Dear Reader,

Welcome to our weekly mailbag edition of The Bleeding Edge. All week, you submitted your questions about the biggest trends in technology.

Today, I’ll do my best to answer them.

And before we turn to today’s mailbag, I’d like to share one more reminder with readers that a replay of my special event this past Wednesday evening is available for just a short time.

If you weren’t able to join me live as I shared what I’ve been seeing on my most recent trip to Silicon Valley, then please go here to make sure you don’t miss out.

On Wednesday, I not only told you how to turn the tables on Wall Street with “Penny IPOs”… I also gave away the name of my top private “Penny IPO.”

These are small tech companies that still have their biggest days ahead. They’re a “last bastion” of wealth creation for regular investors… capable of providing returns like Amazon when it first went public.

So please go right here to watch the replay of Silicon Valley “Unlocked.” This is an event you don’t want to miss.

And with that said, let’s turn to our mailbag…

If you have a question you’d like answered next week, be sure you submit it right here.

Let’s begin with a question on putting quantum computing to use for bitcoin mining:

Hi Jeff – love your work. I had a question about your article on quantum computing. You had mentioned in a previous article that companies could rent time with a quantum computer to perform tasks. Would it be possible to rent time on one of these computers to mine bitcoin? I would think that it would win the bid every time using a quantum computer. If that’s the case, why isn’t anyone doing it? Thanks for your research; it’s awesome.

– Mark V.

Hi, Mark. I’m glad to hear you’ve been enjoying our discussion on quantum computing. And I’m happy to address your question…

As a reminder for new readers, quantum computing reached an inflection point back in September 2019. That’s when Google demonstrated that its quantum computer could outperform the most powerful classical supercomputer on earth.

Its quantum computer was able to complete a task in just 200 seconds that would have taken Summit, the most powerful supercomputer at the time, 10,000 years to do.

This clearly has many implications… Last Friday, we discussed the security risks quantum computing poses not only to the blockchain, but also for our standard 256-bit encryption technology. Players around the world are rushing to solve the threat that this tech poses.

But we have yet to discuss the potential impact of quantum computing on bitcoin mining… Could a quantum computer be a game changer for miners?

Mark, your instincts are correct. After all, quantum computers are capable of operating at speeds exponentially greater than any supercomputer on the planet today. That’s why it isn’t unreasonable to think that they would be the perfect way to mine bitcoin.

And with the ability to lease time on a quantum computer, these kinds of resources are actually widely available today.

But there is one major problem. There is no universal fault-tolerant quantum computer on the planet today. Quantum computers are still “noisy” and very error-prone. And they can only run for short bursts and produce accurate results.

In order to solve very specific and complex mathematical equations, which is what is required to contribute to the bitcoin blockchain network, errors or faults simply won’t cut it.

Quantum computers today are primarily being used in limited capacity to solve complex optimization problems. It will be some time before we have a quantum computer that would be able to contribute to something like the bitcoin blockchain network.

So for now, there are highly specialized semiconductors that are manufactured to support bitcoin mining.

Bitcoin miners upgrade their systems quickly whenever new versions of these application-specific semiconductors (ASICs) are released in order to take advantage of the most up-to-date computer processing technology and improve their chances of mining more bitcoin.

Thanks for the interesting question.

Next, a reader chimes in with more thoughts on Facebook’s smart watch and augmented reality (AR):

Hi Jeff,

You are correct that the Facebook watch will eventually be wirelessly connected to the AR glasses. That is why Facebook acquired CTRL-Labs. (AR is the area that I studied closely during my master’s degree. I’ve continued watching the industry closely over the past few years as I work on extended reality [XR] software.)

While voice interaction is (in my opinion) most critical to AR, the users’ experience is not complete without hand gestures. Microsoft’s HoloLens (and the Leap Motion controller) relies on line-of-sight for hand gestures, which is not ideal. The Magic Leap headset includes a hand-held remote – also not ideal.

The AR “watch” is the best form factor. It stays on your wrist, and it’s always ready. Future versions of the watch will learn to detect your hand gestures (courtesy of CTRL-Labs), and it’s external to your AR glasses, so you can hold up the watch and video chat with friends.

Don’t be distracted by what the Facebook watch is now. The ideal AR platform will be voice-controlled smart glasses with one (or two) gesture-sensing wrist bands. Facebook needs to stake a claim on the user’s wrist now. It’s an incremental step towards the ideal AR platform in terms of business capability, branding, and user acceptance. Facebook might not profit from the watch in isolation, but it will position them well for the future of AR.

– Joe B.

Hi, Joe – thanks for writing in. I’m glad you brought up the CTRL-Labs acquisition as it raises an interesting question about the forthcoming Facebook watch.

The reality is that if the user is wearing the CTRL-Labs device, there isn’t anything that would be in the watch that couldn’t be incorporated into the wrist-worn CTRL apparatus. Facebook could get it all done with the eyewear plus the CTRL tech.

Technically, it wouldn’t really need to produce a watch, but it wants to do so for the small screen. And the company clearly prefers to use the watch for the cameras instead of embedding them in the CTRL-Labs device.

We’ve discussed Facebook’s acquisition of CTRL-Labs before. And ultimately, I believe Facebook’s vision will be to combine AR with an artificial intelligence (AI) assistant, electromyography (EMG) technology, facial recognition, and speech segregation tech.

The AI assistant will link with ear pods, allowing users of Facebook’s AR headset to have conversations with the AI, who will also see exactly what we are seeing. The AI will be able to provide us with information throughout the day as we go about our lives.

As for the EMG technology, CTRL-Labs has already done a demonstration of a brain-computer interface. Its wristband reads electrical pulses coming from the user’s brain whenever the user moves his or her hands and fingers.

This enables users to control a computer just by making motions. In fact, users don’t actually need to move their hands or fingers to use the device. They just need to think about moving.

In the context of AR, this would allow us to “touch” items in our field of vision to prompt certain actions.

And this certainly could be the game plan for Facebook’s smart watch. As you suggested, this could be a way for it to get its foot in the door.

But I also think other ideas under development could play an interesting role as we get closer to mass-market AR…

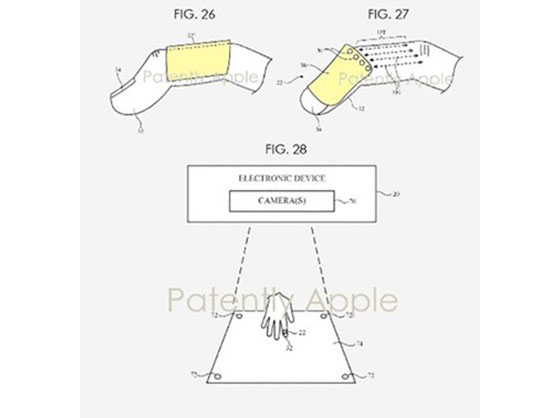

I’ve written about Apple’s patent for “finger sleeves” that use haptics technology to sense the user’s movements.

Finger-Mounted Control Device

Source: MacRumors

Haptics technology simulates touch through strategic vibrations. At the simplest level, our phones vibrating when we receive a call is a form of haptics technology.

But this finger sleeve will employ more advanced haptics technology. Users will feel specific vibration patterns based on their actions. And it could allow us to interact with a computing system.

For example, making certain motions with our fingers will cause certain actions to happen on an augmented or virtual reality (VR) headset. And we’ll feel different vibration patterns on our fingers based on which actions are taken.

Another option is gloves like the ones being developed by researchers at Cornell University.

These gloves work in a slightly different way, by combining haptics with fiber optics to transmit information to an AR or VR experience.

Fiber-Optic Gloves

Source: Futurism

These gloves could pick up motions like waving, throwing objects, writing a letter, and more. The result would be an incredibly immersive experience.

What’s fun about watching the industry experiment is that we’re seeing the evolution of what will ultimately become the next user interface for computing systems.

In time, our smartphones will take a back seat to our augmented reality eyewear powered by artificial intelligence and coupled with some form of wearable technology to enhance our ability to interact.

Let’s conclude with a question about a shift in the market:

Hi Jeff,

So I keep hearing things about a shift in the market as well as things about our banking system changing, which could be bad for “most Americans with money in the bank.” Is there anything on your radar that you feel we should be worried about regarding those comments?

Is our portfolio one that should withstand all of those? Is there anything different we should be doing? I am up a total of 27% in one of my accounts since last June, so I feel confident but wanted to hear if you had any wariness about the above comments made by other investors?

– Stephanie S.

Hi, Stephanie – thanks for writing in. We are on the cusp of changes to our financial system. And these changes could have a wide range of impacts, so you are correct that we do need to be prepared.

One major change to be aware of is the development of a central bank digital currency (CBDC). We’ve spoken often about how other countries – particularly, China – have been working on their own CBDCs.

And our own Federal Reserve has been working hard to make sure it isn’t left behind.

As a result, there is a lot more discussion in the mainstream financial media about this topic. Just this week, in fact, The Wall Street Journal reported on “Why the Fed Is Considering a Digital Dollar.”

The answer to that question is easy: The prospect of a U.S. CBDC, or “Fed Coin,” is simply too appealing to a central government. A CBDC would allow the government to track and tax every transaction we ever make. It could also “airdrop” stimulus checks immediately in our accounts.

And, of course, the government could “print” more digital dollars, unfettered, whenever it wanted. Its ability to do so would be far greater that what exists today. What government wouldn’t want that sort of control?

Following the adoption of a CBDC, physical cash would likely disappear in the years that follow. Once a “Fed Coin” is issued, the government would begin the process of removing all paper bills and coinage from the system. The government wouldn’t want bills and coins to be used for any transaction.

I foresee a multiyear window where people could “return” their bills in exchange for digital dollars. But eventually paper and coins would no longer be counted as legal tender.

And the reason you may have been hearing doomsayers sounding the alarm on this transition is that a CBDC also makes things like negative interest rates possible. The Fed could deduct interest from our digital wallets each month to encourage spending in hopes that it would stimulate the economy.

This is the most likely scenario for the government “taking” our money using a CBDC. And it is a very real concern.

But I think the potential of unlimited government printing of fiat currencies around the world is the bigger threat.

If our government is not transparent with its own monetary policy, and how many new units of currency it is creating, we won’t know that our currency is being actively devalued through inflation. Our savings will effectively erode away.

So what can we do? I’ve offered the following suggestions in our recent discussions of this issue…

We can finance or refinance our home with a fixed 30-year loan at the lowest possible rate. We’ll be paying back the loan over time with inflated dollars (devalued dollars), and we can invest the money that we didn’t put into the house to make higher returns. Real assets, like property, are always a good store of value in inflationary times.

We can finance income-producing properties using fixed interest rate loans. These could be rental properties or timberland. It’s the same reason as above, and the benefit is that land is a real asset.

We could invest in digital assets like cryptocurrencies, digital tokens, and digital securities. There are important distinctions here, however, and this asset class has higher risk.

Well-designed digital assets like bitcoin are an interesting alternative. But governments could potentially see them as a threat and make it very difficult to transact with them. So this kind of investment would require more diligence from investors to avoid losing their hard-earned capital.

There will also be digital assets backed by real assets, cash flows, dividends, or equity that could be smart places to allocate capital.

Precious metals like gold and silver might be interesting, but I’m not convinced. More than $10 trillion was printed during 2008–2016, but gold just didn’t rise that much. And now, even with trillions of dollars of new stimulus spending, gold is still only around $1,773 an ounce.

Collectibles present another interesting asset class. Artwork, rare wine, vintage automobiles, rare watches, numismatics, and other collectibles have historically been excellent stores of value.

The problem, however, is that these asset classes have been mostly off-limits to normal investors. They have been only accessible to high-net-worth individuals.

But this is changing. A perfect example is a new company called Masterworks. It acquires artwork, securitizes that artwork, and allows fractionalized ownership of the art. We’re going to see a lot more of these types of investment alternatives in the near future.

And the collectibles market is now racing into the digital age with non-fungible tokens (NFTs), which will eventually become a mature market and an asset class all its own.

These are just a few options for readers to consider.

But the very best way to stay ahead of these irresponsible monetary policies that effectively steal money from those who work hard, save, and invest is to invest in the areas of the market that are growing at a pace that is far faster than the rate of inflation.

If we maintain large exposure to the highest-growth segments of the economy, it ensures that our wealth will grow faster than a government’s ability to devalue our currency. And by growing our wealth, it will empower us to diversify our portfolios in the areas that I mentioned above.

This is precisely why I founded Brownstone Research. We are going to stay laser-focused on the highest-growth segments of the markets, irrespective of where they are.

And right now, the growth in high technology, biotechnology, and blockchain technology is unlike anything else in the market.

If that ever changes, so will our focus. But for now this is where we’ll be finding the best investment opportunities for our subscribers.

And if you want to learn about the specific investments I recommend in the face of the coming reset of our financial systems, I recently put together a presentation on this very topic. You can go right here for the details.

That’s all we have time for this week. If you have a question for a future mailbag, you can send it to me right here.

Have a good weekend.

Regards,

Jeff Brown

Editor, The Bleeding Edge

Like what you’re reading? Send your thoughts to feedback@brownstoneresearch.com.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.