Dear Reader,

They knew.

As with all crises, whether it be FTX, Terra Luna, Signature, Silvergate, SVB, Lehman Brothers, Man Financial, or boring old U.S. Treasury bonds held at banks; the story gets a lot more interesting in the days that follow an implosion.

On March 6, FDIC Chairman Martin Gruenberg gave a presentation at the Institute of International Bankers. It’s the kind of event most of us wouldn’t have had any idea about, let alone have the access to attend. But what Gruenberg spoke of is revealing with regards to the events of the last seven days.

He spoke of the difficult conditions of the banking industry in 2020 caused by the pandemic. Income in the industry declined 37% primarily due to credit loss provisions in anticipation of pandemic-related issues. He also cited the lower interest rate environment impacting bank net income (i.e. U.S. Treasury bonds weren’t paying much at all, the Fed Funds Rate was at 0.25% from mid-March through the end of the year).

Gruenberg then noted that the industry strongly rebounded in 2021 with a record net income of $279 billion, which was largely driven by the reduction of loan loss provisions as banks realized the pandemic wasn’t nearly as bad as it was originally positioned to be.

Also interesting was at that time, commercial lending had declined significantly. Banks weren’t doing as much commercial lending, they diverted even more capital into longer duration U.S. Treasury bonds looking for higher yields.

And conditions remained robust in 2022. With the rapid hikes in interest rates, net interest margins increased for banks. This is because the interest rates on U.S. Treasuries were increasing far faster than banks were increasing the interest they paid to their depositors. Fancy that…

But the most interesting comments that he made were concerning the industry risks. He said:

First, as a result of the higher interest rates, longer term maturity assets acquired by banks when interest rates were lower are now worth less than their face values.

The result is that most banks have some amount of unrealized losses on securities. The total of these unrealized losses, including securities that are available for sale or held to maturity, was about $620 billion at year end 2022.

They knew.

It was a $620 billion hole in the banking industry. And they knew about it last year. The liquidity crunch at SVB is just a drop in the bucket. This is a gargantuan problem.

And that’s why the Federal Reserve Board, the U.S. Treasury, and the FDIC announced the creation of the Bank Term Funding Program (BTFP)… to keep the banks liquid and ensure depositors are made whole.

The Federal Reserve will value and buy back long-duration U.S. Treasuries at par value to provide liquidity to banks. That’s what the BTFP provides for.

Put more simply, if a bank has $200 million worth at par value of long-duration Treasury bonds that are now only valued at $160 million, the Fed will buy them back at $200 million. In one fell swoop, the BTFP erases a $40 million paper loss for the bank. Liquidity problem solved.

Will the Fed do the same for us lowly taxpayers? Will it make us whole on our losses caused primarily by its monetary policy? No way.

And who pays for the BTFP? Anyone who holds U.S. dollars. When the Fed buys assets at prices significantly higher than they’re worth in the market, money has to be printed, and thus the U.S. dollar is devalued.

We won’t be fooled by this sleight of hand.

They knew. And they knew this would happen when raising the Fed Fund Rate so far in such a short period of time. As I wrote yesterday, I believe that was the point.

And as I write to you today, it appears the contagion is spreading. As of this morning, the storied Swiss bank Credit Suisse plunged more than 30%.

Other European banks like Deutsche Bank, UBS, and Societe Generale are also down as much as 15%. My team and I are reviewing these developments today and will share anything interesting in tomorrow’s Bleeding Edge.

But there’s one thing I’m sure of. They won’t let this crisis go to waste…

Ford just published an innovative patent. It envisions a self-driving car with the ability to repossess itself.

I think this is something that’s inevitably going to catch on in a big way. This patent creates an interesting incentive system that encourages borrowers to pay their car loans.

We’ll go over Ford’s vision for autonomous repossessions in just a minute. But first we need to understand how the traditional process works.

It starts when a borrower misses a car payment. The bank or the lender typically are required to make a number of phone calls to the borrower to see if they can come current with their payments.

If the borrower is not responsive, the lender will likely send a couple letters in the mail as well. These may even be auto-generated by a computer system.

Then if the borrower remains unresponsive and doesn’t make the payment, the lender will hire a company to roll out a tow truck and repossess the vehicle.

This involves the tow truck driver scouting out the borrower’s home or work location until they find the vehicle. Then they must physically hook it up to the tow truck and haul it away.

Of course, there’s always a chance that the borrower will confront the tow truck driver about this. That can lead to verbal and even physical altercations. I can imagine it’s a tough job that comes with risk. And most of the work is late at night when people are asleep.

So we’ve got a highly manual process that runs the risk of direct confrontation and even potential injury. The hours are bad. And it’s expensive as well. Tow truck drivers typically charge several hundred dollars for a repossession.

Ford’s patent envisions a better way. It outlines a three-step process…

It starts when the borrower misses their car payment. When that happens, Ford’s system would disable the car’s radio. That’s meant to be an inconvenience to encourage the borrower to make their payment.

If that doesn’t work, the second step is to disable heating and air conditioning in the car. This is a much bigger inconvenience. In certain climates it could make using the car incredibly uncomfortable.

Then if the borrower still doesn’t pay, Ford’s patent envisions locking the borrower out and having the car drive away by itself to a location specified by the lender.

In other words, the car will repossess itself. No chance of conflict there.

To me, this makes a lot of sense.

In a world of self-driving cars, why shouldn’t repossessions be autonomous as well? It’s cheaper. And it completely disintermediates all third parties.

So I have to tip my hat to Ford here. This is something I would expect an innovative company like Tesla to come up with… but Ford’s showing a little creativity here.

And I’m sure we’ll see this type of system roll out in the years to come once cars are widely equipped with autonomous driving technology.

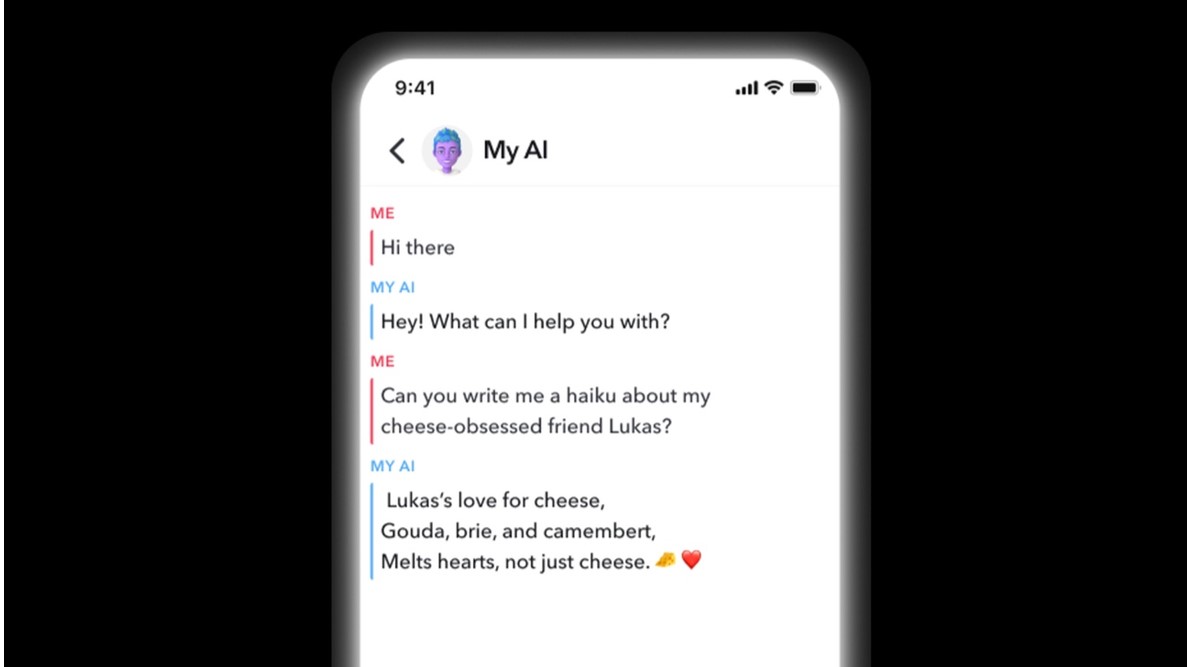

Snap just announced that it is incorporating OpenAI’s ChatGPT into its social media application.

For the sake of new readers, ChatGPT is the generative AI that’s set the industry buzzing since its release back in November. It’s incredible technology capable of producing content and even writing software code on command. It can also have intelligent conversations with us humans.

And as we discussed earlier this month, OpenAI just made ChatGPT available through its application programming interface (API). This allows entities to integrate ChatGPT into their own software code for a nominal fee.

That’s exactly what Snap’s doing here. It’s bringing ChatGPT into its Snapchat application.

Snap believes this is something its users will interact with on a daily basis. They are calling the upgraded feature “My AI”. Snap sees it as a personalized AI that can answer questions, provide information, and even have casual conversations with users.

Snap Is Incorporating AI Into Its App

Source: Snap

And Snap’s business model is telling. They decided to offer the MyAI feature for $3.99 a month. It’s another tier in their subscription model.

This is a great move.

What’s exciting is that Snap now has 750 million monthly users. And for just $3.99 a month, every single one of those could have access to incredible generative AI technology.

And the timing here is interesting…

If we look at what’s happening with TikTok right now – there’s proposed legislation that wants to ban the Chinese social media app here in the U.S.

We don’t know if that legislation will go through yet. But if it does, TikTok’s roughly 90 million U.S.-based users will be looking for a home to post and view short-form videos.

Snap is well positioned to take them on. Especially with the integration of ChatGPT.

This is something that could easily push Snap’s monthly active users north of one billion. That would be a huge milestone. And it would lead to strong revenue growth as well.

So, Snap’s certainly worth keeping an eye on here.

I’m surprised the stock hasn’t moved more on the back of this news… but it has tremendous potential right now. And this latest development is a clear indication of how valuable the potential business will become in providing personalized AI services to consumers.

Every major social media platform is racing to deploy an AI in hopes of capturing as much of the market as possible. It’s a multibillion-dollar annual prize for those that win the race.

There’s a new digital asset in town. It’s none other than Britcoin. What a great name…

Britcoin is a play on “Bitcoin” and “Britain”. And sure enough, it’s going to be the United Kingdom’s central bank digital currency (CBDC). Very catchy.

One of the deputy governors of the Bank of England (BoE) just revealed their plans to roll out Britcoin at a recent conference. They also refer to it as the “digital pound”.

Of course, the BoE is talking up the benefits to a CBDC. Fast transactions… low costs… low friction… it’s the same array of benefits that most blockchain technology enables.

The big difference is that Britcoin will live on a private blockchain controlled by the Bank of England. That means the BoE will have total control over all Britcoins and all transactions. It could freeze wallets and reverse transactions should it so desire.

So Britcoin will offer all the functionality of private digital assets like Bitcoin and Ethereum… but it will not provide users with full, unbridled autonomy. The BoE is always watching…

With this announcement, the BoE advised that it will accept feedback through June 7th. At that point they will begin the process of designing and implementing Britcoin.

We’ve talked a lot about the rise of CBDCs. But up to this point it’s largely been small island nations rolling them out.

Well, we’ve crossed the line.

Now we’re talking about major countries accelerating the push towards CBDCs. I expect we’ll see a lot more activity around this in the months to come.

Regards,

Jeff Brown

Editor, The Bleeding Edge

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.