Last month, I took the stage at the Mandarin Oriental in Washington, D.C.

It was the annual Legacy Investment Summit, put on by Brownstone Research’s parent company for the benefit of our subscribers.

Before me were hundreds of attendees, and several hundred more were watching virtually.

Jeff at the 2022 Legacy Investment Summit

During the conference, one of the most popular questions was some variation of this: “What should we do now?”

As we all know, markets have been incredibly volatile this year. Inflation is at a 40-year high. We’re seeing shortages of everyday goods. And cryptocurrency markets are down more than 50% from their November highs.

I know these are trying times. So today, I’ll share my answer to that question. I’ll reveal what I told conference attendees.

And I’ll share what I’m doing in my own portfolio… and how everyday investors can use the same strategy to see generational wealth in the years ahead.

We might think that “hard assets” like precious metals are the best way to protect and grow our wealth right now. And that’s not a “bad” idea. To this day, I still own several hundred ounces of silver coins.

But this isn’t my favorite strategy for volatile markets, and it’s not the idea I shared with conference attendees. Instead, I shared this chart:

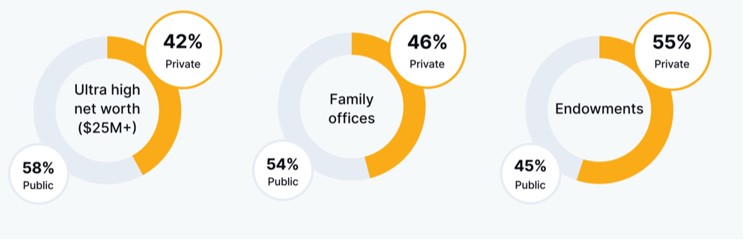

What it shows is how much wealthy investors are allocating to private investments.

And what we’ll see is that wealthy investors and family offices have nearly half of their portfolio in private investments.

Endowment funds have more than half of their portfolios in private investments.

Meanwhile, the average retail investor has zero percent. That’s right. Nothing at all.

So, why are wealthy investors putting nearly half of their capital into private companies?

It’s because they know placing small investments into the right private companies can create generational wealth. The returns seen from great private companies will easily outpace inflation and then some.

And because private investments do not trade in public markets, there is no daily volatility. They’re not impacted by the daily gyrations we’re seeing right now. They are the purest form of “set it and forget it” investments.

Wealthy investors have known this. That’s why they have been investing in private companies for decades.

And here’s what I told conference attendees: It’s time for us to do the same.

By investing in private companies at the earliest stages, we have the potential to see 10X, 100X, and yes, sometimes even 1,000X returns.

There are famous examples of private investors and venture capital (VC) firms making a fortune with early stage companies.

Early, private investors in Uber, for instance, turned $30,000 into $149 million… $50,000 into $248 million… and even $510,000 into $2.5 billion when the company went public.

So yes, investing in private deals can be very profitable.

I say this from personal experience. I’m an active angel investor myself. I’ve invested in more than 300 deals over the years.

I have seen returns on these investments that have all but guaranteed that my family will be secure should anything ever happen to me.

I don’t share this to brag. I simply want readers to know that I speak from a place of experience. I have spent decades cultivating my ability to analyze private companies. And I have deployed my own capital based on that analysis.

And of all the private companies today, there is one group that I am paying special attention to.

Crypto placements are where private investing meets cryptocurrencies and blockchain technology. And I believe the largest returns will be seen here in the years ahead.

And I can tell us from personal experience the potential of investing in these crypto placements.

Of all the companies in my portfolio, my largest focus is on private blockchain and cryptocurrency companies.

That’s right. This is the exact same strategy I use in my own private investing.

And I’m happy to report I’ve seen some incredible returns with these investments.

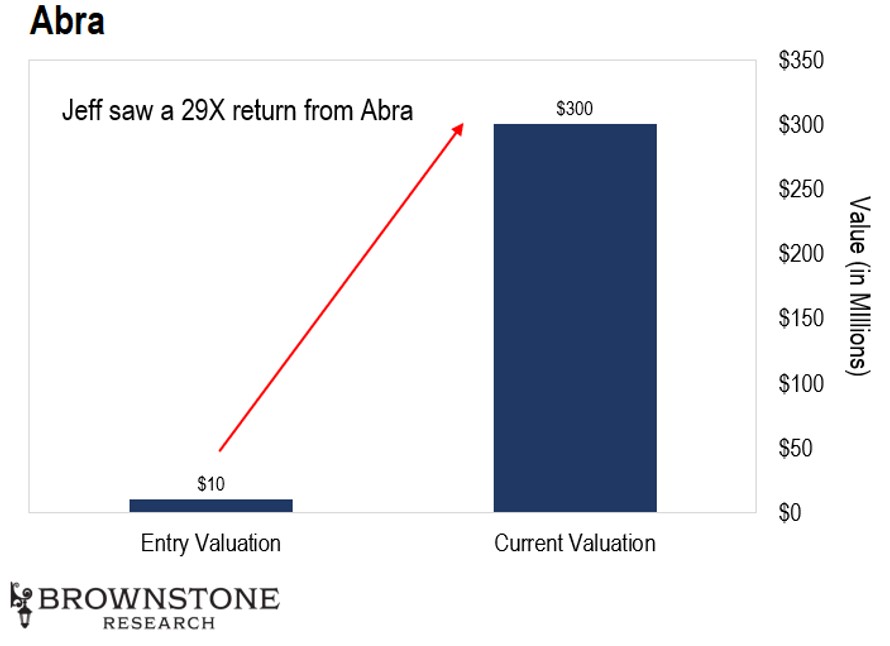

For instance, I invested in Abra, the company behind one of the most popular cryptocurrency wallets.

I made an investment when the company was valued at just over $10 million. Recently, Abra was valued at more than $300 million. That’s a 29X return on investment.

Here’s another from my portfolio: Ripple Labs.

This is a company revolutionizing cross-border transactions. And this is also the same company behind XRP, one of the largest digital assets by market capitalization.

I took a position when the company was valued at $250 million.

Today, Ripple Labs is a decacorn. It’s valued at $10 billion. That’s a 40X return on investment.

Here’s one more…

I’m sure we’ve all heard of Coinbase. It’s the world’s largest cryptocurrency exchange. I was actually a private investor in Coinbase. I invested back in 2017 when it was valued at $1.5 billion.

Shortly after its IPO last year, Coinbase was valued as high as $74 billion. That’s a 49X return on investment.

Coinbase has since shed much of its value as a public company. But even after an 80% fall from its highs, I’m still up approximately 500% on my initial investment.

And I’m not the only private investor taking a position. Last year was a record for venture capital entering the crypto industry. As the below chart demonstrates, a record $35.1 billion capital was invested in cryptocurrency and blockchain companies.

Again, I’m not telling us this to brag or show off…

I just want to show that I have seen firsthand what crypto placements can do for a portfolio. And I would like to guide us through the exciting world of private blockchain investing.

And it all starts tonight, at 8 p.m. ET.

Tonight, I’ll be hosting a special investment summit to profile what “crypto placements” I’m currently seeing in the market, including a new private recommendation I’ll be making in the coming weeks.

So, if we are at all interested in entering the exciting world of private investing, I’d invite you to join me. Simply go right here to reserve your spot.

Regards,

Jeff Brown

Editor, The Bleeding Edge

Like what you’re reading? Send your thoughts to feedback@brownstoneresearch.com.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.