Van’s note: Van here, Jeff Brown’s longtime managing editor. Today, we’re bringing some special insights from our friend and colleague Teeka Tiwari.

During past “anomaly windows,” Teeka has shown readers how to make 21 years’ worth of gains within 12 weeks. And now, he says the biggest anomaly in 28 years is coming to the stock market… Not only that, but he believes the stakes for this one are higher, and the next 90 days are make or break.

To that end, Teeka is holding a free urgent event this Wednesday, July 20, at 8 p.m. ET. He’s holding this event on short notice to help you prepare – and will reveal the name of the stocks to trade during this upcoming mega anomaly. To RSVP to attend, simply go right here.

|

What I saw made me sick to my stomach…

The market was coming off a huge rally. Stocks and bonds were up 17% and 34%, respectively, for the year.

The year before, we had fabulous economic growth. The overall sentiment couldn’t have been better.

And then… all hell broke loose.

Russia invaded its neighbor. Inflation was heading higher. The Fed hiked rates to rein in rising prices.

Then one day… just like that – bam! My computer screen started bleeding red.

All my positions were down… big.

It was a nightmare.

I received ear-splitting calls from angry clients. My office was in a tizzy. Investors panicked. Stocks plummeted.

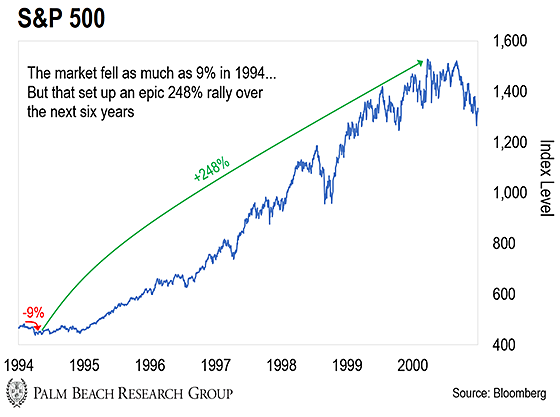

Overall, the S&P 500 fell 9% in two months…

Sounds familiar, right?

But everything I just told you is exactly what I experienced back in 1994.

At the time, I was 24. I’d been working on Wall Street for six years, but nothing prepared me for that carnage.

In 1993, the U.S. economy was humming along… GDP was growing at an inflation-adjusted 2.8%… And the market was hitting all-time highs.

Then the Federal Reserve rained on the parade…

Worried about the economy and a modest uptick in inflation… the Fed turned hawkish. Starting in February 1994, the central bank nearly doubled its policy rate to 6% in seven rapid-fire hikes over 12 months.

The rate hikes spooked investors, and the markets tanked.

After hitting an all-time high of 482 on February 2, 1994, the S&P 500 dropped 9%… a hair’s breadth away from “official” correction territory…

Later that year, Russia invaded the republic of Chechnya, creating more volatility into 1995.

At the time, it felt like the world as I knew it was ending.

But I – and everyone else at the time – was dead wrong. The world wasn’t ending.

Instead, it was the absolute best time to buy stocks.

After its 9% fall, the S&P 500 climbed 248% by the year 2000…

Here’s why I’m telling you this…

The market activity between 1994–1995 parallels what we’re witnessing today.

To me, that suggests another bull run is right around the corner…

In retrospect, I now know what happened from 1994–95 was merely a short-term positive to negative shift in sentiment.

In other words, it was merely the start of a “cyclical” bear market, not a “secular” one.

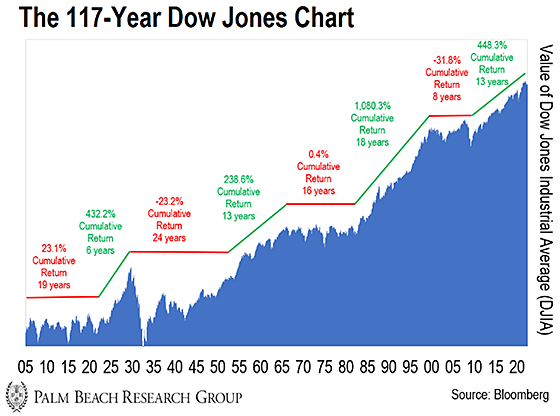

“Secular” markets are long-term, one-way directional moves up or down. They typically last between 12 and 20 years.

Within each secular market, there are short-term moves opposite to the main trend. These are the “cyclical” markets, which tend to last nine to 18 months.

The chart below shows a history of secular and cyclical markets measured in the Dow Jones over the past century.

As you can see, individual secular markets have lasted for as long as a quarter-century.

The big-picture moves can be higher (the green sections) or sideways/lower (the red sections). But short-term, cyclical moves happen throughout.

During the 1982–2000 secular bull market, we experienced seven cyclical bear markets. Each involved geopolitical uncertainty and/or financial crises.

The average peak-to-valley drop during those cyclical bear markets was 17%. However, the average recovery to new highs was just 94 days.

The period between 1994–95 is the one most like today…

And as far back as October 2014, I said we were in the middle of the next secular bull market… one that would last until 2028.

Now, this bull run hasn’t been a straight shot up. We’ve seen corrections and crashes along the way, including the most recent pullback…

The latest cyclical sell-off started in January 2022… After reaching an all-time high of 4,796, the S&P 500 is down over 25%.

But at the same time, the S&P 500 is up nearly 47% since March 2020. So if you just bought an index that tracks the market back then, you’d have double-digit gains.

To me, it’s eerily like what we saw in 1994.

Just like then, years of strong growth have caused higher inflation… the Fed is raising rates to cool the economy… And the markets have tanked.

It’s the perfect recipe for a short-term bear market within a long-term bull market.

It’s painful and scary… but it’s also an absolute gift.

Here’s why…

You should do only one thing in the middle of a cyclical bear market…

Buy great names and hold them. That’s it.

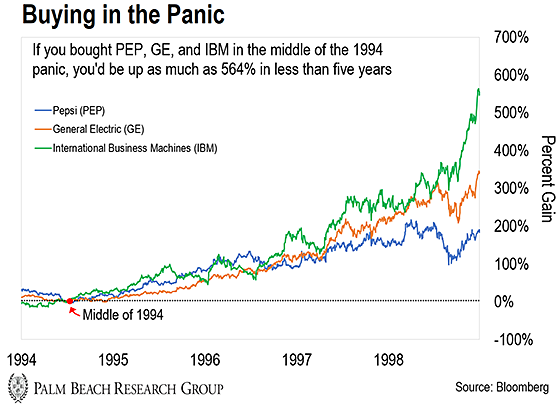

In my opinion, the 1994–95 downturn was the single-best buying opportunity of the entire decade…

If you dared to buy blue-chip stocks back then, you would’ve made a killing over the following five years. The risk/reward ratio was fantastic.

Remember, the market fell 9% overall in 1994.

The sell-off hit world-class companies hard. Pepsi, General Electric, and IBM fell 27%, 16%, and 14%, respectively.

There was no fundamental reason for the sell-off. They were high-quality companies with high-quality earnings. They made billions in revenue.

If you recognized these were world-class assets… you could’ve made a fortune buying them when everyone else thought they were toxic.

As you can see below, Pepsi, General Electric, and IBM saw gains of 217%, 345%, and 564%, respectively, in less than five years.

These cyclical bear markets are like an “in-game reset”…

If you missed the beginning of this bull market, these in-game resets give you a rare chance to start over and capture all the upside as the secular bull market resumes.

You just must tune out the negative news and focus on acquiring great names at bargain prices.

That’s it.

My research suggests we will be in a secular bull market in stocks until 2028, so there’s still plenty of upside to capture.

I know that’s an outrageous prediction to make… especially given all the volatility this year.

And I realize this isn’t the message you might want to hear.

Your portfolio’s down… food prices are climbing because of inflation… and watching the news each night is terrifying.

So I get it if my message is making you uncomfortable…

I got a similar reaction in 2014 when I said we’d be in a secular (long-term) bull market in stocks. Very few people believed me then. But those who followed my research made a ton of money.

Like then, I promise to tell you what you need to hear… not what you want to hear.

It’s exactly what I demand from fund managers who handle my money. It’s the same yardstick I hold myself to in all my newsletters.

And what you need to hear right now is that it’s not the time to sell.

Instead, consider this…

Despite record-high inflation and a painful market pullback, there’s a catalyst on the horizon that could return 21 years of S&P 500 returns in as little as 12 weeks… all from blue-chip stocks… and it could begin as soon as this month.

That’s why this Wednesday, July 20, at 8 p.m. ET, I’m holding a free urgent event to explain all the details…

This catalyst is a rare opportunity to recapture any gains you’ve lost in the market this year… and position yourself to make much more.

But you need to act now… Because this opportunity could be gone before the end of the month.

So click here to reserve your spot… and if you show up to watch my July 20 event, you’ll even get a free list of stocks to play this catalyst.

I hope to see you then.

Let the Game Come to You!

Big T

Like what you’re reading? Send your thoughts to feedback@brownstoneresearch.com.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.