- A sign of things to come in the blockchain community…

- Tesla is accelerating its self-driving tech…

- We’re entering Phase Three of the 5G boom…

Dear Reader,

50 years ago, almost to the day, Intel released its first microprocessor.

The Intel 4004 looks like an antique compared to what we’re used to seeing today from the semiconductor industry.

Intel 4004 Circa 1971

Source: c&en

The 12 mm2 processor was quite large by today’s standards, especially considering the task that it was designed to do. The Intel 4004 was designed into a printing calculator manufactured by Busicom, a Japanese company at the time. The Intel 4004 had only 2,300 transistors.

I have actually seen the original Busicom 141-PF prototype in real life as it is on display in the Computer History Museum in Mountain View, CA. I’ve been there several times over the years for conferences. It’s one of those must-visit places if you’re a technologist, and it’s still interesting even if you’re not.

So what has happened over the last five decades in the semiconductor industry?

Well, things got bigger and smaller.

More specifically, the size of silicon wafers increased dramatically in size.

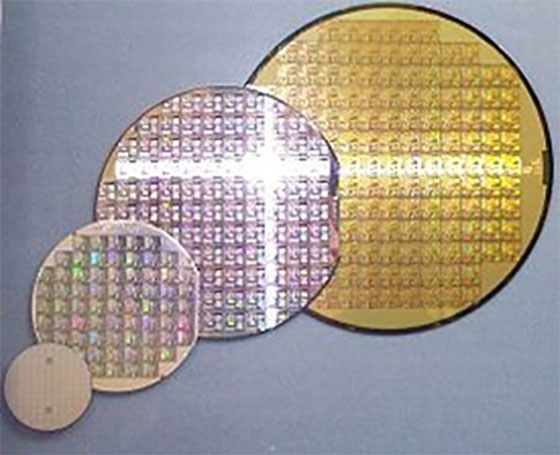

Increasing Sizes of Silicon Wafers

Source: Wikipedia

In the lower-left of the image is a two-inch wafers, and in the upper-right corner is an eight-inch (200 mm) wafer. 300 mm wafers are common today, and the industry is working on making larger geometries like 450 mm more common.

And at the same time transistors got smaller… Much smaller.

Remember the Intel 4004 with just 2,300 transistors? Last year the most valuable semiconductor company in the world, NVIDIA, released its A100 chip with a mind-boggling 54-billion transistors.

That’s a 23,478,261x increase in the number of transistors on a single semiconductor. This is the sheer definition of exponential growth. And the industry continues to double its transistor counts every couple of years or so.

What has made this trend so powerful is that the combination of larger wafers and smaller transistors always increases the overall yield in production. This results in the continuous decline in both the cost of semiconductors, as well as the size of the chips.

And the entire world has benefited from this extraordinary technological advancement. Year after year we get smaller, faster, better, cheaper semiconductors that enable conveniences that were unimaginable 50 years ago.

Skeptics have been crying about the end of Moore’s Law for more than a decade now. I just don’t see it. Leading semiconductor manufacturing companies like TSMC and Samsung are innovating with technology that many industry experts thought was impossible even five years ago.

And advancements in materials science will empower us to work with new materials in the manufacturing of semiconductors. This will allow us to overcome some limits in working with silicon. Not to mention how advanced photonics and quantum computing will impact computing technology.

No, it’s not coming to an end. Quite the opposite. We’re at an inflection point where we start to move at a speed faster than Moore’s Law. And the technological advancements that we’ll see this decade are going to dwarf what we’ve experienced in the last 50 years.

And that’s why I’m so excited. Thank you for being a reader of The Bleeding Edge and coming along for the ride. And if you decide to stick around, there is one thing that I can promise – it will never be boring.

We have so much to look forward to.

A radical shift in the blockchain industry…

ShapeShift – one of the most prominent projects in the blockchain space over the past decade – is making a radical move.

ShapeShift started in 2014 as one of the single most valuable utilities in the blockchain industry. It was a beautiful service that allowed users to exchange one cryptocurrency for another nearly instantly.

Users simply sent ShapeShift a certain amount of one cryptocurrency and told it which cryptocurrency they wanted in return. Then ShapeShift would send that cryptocurrency back to them in equal value, minus a small transaction fee.

ShapeShift did not require anyone to provide personal information or set up an account. And this model made ShapeShift massively successful… At first.

That changed in 2018 when the Securities and Exchange Commission (SEC) got involved.

The SEC forced ShapeShift to implement “Know Your Customer” (KYC) requirements to the service. That meant ShapeShift had to require users to create an account and provide a lot of personal information. Per KYC, ShapeShift could only approve new accounts after confirming the information and following all of the regulatory guidelines.

This destroyed the convenience of using ShapeShift. Most of the company’s customer volume came from partner wallets that connected to ShapeShift in the background. Prior to the KYC rules, wallet users could seamlessly transact with ShapeShift without even knowing it was there.

But afterward, the wallets had to send users to another company – ShapeShift – to create an account there. That added friction and changed the user experience, and many of the partner wallets dropped ShapeShift in favor of competitors without those requirements.

In other words, no longer could consumers show up, swap out one cryptocurrency for another, and go about their day. Now there was a cumbersome process involved. And ShapeShift lost 95% of its customer base as a result.

What’s more, ShapeShift CEO Erik Voorhees felt this turned the company into a highly bureaucratic organization. That is the exact opposite of what it set out to be.

As a result, the new requirements prompted ShapeShift to pivot again to decentralized finance, or “DeFi.” We talked about that back in January. The idea was for ShapeShift to simply be the “bridge” between its customers and digital asset exchanges.

Well, ShapeShift just announced that it is taking this shift one step further. The company is going to completely dissolve its corporate entity and become a decentralized autonomous organization (DAO). That means no more office, no more bank accounts, no more CEO, and no more employees. Sounds impossible, right?

With the DAO structure, ShapeShift’s technology platform will still exist. And it will operate much like it did at first with no customer accounts.

In addition, ShapeShift is creating FOX tokens to incentivize people to use the platform. FOX tokens will allow users to earn income on the platform.

And the developers who continue to work on the platform will be compensated in FOX tokens. The idea is that if the project is successful, FOX tokens will go up in value, which will incentivize more development. The increasing value of the FOX tokens is a replacement for what traditionally would be a base salary and bonus structure.

This is a wild experiment in radical decentralization. And I suspect that it will either be immensely successful, sending the value of FOX tokens soaring… Or it will flop and gradually wither away. I doubt there will be much middle ground.

I know that for many of us, this concept of a DAO feels uncomfortable. For those of us who have worked for decades in a traditional enterprise or corporate environment, this seems so foreign. It’s natural to feel that it just won’t work.

But I believe that it will, which is why we should keep a close eye on these developments. Work has already started a major shift towards being more project-based.

This is especially true in the tech industry. It will become common for workers to engage in projects without any employment contracts and be “rewarded” for their contributions to the project with digital assets.

And the value of those digital assets will be significant enough to live on and support a family. And just like traditional companies that have great success going public, the most successful projects will mint millionaires as well. The only difference is that it will happen much more quickly.

Tesla just launched the latest version of its full self-driving beta…

It’s finally here. Tesla just launched beta version 9 of its full self-driving (FSD) software. This is a big deal.

For the sake of newer readers, Tesla did a scrap and rebuild of its autonomous-driving artificial intelligence (AI) software several months back. Tesla built its new AI from scratch, basing it on neural networks. This was a bold move, but one that Tesla felt was necessary to evolve its technology to full self-driving capabilities.

Tesla wasn’t, however, starting from scratch. Tesla has been able to train the new AI with its billions of miles of self-driving data collected over years from its “fleet” of Autopilot-enabled vehicles. The result was a newly architected, fully self-driving software package.

This FSD software currently provides advanced driver assistance that reduces the more burdensome parts of driving, but it’s well on its way toward a completely autonomous self-driving experience.

The first version of this newly architected AI was pushed out to a limited number of employees and passionate customers willing to provide detailed feedback. These drivers have been testing the software on the road in a live beta since last October. Their feedback is what enabled the launch of beta version 9.

And Tesla is clearly excited about this latest version. Musk called it “mind-blowing.” And the fact that Tesla is rolling it out to more drivers tells us that the company is making material progress.

What’s interesting here is that this release moved the AI away from relying on radar and sensor data. Instead, the AI focuses exclusively on the video input coming from the car’s cameras. This has some incredible implications.

For one, scrapping the radar and the sensors will reduce the cost of manufacturing a self-driving EV materially.

And training the AI to operate solely on visual inputs ensures that it will make decisions very similar to human drivers, who drive almost exclusively by vision as well.

Tesla is essentially modeling its AI after the human brain with this move.

To me, this suggests that Tesla is well on its way to Level 4 autonomy by the end of the year. This is only one step away from full self-driving capabilities. At Level 4, Tesla’s cars will be able to drive themselves in all but the most complex driving conditions.

I’ve already reviewed some of the videos on the internet using this latest version. All I can say is that I’m impressed. So far, what I have seen is a huge leap in performance, and it’s very bullish for what will be widely available from Tesla by the end of this year.

I think that the automotive industry is in for an incredible surprise.

How I know Phase Three of the 5G boom is here…

We’ll wrap up today with exciting news from the world of fifth-generation wireless technology (5G).

Apple just asked its iPhone suppliers – the companies who provide the components that go into the phone – to increase their production by 20% this year. That’s a huge bump. We’re not talking a few percentage points here – 20% is a major increase.

Apple’s goal is to produce 90 million of its second-generation 5G-enabled iPhones (iPhone 13) in the calendar year 2021. And that’s our sign that we have hit an inflection point in the 5G wireless rollout where the majority of smartphones that are sold will be 5G-enabled.

On a full-year basis, 5G-enabled phones will probably represent about 47% of all smartphone sales. But for the second half of this year, 5G will win out over 4G.

This is when things get exciting for Phase Three of the 5G boom… The services phase.

As a reminder, Phase One is infrastructure – think cell towers and fiber-optic wiring. Phase Two is devices, like 5G-enabled phones. And Phase Three is when normal consumers will really start to see and feel the advantages of 5G. It’s when at least half the population will carry 5G-enabled phones and have access to 5G networks, and software developers will launch applications designed for 5G.

The 5G-enabled iPhone 13 is set to be announced in September. I’m sure there will be many new 5G-application announcements around it as well. Developers are gearing up to take advantage of 5G phones and networks being widely available. It is hard to believe we’re less than two months away.

And this will only accelerate the mass adoption of 5G technology. Very few want to miss out on the latest and greatest things happening with some of the most important devices that we use every day – our smartphones.

In my 2021 prediction series, I predicted that we would enter Phase Three of the 5G boom in the summer of this year. And I’m confident that’s exactly what we’re seeing right now.

The big takeaway here is that we’re still in the early stages of the 5G boom. In fact, it’s set to ramp up now that we are entering Phase Three. That’s why I remain so bullish on the top 5G positions we hold in our premium research services.

And if any readers would like to gain access to my No. 1 pure-play on 5G, please go right here for the details.

Regards,

Jeff Brown

Editor, The Bleeding Edge

P.S. A week from today, I’ll be sharing details about a “glitch” in the stock market…

Before you make your next move in your brokerage, you’ll want to know about this glitch. That’s because it can help you spot moves in individual stocks… Weeks before they happen. My research showed 17,000 instances when this glitch could have helped you double your money or more.

The financial elites have known about this glitch for years… It’s been one of their best-kept secrets, in fact. But I believe it’s time to change the script.

That’s why on July 28 at 8 p.m. ET, I’ll be revealing what this glitch is… How regular investors can profit from it… And what this glitch is showing right now about some of the hottest stocks on investors’ wish lists.

I’ll even be giving away the name and ticker of a top “glitch” stock for free to those who attend.

So please, if you haven’t already, simply visit this link to sign up. That way, I’ll be able to keep you posted on all of the latest developments.

See you next Wednesday.

Like what you’re reading? Send your thoughts to [email protected].