Van’s Note: For this Saturday issue of The Bleeding Edge, we turn to our colleague Teeka Tiwari. Read on to hear Teeka’s thoughts on how to prepare ourselves for the possibility of another crypto sell-off…

Dear Reader,

The last time I felt like this was 14 years ago…

It was a devastating time in the financial markets. It was so bad people wondered if we’d ever come through to the other side.

The memory of it is probably fresh for many of you, too: the Great Financial Crisis of 2007–2009.

In October 2007, the S&P 500 hit new highs after an epic 101% run from the 2000 dot-com bust lows.

But Wall Street got greedy. They started taking outlandish risks. Firms like Lehman Brothers were using leverage as high as 31 to 1.

Many of Wall Street’s trades involved low-quality assets masquerading as high-quality assets. Somehow Wall Street had convinced the rating agencies to give subprime loans, (loans made to the riskiest borrowers) AAA ratings.

So when Wall Street treated these risky assets as safe AAA-rated assets, it led to disaster.

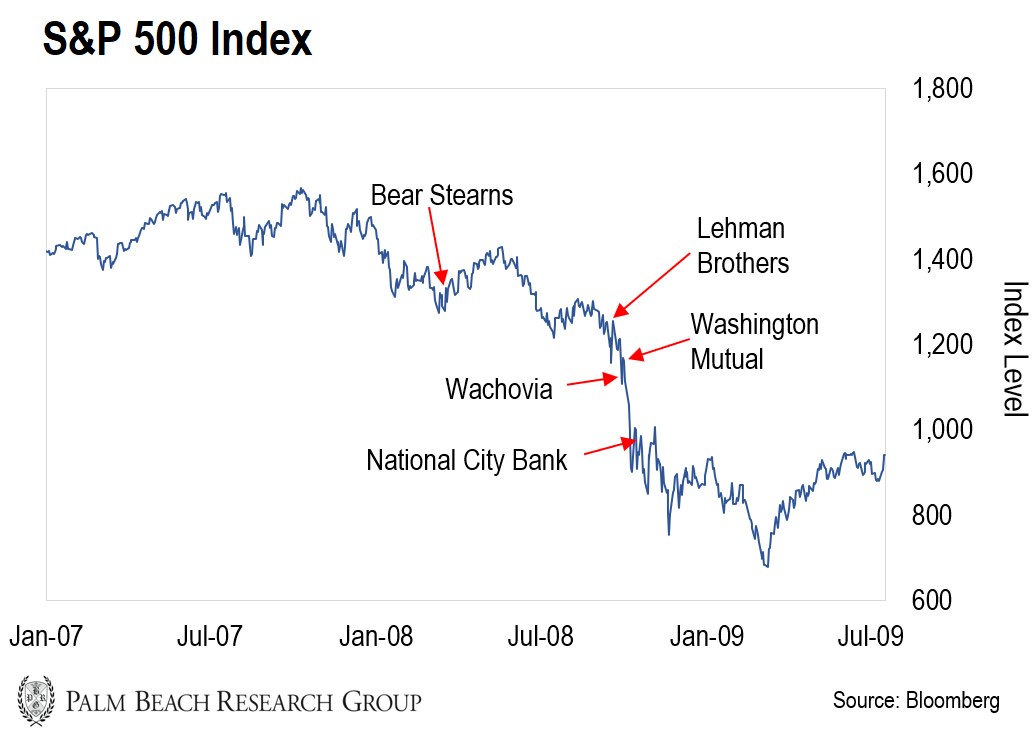

When the subprime loans unraveled, the S&P 500 dropped from its 1,565 point all-time high in October 2007 to a 676 low in March 2009…

And the first domino to fall was global investment firm Bear Stearns.

In early 2007, it had a $20 billion market cap and traded for $171…

Less than a year later, the company narrowly avoided bankruptcy when JPMorgan swooped in and bought it for $10 per share… a 94% discount on its share price a year prior.

At the time, I was running my own hedge fund. I remember thinking, “This isn’t over. Bear Stearns is massive. There’s no way more dominoes won’t fall.”

It took some time, but that’s exactly what happened…

After its March 2008 lows, the market recovered more than half its losses and rallied 12% to 1,425 in two months…

I’m sure investors who bought the dip were popping the proverbial champagne bottle for their wizard-like timing.

Then, just like that… the next domino fell.

In September 2008, we saw the granddaddy of all bankruptcies occur with Lehman Brothers.

The 158-year-old firm had a record $613 billion in debt when it filed for bankruptcy on September 15, 2008.

This would send markets to new lows. But the sell-off was far from over.

Washington Mutual collapsed… Then Wachovia… Then National City Bank… and more market carnage ensued.

The chart below shows the S&P 500 during the financial crisis. As you can see, none of these firms’ collapses marked the bottom:

Here’s why I’m telling you this: We’re seeing a scaled-down version of the Great Financial Crisis play out in the crypto markets.

The first domino to fall was Terra (LUNA) and its stablecoin, UST…

Since LUNA’s implosion in May, crypto’s market cap has plunged 44%… and has dropped a total of 66% from the November 2021 all-time high.

But the ripple effect hasn’t stopped… And despite a recent turn toward the positive, I expect more dominoes to fall.

We’ve seen the entire crypto market rally this week, crossing the $1 trillion mark for the first time in just over a month… and bitcoin and Ethereum are up 30% and 70%, respectively, from their recent lows.

That’s encouraging… but it’s still too early to say the bear market is over.

Let me be clear: Nothing would please me more than being proved dead wrong by the market going straight back up. I hope you get to mock my concerns as overly cautious hand-wringing.

As a large investor in this space, I’d be the first to welcome a quick reversal back to a bull market.

Does my concerns about more weakness ahead in crypto mean we should sell everything and go to cash?

Absolutely not.

The situation in the crypto market is very fluid right now. It’s important to remember this is a liquidity problem, not a bitcoin or Ethereum problem. Greedy actors took on too much risk and got caught using far too much leverage on risky assets.

Just like in 2007, they were using the type of leverage reserved for only the safest of assets except they were buying high-risk junk. This has caused everyone in the space to dial back risk… raise cash… and take a wait-and-see attitude on who is next to fail.

Now, if monetary policy were to suddenly become accommodative again (which I do not expect until October of this year at the earliest) then yes, crypto would gun higher and we would in all likelihood be back to the races.

Even though that is a low-probability event, I would hate to be out of the market if that were to happen.

Now, normally, Fed actions like this wouldn’t concern crypto. But we’ve seen that a looser monetary policy acts like rocket fuel for crypto prices. So we can’t ignore that possibility.

As to the action we are seeing right now? Well it looks like an oversold bounce to me. That’s why I’m sharing this article with you so you can prepare yourself mentally if the crypto sell-off resumes.

We’ve already seen crypto firms like Celsius and Voyager Digital go belly up.

Just like Bear Stearns and Lehman during the financial crisis, their demise will have a domino effect on other crypto firms exposed to their toxic assets.

One area of concern is the stability of Tether (USDT), the largest stablecoin. It accounts for roughly half of all stablecoins in existence.

When Tether was small, I didn’t worry about its impact on the crypto market.

But with $66 billion worth of USDT in circulation today, Tether is one-sixth the size of bitcoin and one-third the size of Ethereum.

The crash of UST crash led many investors to reevaluate the strength of stablecoins. And hedge funds have ramped up their bets against Tether.

I’ve never been a fan of Tether because it never proved it had the 1:1 peg it claims. ($1 in cash for every USDT in circulation.)

Instead, assets like secured loans, corporate bonds, and cryptos are reported (but not verified) to back it up.

These assets come with greater risk than simply holding cash… And if the majority of investors rushed to redeem their Tether for U.S. dollars tomorrow, we’d see liquidity issues.

And if Tether’s peg slips significantly, it would mean massive pressure on the crypto markets.

Now, I’m not saying that Tether will completely collapse… They’ve done a good job processing approximately $16 billion in redemptions while still maintaining their $1 peg. That is impressive. But it’s something we are still monitoring closely.

Bitcoin miners are another reason I’m cautious right now.

As you know, miners secure the network by validating transactions in return for BTC.

Over the past year, we’ve seen miners tap into the debt and equity markets to fund operations. And as I predicted, that allowed them to hoard their tokens as the price of bitcoin surged higher.

But that’s no longer the case…

Roughly $4 billion in bitcoin miner loans are under stress as profit margins shrink. And financial institutions are pulling back their appetite for risk. This is drying up the miners’ funding.

So these miners must sell their BTC hoard to cover operating expenses.

Today, bitcoin miners hold roughly 1.82 million BTC, valued at roughly $39 billion. If market conditions deteriorate and miners can’t pay their bills, we could see hundreds of thousands of bitcoin hit the open market.

Not because they want to sell their bitcoin… But because they must.

Eventually, the stronger miners will emerge from this crisis in better shape than ever. And as bitcoin recovers, they’ll resume hoarding their BTC.

It’s important I point out that my timing was wrong regarding miners boosting the market.

I had expected the miners to continue holding their bitcoin just as a surge of new usage in the form of bitcoin credit card rewards would cause a supply squeeze, causing bitcoin to leap higher.

The forced selling of bitcoin by overleveraged centralized finance firms like Three Arrows Capital and Celsius cratered bitcoin’s price to a level I didn’t think we’d see again.

This in turn crushed the economics for many bitcoin miners and will, in all likelihood, lead the miners to sell off a good portion of their bitcoin hoard.

The last time I was this wrong was back in 2018. At the time I predicted BTC would hit $40,000 per token. Within a year BTC was at $3,000.

I took a lot of well-deserved “stick” for the BTC $40,000 call. But I never hid from what I said. And I faced my readers squarely just as I am doing now.

It would take two more years than I predicted before bitcoin would hit $40,000… on its way to its all-time high of near $70,000 last year.

This is my way of saying, again, that I believe time will prove my thesis correct…

And I still believe bitcoin will reach $500,000 over the coming years.

As it climbs back to new highs, we’ll see bitcoin miners hoarding their BTC again. We’ll also see massive adoption of bitcoin reward credit cards that will act as a huge future demand driver for bitcoin.

However, over the short and intermediate term, miners selling off their bitcoin will be another headwind against a speedy recovery.

The next hurdle we may see is increased regulation.

The implosion of UST and the meltdown of centralized lenders like Celsius and Voyager Digital have given the industry a black eye with the public and regulators.

Many investors experienced losses due to the reckless actions of a few individuals. And new crypto investors may sit on the sidelines until there’s more regulation.

Ultimately, regulation is needed for centralized finance operators if you want billions of people to come into this space.

If the regulation doesn’t stifle innovation, we welcome oversight that protects investors. But in the short term, regulation could be viewed by the market as a headwind.

Despite the recent pullback and the headwinds I’ve outlined above, crypto still has tremendous growth ahead of it.

During the first quarter of 2022, venture funds raised a record $9.9 billion for crypto-related projects. And in the most recent quarter, they raised $6.8 billion.

Two recent fundraising rounds include big names like Andreessen Horowitz (A16z) and Multicoin Capital.

This year, A16z has raised more than $7.6 billion to fund blockchain and Web3 projects.

And just last week, Multicoin Capital raised $430 million for decentralized autonomous organizations (DAOs) and to develop Web3 projects.

So despite the meltdown we’ve witnessed in CeFi (centralized finance), DeFi remains strong.

Today, over $70 billion in assets are exchanged, borrowed, and lent directly on DeFi protocols without centralized middlemen. That’s incredible growth for an industry (Decentralized Finance) that only came into existence four years ago.

Friends, if you missed the crypto bull runs of 2013, 2017, and 2021… I want you to view this current pullback as an “in-game” reset.

The crypto market cap hit a $3 trillion all-time high in November 2021. Right now, it’s around $1 trillion. If it rallies back to its previous high, that’s a 233% increase from today.

Eventually, I believe bitcoin alone will rival gold’s $11 trillion total market value. That’s a 2,400% increase from today.

I don’t believe any other asset class in the world offers that kind of upside potential.

That’s why I call this pullback an “in-game” reset.

It’s a chance to buy quality projects at steep discounts… And to deploy additional capital to those that have crashed.

But we’re not there yet…

It’s prudent to wait for the worst to be behind us before diving back in and potentially losing even more… Even if that means buying at slightly higher prices.

Many got this wrong during the Great Financial Crisis. They thought things couldn’t get worse after Bear Stearns’ bankruptcy… and they got wiped out.

By being patient, we’ll avoid that mistake and be set up to deploy capital at what could prove to be much better prices.

And if I’m wrong and we go straight up? It will have been the first time in the short history of crypto that a “Crypto Winter” would have been over in under a year.

And you’ll be able to tell me “I told you so.”

That’s a risk I’m willing to take.

Remember, it’s a marathon, not a sprint.

Just like in the stock market in March 2009, there’ll be incredible buying opportunities. And even if we don’t nail the absolute bottom, there will still be enormous upside left.

Let the Game Come to You!

Big T

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.