only offering 0.25% annually on deposits up to $249,999, and only 0.95% up to $999,999.

As I highlighted at the time, the 3-month U.S. Treasuries were yielding 4.8375%. This is the rate at which banks can purchase U.S. Treasuries and earn a yield on assets held at the bank (i.e. depositors’ capital). Today that yield has jumped to around 5.13%. Have depositor rates increased? Not at all.

And that’s where the record net interest income comes from. JPM and all the major banks take our money and typically pay out 0.25%-0.50% in annual interest. They are now earning about 5% on our capital. That’s a massive spread. And that’s where the $20.71 billion net interest income comes from.

JPM also benefited from the net depositor inflows that accelerated after the collapse of Silicon Valley Bank and Signature Bank earlier this year. The entire regional banking sector was on the precipice, which required the Federal Reserve and U.S. Treasury to step in and save the entire sector through the Bank Term Funding Program (BTFP). It was a massive liquidity injection to save regional banks from collapse as depositors flocked to the megabanks for safety. And things appeared to have settled down… until yesterday.

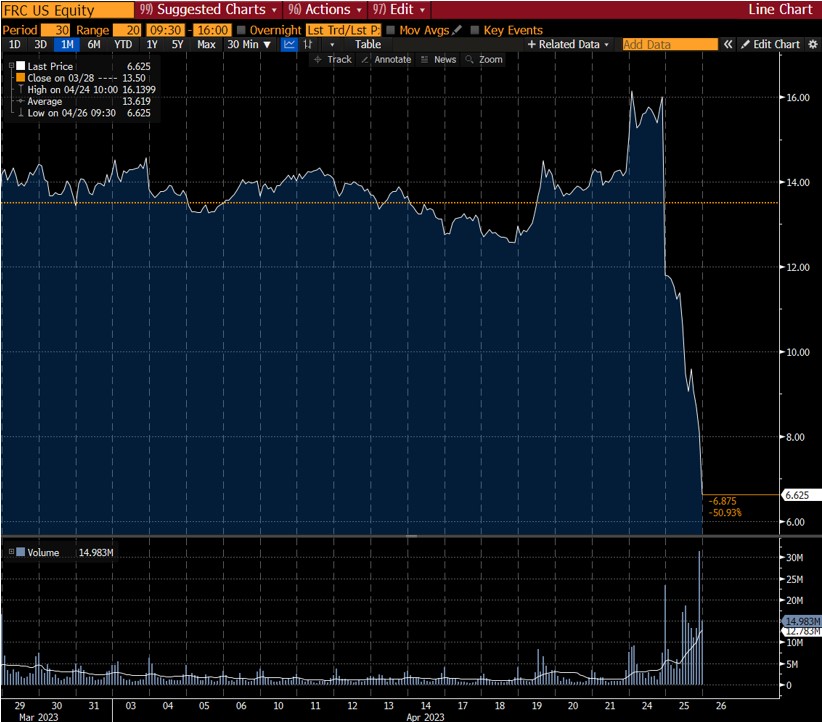

Regional bank First Republic Bank (FRC) announced earnings that were remarkable as well, but not in a good way. FRC’s stock collapsed more than 60% since yesterday as I write this morning, and it may be worse before the day is out.

This stock is now down more than 97% since its November 2021 highs. And this is after having borrowed $92 billion from the Federal Reserve, and another $30 billion from a group of large banks.

That wasn’t enough. In the first quarter alone, depositors yanked out $102 billion in deposits from First Republic.

This isn’t a normally functioning market. This isn’t healthy. And it is going to get worse. FRC is just a snapshot of how bad things are. There are hundreds of other regional banks that are at risk of a similar liquidity crisis. Money continues to flee for money market funds and the safety of megabanks.

The real question is, how far will the Federal Reserve go? The latest numbers show that the Federal Reserve’s balance sheet has grown by about $300 billion. I’m confident that the numbers are even larger by now.

It’s important to note that this isn’t quantitative easing (QE). The Fed is engaged in this charade of accepting securities that have dropped materially at par value and providing banks U.S. dollars in return. Said another way, it’s a loan, not money printing. The Fed continues to tighten by letting $50-$60 billion in Treasuries roll off every month… This is compounding the liquidity problems that we’re seeing in the financial markets.

What will it take to keep the regional banking sector from collapse? Five hundred billion dollars? A trillion? And how long will the Fed be willing to sit on top of all this devalued collateral? The BTFP is supposed to be only for 12 months. Yet there is no way that the regional banking sector will recover within this time frame. It literally won’t have the money to “buy back” its collateral and reduce the Fed’s balance sheet.

It’s wild and depressing to see this happening in real-time. A direct result of monetary policy. A gradual train wreck that has reached the point of sudden collapse.

And who benefits from all this nonsense? As we’ve just seen above, the megabanks are sitting pretty right now with their net interest income and the influx of new depositors’ capital.

It’s good to be the king.

A very interesting development in the blockchain space just caught my eye. Chia Network just filed for an initial public offering (IPO).

This is highly unusual in the industry. Historically, blockchain companies have treated their initial coin offerings (ICOs) or token generation events as their major public funding round. They tend to see little value in a traditional equity IPO, as most have the funding that they need from venture capital firms or funds from the sales of tokens to run their business.

Outside of digital asset exchange Coinbase and several crypto mining companies, there have been almost no IPOs in the space. That’s what makes this Chia Network filing with the Securities and Exchange Commission (SEC) so interesting.

Longtime readers may remember Chia Network. We had a look at this exciting project back in 2021.

For the sake of newer readers, Chia is a smart contract project founded by Bram Cohen in 2017. Cohen is the inventor of BitTorrent – a Napster-like, peer-to-peer file-sharing protocol. And by all accounts, he’s a very sharp technologist.

Chia Network’s point of differentiation is that it developed a brand-new consensus algorithm called Proof of Space Time (PoST).

Consensus algorithms are critical to a blockchain’s security. They prevent bad actors from hacking the blockchain or tampering with transactions.

So Chia is pioneering a unique model that has been received well by the industry and investors. Chia Network has completed five early-stage funding rounds so far. The company’s last valuation was at $455 million.

And Chia has its own cryptocurrency. It’s the XCH token. And it currently trades around $40 per token.

So there’s no clear reason why Chia wants to go public. It doesn’t appear to need additional funding right now.

Plus, the SEC has been incredibly hostile toward the blockchain industry for the last three years. And of course, Chia will have to get SEC approval to move forward with its IPO.

So this got me thinking – is the blockchain industry starting to see some light at the end of the tunnel?

This appears to be a terrible time for Chia to try to go public… Does Cohen see something that we don’t? At some point there will be a turn in regulatory sentiment – is it possible that Cohen believes that time is now?

I’ve said from the beginning that blockchain companies will need to go public in order to increase credibility and clean up any stigma regarding the blockchain industry and cryptocurrencies. Publicly traded companies must make quarterly filings with the SEC. That way everybody can see what their financials and their operations look like.

It’s all about transparency. And it would go a long way toward positioning blockchain companies for what they actually are, the next generation of internet technology and payment systems. Hopefully, Chia Network will be one of the first to make that jump.

Either way, this is one we’ll be watching closely. As the SEC filings for public offerings are public information, we’ll be able to watch the SEC process in real-time. We can watch out for amended filings to see what kind of changes Chia makes in order to get SEC approval.

China’s equivalent to Uber, Didi, just announced plans to roll out a fleet of 24/7 robotaxis by 2025. That’s only two years away.

Didi is calling its robotaxi the “Neuron.” Here’s what it looks like:

Source: Didi

Here we can see that the Neuron looks quite futuristic. Notice how there’s no true front or back – it reminds me of Amazon’s Zoox in that way.

And the futuristic design is reflected on the inside of the autonomous vehicle as well. The Neuron does not have a steering wheel or pedals. Instead, it’s optimized for passengers.

And Didi implemented a bold twist that I haven’t seen anywhere else yet. They equipped the vehicle with a robotic arm. This is an interesting addition.

The idea is that the robotic arm can reach out, pick up luggage, and put it inside the vehicle when it picks passengers up. The arm can also grab items within the car and move them around. It could even grab drinks and pass them out to passengers.

This is certainly an interesting take on autonomous robotaxis. And it doesn’t stop there…

Didi also designed fully autonomous service stations where the cars can be charged and cleaned. This is all handled by robotics.

So when a Neuron needs some attention, it can pull itself into one of these service stations and robots will plug it in for charging and perform any necessary maintenance or cleaning. Then the car could go back out and rejoin the fleet.

This will be an efficient system if Didi implements it at scale. And it will serve to reduce transportation costs materially in any market that it deploys this technology.

Among the major ride-hailing services around the world, Didi is stepping up its intended leadership position compared to players like Waymo and Lyft/Motional in the U.S. And it puts Uber way behind with regards to autonomous driving technology.

If we remember, Uber had to sell its self-driving unit several years ago to reduce its operational expenses. This was largely a cost-driven decision that followed after Uber went public. That decision put Uber significantly behind in the race toward autonomy.

What’s more, Didi revealed that it is launching an autonomous cargo hauling business. It will consist of a fleet of 100 autonomous trucks.

Looking at the big picture, these developments are clearly an indication that autonomous technology is getting very close to widescale adoption. The advancements at Cruise, Waymo, Motional, and of course Tesla are obvious signals that large deployments are in the near future.

We have a lot to look forward to later this year as we can expect to see a larger number of self-driving deployments of ride-hailing services in various markets in the U.S., and what will most certainly be a commercial release of Tesla’s Full Self Driving (FSD) software in the months that follow.

We’ll wrap up today with an exciting development on the space exploration front.

The European Space Agency (ESA) has launched a mission to explore Jupiter’s moons. They are calling it the JUICE mission. That stands for Jupiter’s Icy Moons Explorer.

This is a fascinating mission. The ESA plans to explore three of the four Galilean moons of Jupiter. These are the moons that Galileo discovered back in 1610.

The three moons involved are Callisto, Europa, and Ganymede. Ganymede is especially interesting because there’s evidence of an ocean beneath its icy surface.

Here’s an image of Ganymede taken by Juno on June 7, 2021.

Source: NASA

If proven to be true, this has tremendous ramifications for future outposts in space. And of course, where there’s water there very well may be life.

So I can’t wait to see what the JUICE mission discovers. That said, it will be a while before we find out.

The JUICE spacecraft launched just a few weeks ago. It’s going to orbit the Sun and come back past Earth and the Moon again. This is a “gravity-assist” maneuver that will help slingshot the craft towards the outer solar system.

That puts the JUICE craft on target to fly by Venus in 2025. Then it will make another two passes by Earth before rocketing out to Jupiter.

The ESA expects the craft to reach Jupiter by 2031. It will spend a few years exploring Callisto and Europa. Then it will enter into orbit around Ganymede around 2035. It will remain in orbit for at least nine months.

So it’s going to take eight years for the spacecraft to get out to Jupiter. That’s the only downside here. The gravity-assist maneuvers are important, however, to help the spacecraft save fuel.

Regardless, I can’t wait to see what this mission turns up. This is another exciting development in space exploration. And it will be the first time that a spacecraft goes into orbit around a moon of another planet.

Regards,

Jeff Brown

Editor, The Bleeding Edge

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.