Dear Reader,

Crisis averted! Or is it?

This last weekend turned out to be as much of a nail biter as the last one.

Just like last weekend’s last minute rescue by the U.S. Federal Reserve and U.S. Treasury of the depositors of Silicon Valley Bank, and for that matter all other regional banks in the U.S., the Swiss National Bank did the same for Credit Suisse.

There was a lot of back and forth on Saturday and Sunday with an urgency to get a deal done for Credit Suisse before the markets opened in Asia Monday morning. In the end, UBS stepped up with 3 billion Swiss francs ($3.2 billion) to acquire Credit Suisse and a willingness to clean up the mess.

And it wouldn’t have happened without the “facilitation” of the Swiss National Bank (SNB). The SNB stepped in with 100 billion Swiss francs ($108 billion) of liquidity assistance to UBS to get the deal done. And it went even further by guaranteeing 9 billion in Swiss francs of potential losses related to the acquisition. Mercy.

But it gets better. One of the more interesting Swiss government-sponsored provisions supporting the deal came from the Swiss regulator Finma. Finma said that 16 billion Swiss francs of additional tier 1 bonds (AT1 bonds) will be completely written down.

In the U.S. these types of securities are referred to as contingent convertible bonds – CoCos. They are convertible to equity if certain conditions are met. Their use became more popular after the financial crisis, and they were often positioned as a relatively safe bond offering that provides far higher yields than other forms of fixed income.

But, in a certain set of circumstances, CoCos can be written down to zero. And that’s exactly what has happened here.

Making matters more confusing, it appears that given the UBS acquisition of Credit Suisse, equity holders in Credit Suisse will make out better than the AT1 bond holders of Credit Suisse. Said another way, that’s the opposite of what should be happening.

So, is the crisis averted? No way, not even close.

Just imagine how anyone would feel right now if they were holding a bunch of CoCos in other European banks right now. Do we think they’d be a buyer or seller of that debt after watching 16 billion Swiss francs of CoCos written down to zero? That’s right. They’ll be dumping them as quickly as possible, which could lead to further liquidity problems in Europe.

It’s unravelling right now, and we just don’t know how deep and dark the hole goes. Who knows what leverage is lurking in the system right now on the edge of a cliff, or what set of circumstances will cause the global market for credit derivatives to explode.

If the U.S. Federal Reserve needed cover to stop hiking its Fed Funds rate this Wednesday at the FOMC meeting, it now has it. I’d like to ask the Fed politely to please stop. It’s time to pause, breathe, and hopefully calm the markets down and avoid outright panic.

And yet, if it retains its aggressive stance and hikes yet again given the events of the last couple of weeks, I can only come to one conclusion: Its goal is to break things even further and then implement new policies and controls that will make it more powerful than ever before.

The Journal Frontiers in Science just featured an incredible piece of research. It explores the concept of biological computing.

More specifically, this research details how something called “organoid intelligence” could create the world’s most efficient supercomputer.

So what’s organoid intelligence all about?

To put it simply, it’s a method of using human stem cells to produce brain organoids (brain cells) in a laboratory. We can think of these as a kind of artificial human brain.

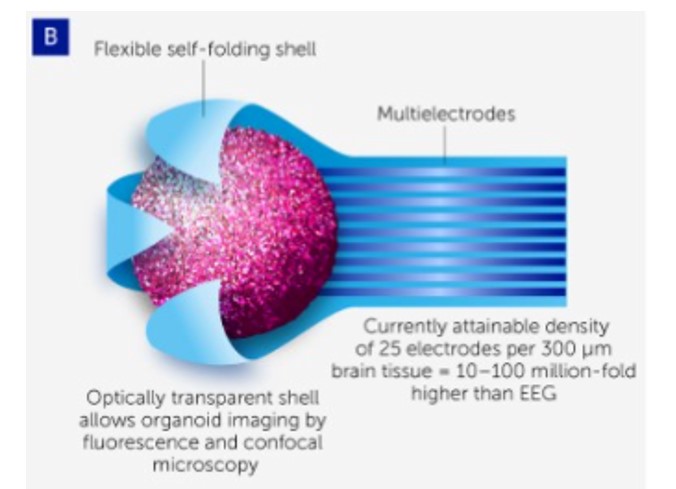

If enough of these organoids can be cultured, connected, and harnessed together, it could become an incredibly powerful and efficient supercomputer. Here’s a visual:

Source: Frontiers in Science

Here we can see a single brain organoid encapsulated by a shell of electrodes. The shell effectively wraps around a brain organoid and is the medium through which signals can be sent and received via a traditional computing system. Theoretically, there’s no limit to how much a system like this could be scaled.

A technological approach like this could become a massive biological supercomputer. This is something that’s long been imagined in the world of science fiction. But why?

What makes this idea so compelling is the fact that today’s supercomputers consume massive amounts of energy. That makes them expensive to operate. And as we know, most electricity comes from fossil fuels, which means massive computing systems and data centers tend to have very large carbon footprints.

This table tells the story:

Source: Frontiers in Science

As we can see, this table compares the Frontier supercomputer with the human brain. Let’s run through it really quick…

The Frontier is capable of computing at 1.1 exaFLOPS. That stands for one quintillion floating-point operations per second… which currently makes it the most powerful supercomputer on the planet.

But look at the human brain. It’s capable of computing at roughly one exaFLOPs itself.

That’s right – our brains are about as powerful, in terms of processing speed, as the most powerful supercomputer.

But look at the power requirements. The Frontier requires 21 megawatts of power whereas the brain needs only 10-20 watts.

To put this in perspective, there are 1 million watts in a megawatt. And that means that a human brain requires 1 to 2 million times less power than the Frontier supercomputer. That’s how remarkably efficient our brains are.

And the human brain isn’t just efficient in terms of power consumption. It operates in a very small space. Obviously a supercomputer is massive. In the case of Frontier, it takes up 7,300 square feet of space.

Meanwhile the human brain is tiny. It weighs about three pounds, and it fits in our skull.

This is what makes the thought of organoid intelligence so compelling. This approach to biological computing has the potential to be just as powerful as today’s supercomputers and cost just a fraction to operate.

Of course, this does raise some ethical questions.

Should these kinds of human “brains” be grown in a lab? If we do, could these brains become sentient? And if that happens – if the brains become self-aware – is it ethical to keep them suspended in a container fluid harnessed to a computing system in a laboratory?

Obviously these are some tricky issues. And they’ll have to be addressed if this research continues to advance. But I suspect, given the sheer potential of biological computing, that this line of research will be pursued. And with all of the associated advancements in electronics, optics, and sensors… now is a time when something like this just might be possible.

We just had a very exciting development in the CRISPR genetic editing space. It comes from a company Exponential Tech Investors know well – Intellia Therapeutics.

As a reminder, CRISPR is like software programming for DNA. It allows us to “edit” genes just like we use “cut” and “paste” features in Microsoft Word.

And the first CRISPR-based therapies have already demonstrated some success in human clinical trials. There’s a nuance here though. These early therapies have almost entirely been ex vivo.

Ex vivo therapies entail taking cells out of the patient’s body and modifying them using CRISPR technology. Then clinicians can observe the edits in a lab setting before injecting those cells back into the patient’s body.

This is considered a lower-risk approach because it adds a step in the process to ensure that the edits have taken place properly. If for some reason something went wrong, the modified cells could simply be discarded.

Today’s big development is that the Food and Drug Administration (FDA) gave Intellia Therapeutics the green light to advance an in vivo therapy into clinical trials.

In vivo therapies are injected directly into the patient’s body. So the initial genetic editing takes place inside the patient, not in a lab.

This is considered a somewhat riskier approach. And that’s why this is such a big milestone for the industry.

The benefit here is that in vivo therapies are much cheaper to administer. In many cases it’s just a single injection… and that’s it. These therapies are capable of delivering a one-time treatment.

On the other hand, ex vivo therapies are quite expensive given all the lab work that must be done. It’s estimated that some ex vivo therapies will cost millions of dollars… which would place them outside of the range of many patients.

So we’ll be tracking Intellia’s progress here very closely.

The therapy in question is called NTLA-2002. It’s designed to treat hereditary angioedema.

Positive results from the upcoming clinical trial will be a huge catalyst both for Intellia’s share price (NTLA) and for the industry overall. As more companies in the genetic editing space get the approvals for in vivo therapies for clinical trials and eventually FDA approvals, investment and advancement in the field will accelerate.

And yes, for any readers wondering, I do like Intellia as a long-term holding in this space. The stock will almost certainly be volatile as we work through this difficult period in the markets. But for those of us with a two to three-year horizon, it could turn into a great return.

Character.ai just raised a whopping $200 million in its first early stage venture capital (VC) round. This values the company at exactly $1 billion… making it an instant unicorn.

And we should note that the round was led by famed VC firm Andreessen Horowitz. Clearly Andreessen recognizes just how monumental the opportunity is when it comes to generative AI.

We first featured Character.ai back in January. For the sake of new readers, it’s a generative AI company with an interesting idea.

Character.ai is training its AI to impersonate both people and fictitious characters. It does this by feeding the AI all available transcripts and writing from the particular person’s point of view or character.

The idea is that users can use Chartacter.ai to have real conversations with their favorite people and characters. And it will “feel” like they are truly speaking to whoever the AI is representing.

For demonstration purposes, here’s an AI trained to speak as if it were Elon Musk.

Source: Character.ai

But it’s not just contemporary figures.

Let’s say we’re interested in George Washington. The AI could ingest everything that George Washington ever wrote to get a feel for his thoughts, opinions, and communications style.

Then the AI could converse in George Washington’s style and prose. We could have a real-time, in depth conversation with America’s first president.

The same is true for any historical figure we may be interested in. It’s also true of fictional characters.

Suppose we like Harry Potter, Bilbo Baggins, or any other prominent character in fiction. Character.ai can enable us to chat with our favorite characters as if they were real.

This is such a cool idea. And in addition to being novel, it could help researchers and historians tremendously. After all, an AI that is trained on an entire body of knowledge concerning an individual – historical, live, or fictional – basically has perfect recall. There are some great practical applications here.

And of course, it could be incredibly valuable for companies that own the intellectual property for popular characters. As mentioned, a Star Wars fanatic could have a conversation with Darth Vader. “Trekies” could ask their biggest question to Captain Kirk. This is one of the reasons why there is such interest in this technology.

It got me thinking of a new product idea that I wouldn’t be surprised if Character.ai pursued. Imaging being able to have your own personalized AI-powered digital assistant AND being able to give it the character of your favorite person. Would you choose a past president? A rock star? A famous scientist? Or a pro athlete? It would be completely up to you. And those figures who are still alive, or those that are fictional, could license the rights to a firm like Character.ai to enable this kind of feature. I think this would catch on like wildfire.

And bigger picture – this is just more proof that an avalanche of capital will flow into generative AI this year. I predict we’ll see at least $20 to $30 billion pour into generative AI start-ups this year.

Of course, this investment is only going to drive the advancement and adoption of generative AI at an even greater speed. The easy availability of such large amounts of capital accelerates product development, which speeds time to market for consumers.

We’re at the very beginning of a massive trend. And it’s absolutely going to reshape our world in ways we can’t yet envision.

Regards,

Jeff Brown

Editor, The Bleeding Edge

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.