Dear Reader,

“We now believe it’s having an impact on our new customer growth.”

Those were the words of Chegg CEO Dan Rosensweig late Monday afternoon on Chegg’s first quarter 2023 earnings call.

Chegg is a major player in the online learning space. It is most well-known for selling monthly subscriptions for electronic textbooks to students. It’s a great business as students really don’t want to buy a $170 textbook that they’ll only use for a few months. Chegg enables them to rent the e-book version of every textbook. That’s what makes up about 90% of the company’s revenue.

Chegg’s strategy for business growth is built around selling additional subscription services to products that help students learn subject matter, memorize information, and prepare for exams.

Rosensweig’s comment above was referring to OpenAI’s ChatGPT and its impact on Chegg’s core business growth. What he said next was even worse.

Because it’s too early to tell how this will play out, we believe that it’s prudent to be more cautious with our forward outlook. Therefore, we intend to provide only the next quarter’s guidance at this time.

Talk about a red flag! Here’s what happened yesterday to Chegg’s share price:

The stock collapsed more than 50% yesterday. And even with the small rebound towards the end of the day, it was still down 44%. Wow – that has got to hurt…

And yet yesterday, Rosensweig seemed intent to dig his hole even deeper. His defense was simply that the markets’ response to his comments were “extraordinarily overblown” and that “ChatGPT is often wrong, and it’s not going to be right anytime soon.”

That was the nail in the coffin…

Yes, ChatGPT and other large language models do occasionally “hallucinate” and get things wrong… But most of the time, they do a remarkable job of not only getting things right, but synthesizing and condensing exactly the information that we need in seconds.

And the striking realization for those of us that have been following the advancements in generative artificial intelligence (AI), which includes all of my Bleeding Edge readers, is the sheer speed at which the technology has been improving.

OpenAI has gone from GPT-3, to ChatGPT & GPT-3.5, to GPT-4 in the span of just five months. And each iteration of the technology has been materially better. Remarkably so.

It doesn’t even require an exponential mindset to realize that by the end of 2023, ChatGPT and other similar large language models will be radically better than they are today. With each improvement, there will be fewer errors. And it will become an even more powerful platform for study and learning.

That’s where Rosensweig really went wrong. When a CEO makes a broad, sweeping statement claiming that a competitive technology won’t be “right anytime soon,” which is clearly not substantiated and the opposite of what is known to be true… the company is in trouble.

It was a mistake not to provide guidance. After all, its business is very predictable, and students will still need to rent the textbooks that are assigned to classes. The guidance may not have shown strong growth in the business, but it would have at least provided reassurance that Chegg executives understand their business and market.

But the false comments about ChatGPT destroyed confidence by Wall Street analysts and institutional investors, which is what really drove the 50%+ selloff in a day.

Rosensweig’s comments regarding ChatGPT remind me of the traditional automotive industry when they talk about autonomous driving technology. Many have said it won’t be available for at least another decade. And yet, we all know that Waymo and Cruise already have commercial deployments of the technology working in several cities around the U.S. And Tesla’s Full Self Driving (FSD) software is already demonstrating full Level 5 autonomous driving capabilities with no driver interventions. FSD isn’t perfect yet, but it is very close. I’ve used the technology myself. It’s amazing.

What happened with Chegg is a great example of what not to say and do. We all see what’s happening right now and how fast it’s moving. It’s not going away. Companies need to embrace this technology and figure out how to leverage it in their own businesses. And executives need to be able to communicate their product strategy with regards to artificial intelligence to the market.

Just imagine how different the Chegg earnings call would have been if the company had announced that it had integrated ChatGPT with its subscription packages, making it available to all of its customers. In addition, it could have announced a product roadmap where it would train the AI further on the subjects and textbooks offered by Chegg, making the new services available in fall when the new school year starts.

Enterprise software company C3.ai’s share price ran up almost 170% in just five weeks after it announced its own ChatGPT integration back in December of last year.

The ability to speak knowledgeably about AI with respect to any company’s business and sector has become table stakes this year. And the smartest will have a clear plan for how the technology will be leveraged in their own products, services, and operations.

For those companies that don’t… well, we just found out what happens.

We’ve been enjoying the meteoric rise of generative AI all year.

Of course, it started last December when OpenAI launched ChatGPT, to the world’s surprise. Ever since then, we’ve seen one development after another… but one major AI company has been curiously quiet. That’s Palantir Technology.

If we remember, Palantir was one of the hottest initial public offerings (IPOs) of 2020. And the company itself was known for developing some of the most advanced AI technology on the planet.

Palantir’s business is to take in huge amounts of data, analyze it, and extract key insights. It uses artificial intelligence and machine learning to find patterns and key data points that human analysts would likely overlook.

So I’ve been wondering what Palantir has been up to amidst this generative AI boom. Well, now we know…

Palantir just announced that it’s spent the last several months integrating generative AI into its existing infrastructure. The result is a new offering they are calling Palantir Artificial Intelligence Platform (AIP).

This is exactly the kind of smart product strategy that we referred to earlier, and it stands in stark contrast to Chegg. Palantir AIP can generate prompt-based intelligence for entire organizations.

The idea is that any organization can take Palantir AIP as the AI Core. Then the organization can customize the AI for its specific applications.

This is done by training the AI on all existing data held within the organization. Thus, the AI quickly becomes an expert in that specific field.

From there, the organization can make the AI available to all of its employees. That way everybody can consult with the AI about their own specific tasks. Not only does it improve productivity, but it also provides lightning-fast insights on a business or organization in real-time.

Let’s contextualize this with an example…

Let’s suppose we’re a manufacturing company. We produce products in our plant and then ship them to customers all over the world.

And now let’s say we’ve got a number of shipments due out for delivery next week, but there’s also a major hurricane in the forecast. We need to understand how it might impact our shipments so that we can make alternative plans if necessary.

To do this, we can train our customized Palantir AIP on all historical weather data available. This allows the AI to “understand” how particular weather patterns are likely to play out.

Then we can ask the AI to determine how next week’s hurricane is likely to impact our pending shipments… and it will spit out an answer in a matter of seconds. We then take that information and plan accordingly.

Source: Palantir Technology

So this is an immensely powerful tool that could be customized for any industry or organization. Palantir AIP is capable of processing all kinds of data to make intelligent suggestions that inform decision-making.

And get this – the AI can also monitor the use of generative AI throughout the network. That way it can ensure that the organization is using this technology for designated applications… and not misusing it.

In the same way, the AI can also monitor for fraud and illicit activity in real time. It’s like having an auditor comb through the books every day in real time.

That makes this a fantastic product offering.

And it begs the question: What does this mean for Palantir as an investment? Employment of powerful AI by a company that already has a large install base of government and enterprise customers is very attractive to me. Palantir is already generating more than $2 billion in revenue this year with fantastic growth margins.

In a normal, healthy market I’d be very bullish on an announcement like this, as this new offering would drive an increase in platform subscription revenues.

But we’re still in a market that doesn’t appreciate or value growth stocks. We’re still experiencing what is mostly a flight to safety… But Palantir will definitely be a company to watch once institutional capital returns to the growth equity markets.

I’m both fascinated and excited about the bridge between artificial intelligence and the real world. I’ve been researching technologies that enable AI not just to run as software, but to actually do things in the physical world. And some fantastic research out of North Carolina State University just caught my eye.

The focus of the research was on what’s called “wet work” in a lab setting. This has historically been a tedious manual process that is both expensive and time consuming.

However, the research team used a form of AI called reinforcement learning to automate and optimize the entire process. This is incredible. And it has some major implications, as we’ll see in just a minute.

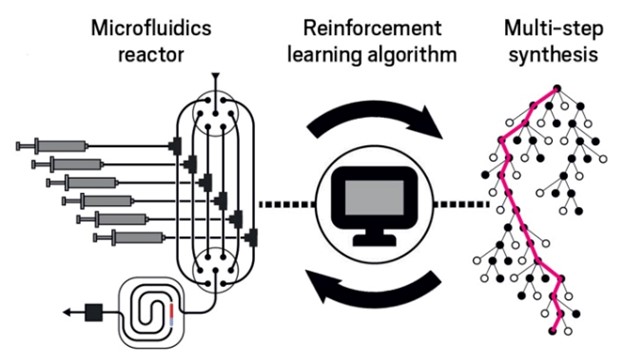

This graphic gives us a simple idea of how this was accomplished:

Source: Will Ludwig/C&EN

The image on the left depicts a microfluidics reactor. We can think of this as a large circuit board with lots of semiconductors to which fluids can be “injected” and chemical reactions can be measured for every possible synthesis.

Wet work involves analyzing a huge number of chemical reactions using a microfluidic reactor with the intent of producing a desired outcome, which we can think of as an optimized chemical result.

In this research, the goal was to see if a better way to synthesize cadmium nanoparticles could be developed using reinforcement learning, a form of artificial intelligence. Cadmium is a semiconductive material that has all sorts of applications.

And given the structure of the experiment, there were about 1 trillion possible paths for synthesis. The above picture is mean to be simplistic, but just imagine the image on the right having 1 trillion possible paths towards a single optimized outcome. It would be impossible for human labor to consider all possible paths.

But that’s not the case for AI. The researchers ran the experiment for 30 days straight, 24 hours a day, and sure enough, the AI took a complicated process and improved it well beyond any known best processes in use today.

So we can see how this process could revolutionize the materials science industry very quickly. The same is true when it comes to biotechnology.

The biotech industry involves a lot of wet work just like this. So this tech could be used to accelerate and optimize both the drug discovery and pre-clinical phase of drug development. Research labs simply need to design and initiate the process, let it run autonomously for as long as necessary (probably measured in weeks), then get the results.

This would save an incredible amount of time and human labor. And that means it would lead to cheaper, better therapies capable of treating diseases that have been untreatable up to this point.

This is the kind of technology that I expect to be commercialized quickly. There is simply too much immediate commercial benefit for it not to be, and we’ll be looking for both existing and new companies using this technology in the months to come.

There’s been an interesting development with regards to the CHIPS Act.

If we remember, the CHIPS Act is legislation that passed last year. It sets aside $52.7 billion to promote the domestic semiconductor manufacturing industry.

Of that money, $39 billion is earmarked to incentivize manufacturing, and $13.2 billion will support research and development (R&D) and workforce development.

Well, something curious just happened. Several major chipmakers just raised an issue that we didn’t know was inherent in the CHIPS Act.

It seems the Biden administration is requiring that chipmakers share sensitive information about their manufacturing processes and materials before they can be approved to receive any funding. Taiwan Semiconductor Manufacturing Company (TSMC) and Samsung are two of the largest semiconductor companies in the world to raise this issue.

The government claims they need this information to make sure the semiconductor companies are using the funds correctly. But it should go without saying that this is a major problem…

What is being asked is for these companies to provide the U.S. government trade secrets. Each company sees its own semiconductor manufacturing process as a competitive advantage. This is a particularly sensitive issue for the industry as specialty materials and processes are critical to competing in a brutally competitive industry that requires immense capital expenditures every year just to keep up.

So I wasn’t surprised to see these companies pushing back on the onerous requirements. And I suspect that behind closed doors, U.S.-based semiconductor companies have raised concerns as well.

And it doesn’t stop there…

There’s another requirement that says any company who accepts over $150 million in funding will be required to share a portion of its sales with the U.S. government from products manufactured at these new locations built with grants from the CHIPS Act.

Again, this could be a major problem.

The key thing for us to recognize is that building a manufacturing plant in the U.S. costs about 50% more than it would in a country like Taiwan. And large semiconductor plants can cost billions if not tens of billions of dollars to build.

It’s not the operations of the plants that’s the problem. It’s the higher costs of construction labor, and all the construction regulations and “friction” in the U.S. construction industry that impact costs.

And that’s precisely what the CHIPS Act was originally designed to do, offset those construction costs so that the operating margins would be competitive with manufacturing plants offshore. Used smartly, it would help to level the playing field and bring advanced manufacturing back onshore.

If the current administration doesn’t back down from its demands, it’s very likely that some major players will cancel their plans to build plants in the U.S.

This is short-sighted. The benefit of the CHIPS Act was that it would help the high-tech manufacturing supply chains become “anti-fragile.” As we’ve learned in the past few years, that can be a matter of national security.

I’m hoping for a better outcome on this issue. The CHIPS Act was originally drafted in June 2020, but it was blocked by Congress at that time. It was finally signed into law in August last year, and yet zero grants have been issued to the semiconductor industry to date.

Regards,

Jeff Brown

Editor, The Bleeding Edge

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.