Dear Reader,

This morning brought exciting news for the biopharmaceutical industry and the entire world.

AstraZeneca announced some surprisingly positive results from its latest Phase 3 clinical trials for its vaccine. Like the Pfizer/BioNTech and Moderna vaccines, AstraZeneca is a two-dose vaccine.

The results demonstrated that symptomatic disease was reduced by 79% in its latest trials. And the vaccine further reduced severe conditions and hospitalizations by 100%.

Most importantly, the vaccine proved effective for those over 65 years, at 80%. What I liked about the trial was that 60% of the subjects had other underlying conditions like diabetes, severe obesity, or heart disease.

As we have learned, these conditions are the primary comorbidities for anyone under 65 years or older.

Unlike the Pfizer/BioNTech and Moderna vaccines, the AstraZeneca vaccine is not developed using mRNA (messenger RNA) technology.

Much like the Johnson & Johnson vaccine, the AstraZeneca vaccine uses a form of a common cold virus to deliver some genetic code. This causes our bodies to produce a protein that looks like the spike protein produced by COVID-19.

This results in our bodies creating the necessary antibodies to fend off what it “sees” as being foreign. That way, if we are exposed to COVID-19, our bodies will be better prepared.

The results were surprising because the previous clinical trials for AstraZeneca only indicated 60% efficacy. These new results are materially better.

This means that we can expect to see AstraZeneca file for emergency use authorization (EUA) within the next few weeks, with Food and Drug Administration (FDA) approval to follow quickly. Once this happens, this will be the fourth approved vaccine in the U.S. for COVID-19. FDA approval would also have positive ramifications elsewhere in the world.

What I do find odd, however, is that millions of doses of the AstraZeneca vaccine have been sitting on shelves in the U.S. 30 million doses alone are sitting in one facility in West Chester, Ohio.

We can consider this… 124 million doses have already been administered in the U.S. The country is now at a pace of nearly 2.5 million doses a day.

Most people in an “at risk” category who are willing to take the vaccine have already received the shots. The risk has passed. The rest of the population is at more risk of severe illness from influenza or pneumonia than COVID-19.

It will likely be another four to eight weeks before we see an FDA approval for the AstraZeneca vaccine.

In the meantime, the U.S. should stop sitting on unused vaccines and distribute them to other countries that are willing to administer them.

Now let’s turn to today’s insights…

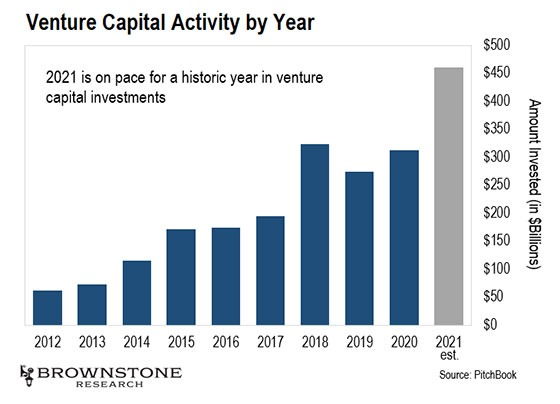

We’ll start today with a glimpse into the unbelievable activity happening in the venture capital (VC) space. The VCs are pouring record levels of investment into early stage companies.

In fact, the amount of money that’s already flowed into private companies this year is nearly equal to VC investment for all of 2013. And March isn’t even over yet.

As it stands, VC investment is on pace to hit $460 billion for the year. That would obliterate the previous record set in 2018 by almost 40%. Have a look:

Much of what we’re seeing right now is carryover from last year. 2020 would have likely been a record year for VC investment had it not been for the COVID-19 pandemic.

But private investment came to a screeching halt in the second quarter last year as investors tried to come to grips with what was happening.

What’s more, nearly $2 trillion worth of dry powder is sitting on the sidelines right now. This is institutional money from pension funds, endowments, and family offices just waiting to be deployed. Much of this money will find its way into early stage companies through VC funding rounds.

And this has caused private deals to move faster than ever before. As an angel investor myself, this is something I am seeing firsthand.

Private investors used to be able to do weeks or sometimes months of due diligence before agreeing to invest in a private company.

Today, many deals are filling up in a matter of days. That means private investors have to compress weeks or months of research into 48 hours or less. Or else they miss the boat.

I’ve been investing in private companies for more than 20 years now, and I’ve never seen things move this fast. And there are two things we need to take away from this…

First, all this investment enables early stage companies to develop their products and services faster than ever before. This gets products to market faster. And it helps private companies grow their revenue much more quickly. That’s great to see.

But there’s a downside.

As we have discussed before, all this VC investment serves to keep companies private for longer. And it drives up the valuation of these companies as well. In effect, the insiders capture all the growth in the private markets.

Then, when these private companies finally go public, they do so at highly inflated valuations. That makes finding great investment opportunities more difficult than ever before.

And this is exactly why more and more institutional investors are moving into the private markets. That’s where the deals are.

This is bad news for normal investors. Simply buying popular, publicly traded companies no longer guarantees results. Too often those companies are overvalued. All the gains were squeezed out by the insiders in the private markets.

The good news is that there is a tiny subsector of the technology market that is largely immune to this dynamic. These are companies that still go public early… just like they did back in the late ’90s.

What’s more, Wall Street doesn’t know how to value these companies. In fact, most of them are too small for Wall Street firms to invest in at all.

We talked about this dynamic at my investor summit last week. And I revealed my system for trading this small corner of the technology market.

For readers who weren’t able to join us, the replay of that event – Timed Stocks: Final Countdown – will be available for a short time. Readers who want to turn the tables on Wall Street can go right here for all the details.

Amazon is making moves in the logistics space.

The company just announced that Amazon Air’s flights have increased by 15% over last year. These are delivery flights that enable Amazon to keep up with its aggressive package delivery timeline. Amazon’s air fleet is what allows it to offer two-day and sometimes even same-day shipping.

And get this – Amazon expects flights to increase another 15% by June of this year. As a result, Amazon Air is on pace to double in size from May 2020 to June 2021.

To keep up with this growth, Amazon is rapidly expanding its fleet. It is in the process of acquiring 11 more Boeing 767 planes from Delta and West Jet. This makes sense, as demand for passenger air travel has dipped while e-commerce has exploded.

Once complete, this will give Amazon 67 active planes in its fleet. Of course, such a big fleet calls for a central hub. Check this out:

Rendering of New Amazon Air Hub in Kentucky

Source: New York Times

Amazon’s $1.5 billion air hub in Kentucky will include a 798,000-square-foot sorting center and more space to accommodate 20 aircraft. And it’s going to be located on 640 acres along the Cincinnati/Northern Kentucky International Airport boundary. Talk about a strategic move.

Amazon will be able to shuttle packages from this facility to its planes docked at the Kentucky airport for efficient delivery. And Amazon expects to launch up to 200 delivery flights from this air hub every day.

This is all part of the company’s logistics masterstroke.

Once this air hub is complete, Amazon will likely be able to offer one-day delivery to customers all over the continental U.S. We’re talking about a nationwide one-day delivery network.

And that means Amazon is coming for legacy incumbents like UPS and FedEx. This is a shot across the bow.

What’s more, there’s been some speculation that Amazon will offer third-party delivery services as well. That means it won’t just ship its own packages – it will ship packages for other companies as well.

That means Amazon is about to wrestle major market share away from UPS and FedEx.

And it works both ways…

Think about when we need to ship a package ourselves. We have to go to the packing and delivery store, wait in line, get all the packing stickers in place, and then pay for the service. It’s inconvenient and time-consuming.

Amazon can make that entire process obsolete. I envision a simple interface on Amazon.com where we can register our package, print a shipping label, and leave the box on our doorstep.

Then, when Amazon comes out to deliver our packages that day, it will also pick up our shipment and get it to where it needs to go. Then our account will be charged automatically. No hassle. No fuss.

So Amazon is set to disrupt the entire shipping and logistics industry here.

I’m on record as saying that it will be the first $2 trillion company. This is just one more reason why. We’re up over 70% right now in Amazon (AMZN) in my Near Future Report portfolio, and the future is bright.

But please, if any readers own shares of UPS or FedEx, buyer beware.

It is going to be nearly impossible to compete with Amazon’s logistics network. Amazon’s ability to build on economies of scale through its “two-way” logistics network will be unparalleled.

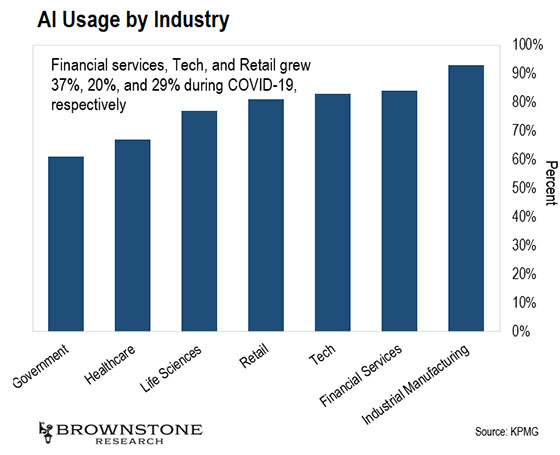

We’ll wrap up today with interesting insights from a report that consulting firm KPMG just released. I normally don’t read these consulting reports due to a lack of substance, but this one caught my eye.

Many people don’t realize this, but the adoption of artificial intelligence (AI) exploded higher in response to the COVID-19 pandemic.

KPMG surveyed 950 decision-makers from companies with $1 billion or more in annual revenue. These are larger companies from many industries including industrial manufacturing, retail, financial services, life sciences, technology, health care, and governmental services.

And the results were remarkable. The survey suggests that the majority of companies in every industry already use AI in their operations. Look at this:

These are eye-popping numbers. 93% of industrial manufacturing companies… 84% of financial services companies… even 61% of government organizations already employ AI.

The adoption of AI is not something that’s a decade away. It’s here now.

And interestingly, many of the decision-makers who participated in this survey said that AI is developing so quickly that they can’t keep up with it. They can’t fully understand the future impact it will have on their businesses.

Some even called for more regulation around AI. It’s not often we see business people wanting more government regulation.

To me, that’s a sign of how fast AI is progressing. It is also a sign that executives are concerned about how quickly the technology is progressing. There is a natural fear of the things that we don’t fully understand.

It’s at the point now where the companies who choose to not employ AI are at a competitive disadvantage. The genie is out of the bottle.

As I’ve said before, I believe some of the best investment opportunities of our lifetimes will come from the AI space.

We’ve been profiting from this trend for years now in The Near Future Report and Exponential Tech Investor. And the best part is, there is so much more to come…

We have so much to look forward to.

Regards,

Jeff Brown

Editor, The Bleeding Edge

P.S. For readers who missed it last week, don’t forget that the replay of our Timed Stocks: Final Countdown event will be available for replay at no cost this week. You can find it right here.

Like what you’re reading? Send your thoughts to feedback@brownstoneresearch.com.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.