Dear Reader,

I’m sure most of us are very happy to put 2022 behind us, but I always enjoy taking a look back to put things into context as we look ahead at the new year.

The holidays and these first few days of a new year provide us with some hope and excitement of good things to come. They also provide us with just enough distance to look behind us with some objectivity.

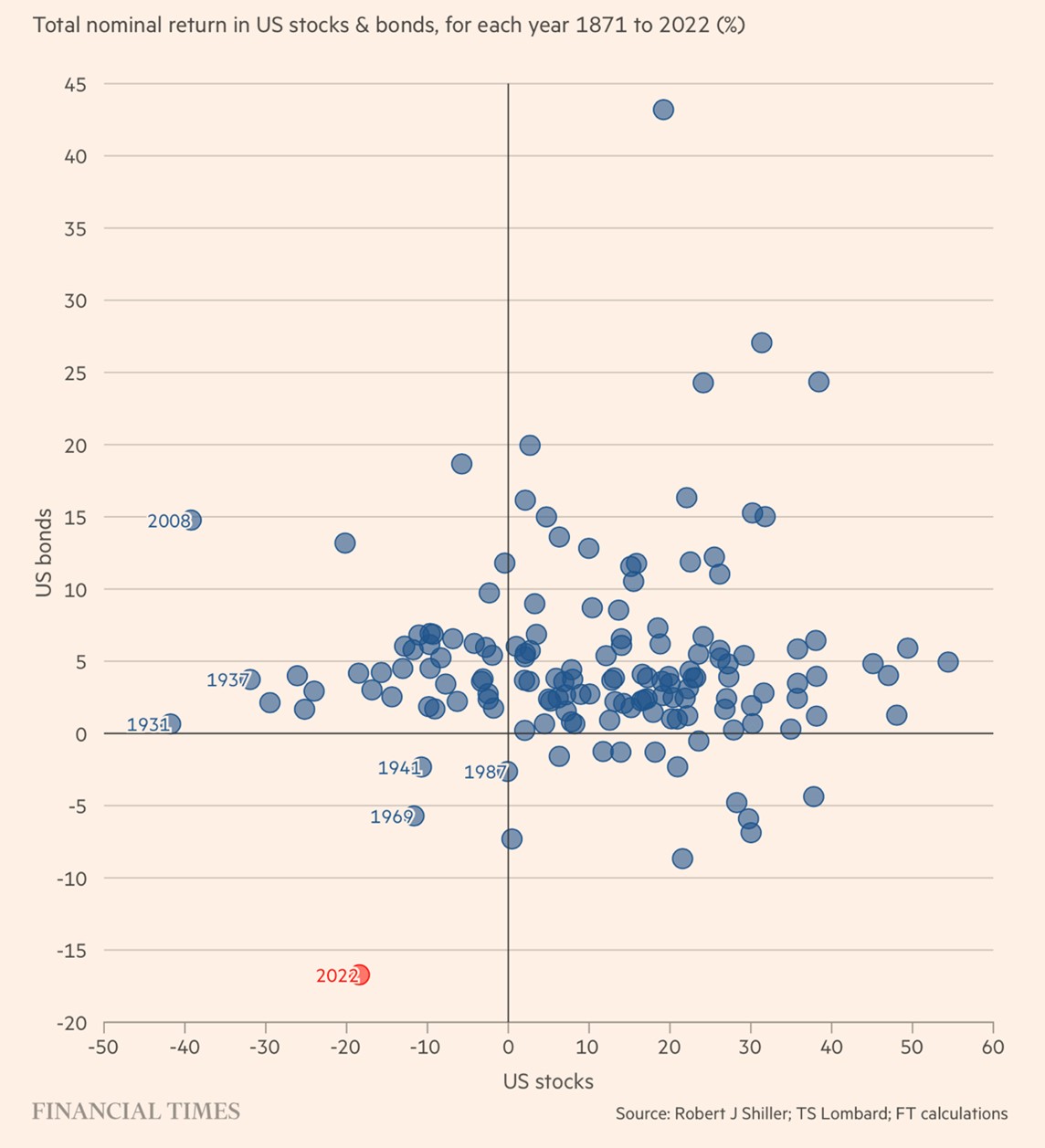

And I haven’t seen any better visual than the one shown below, courtesy of The Financial Times, to demonstrate what we’ve all just lived through the last year.

Historical Stock and Bond Returns

Source: The Financial Times

The above chart has data going all the way back to 1871. The vertical axis is the nominal return for bonds, and the horizontal axis is the nominal return for U.S. stocks.

As we can see above, most years fall into the upper right quadrant, where there are positive returns in both stocks and bonds.

The second most common quadrant is the upper left, where bonds deliver a positive return and stocks are negative.

This has been the reason why the tried-and-true 60% equity, 40% bond portfolios worked well over extended periods of time. When equities lagged, bonds tended to deliver positive returns.

As we learned last year, that’s no longer the case.

There have only been three years since 1871 when both bonds and stocks were firmly in the lower left quadrant (negative): 1941, 1969 and, of course, 2022. But 2022 makes the other two years look timid.

In short, 2022 was:

The worst combined stock/bond performance since 1871.

The worst year since 1788 for U.S. long-term government bonds.

The worst performance since 1932 of the classic 60/40 portfolio.

Additionally, we saw:

A summer low for the S&P 500, when it shed $11 trillion in market cap.

The global stock and bond markets lose more than $30 trillion in value.

For added perspective, the U.S. gross domestic product (GDP) will come in at around $23 trillion for 2022. That means the S&P 500 lost the equivalent of about half the U.S. GDP. And the global markets lost significantly more than the U.S. GDP. Wow…

We’ve reached an inflection point. The egregious deficit spending and extraordinary levels of national debt ($31.5 trillion in the U.S.) have now caught up with us. The chickens have come home to roost.

In other words, the game’s up… and now we’re going to have to deal with it.

The reality is that the old adages like the 60/40 portfolio won’t work anymore. The government’s role in markets through monetary and economic policy is heavier than it’s ever been before.

So successful investing will require us to be a lot more agile than we’ve been in the past. We’ll have to rotate into and out of sectors that are in favor more often – and into and out of asset classes that will benefit from whatever “influence” is happening at the time.

It’s not something to fear. In fact, for those of us who can stay ahead of these developments, it will be a great investing environment.

We survived 2022 – albeit battered and bruised – but I’ve always found that while these challenging windows are short, they can provide great insights and learning that become invaluable in the future.

It’s our “training” for great things to come.

At The Bleeding Edge, we’ve been way ahead of the curve with regard to generative artificial intelligence (AI).

In fact, we highlighted OpenAI’s GPT-3 way back in August of 2020, and GPT-2 a year before anyone had heard of it. At the time, we noted that it was like looking into the future.

As a reminder, GPT-3 was the first generative AI that could write stories, tech manuals, and even software code upon command. Users simply tell the AI what to produce, and it will do so.

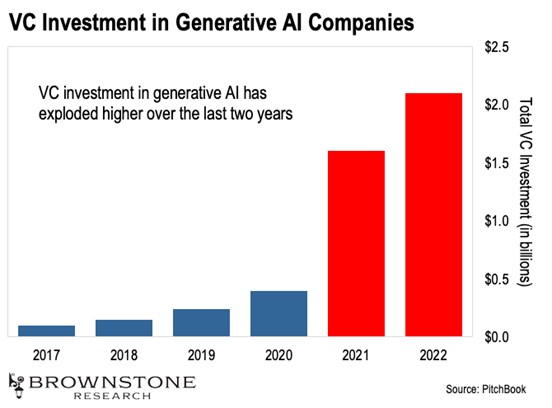

Well, venture capital (VC) investments in generative AI naturally exploded higher after GPT-3 came out. It didn’t take the VCs long to see just how promising this technology is.

As we can see in the chart above, VC investments in generative AI companies were less than $500 million in 2020. It shot up to over $1.5 billion in 2021. And then to over $2 billion last year.

Growth in this space has simply been remarkable. But that’s unsurprising given all the advancements we’ve seen from companies like OpenAI.

As we noted last month, OpenAI’s new ChatGPT is effectively GPT-3.5. And it’s a precursor to GPT-4, which we’ll see later this year.

At the moment, the release of GPT-4 is now the most highly anticipated event in AI for this year. If the amount of progress with generative AIs over the last two years is any indication, GPT-4 will be unbelievable.

And of course, we’ve talked about the other great generative AI tools out there. Stable Diffusion… Google… Meta… Midjourney… OpenAI’s DALL-E – we’ve seen so many breakthroughs in this space in such a short period of time.

This is by far the hottest area of AI right now, for two reasons.

First, these tools are all extremely easy to use. We just tell the AI what kind of content or code to produce… and it does all the work for us.

I would argue that using these tools to produce meaningful work for the average user is no more difficult than typing a tweet in Twitter. Our inputs can be short and simple.

The result is that people with no level of experience or expertise with AI or computer science can effectively use this technology. That’s how advanced the AI has become.

The other reason generative AI is taking off centers around productivity. In short, these tools can augment human work in an incredibly powerful way.

For example, one programmer recently shared his experience with generative AI. He said it didn’t take long before the AI was producing about 80% of his computer code. He only has to write the other 20%.

Let’s think about this in the context of a five-day work week. Eighty percent of the work equates to four days’ worth of work. That means this programmer only needs to work the equivalent of one day to get a full weeks’ worth of work done.

This also means that if the programmer chooses to work more than one day a week, he can essentially get several weeks’ worth of work done in a normal five-day work week. And naturally, human nature – when empowered with tools – has always been to do more.

That’s the power of generative AI.

So I have no doubt that we’ll continue to see investments pour into this space. I’m predicting the VCs will pour more than $5 billion into generative AI companies this year.

And notice how these generative AI companies are following the social media playbook?

They’re releasing these tools for free to build up their user base. Then, once people are hooked, that’s when these companies will figure out how to monetize their products. That means these tools are being designed for the mass market, and everyone will have access to them.

The bottom line is that generative AI is going to become a part of many consumers’ daily lives. And we’re going to start seeing companies form to apply these tools in very specific ways.

This will be one of the biggest stories of 2023. And it will ultimately lead to some fantastic investment opportunities down the road.

Next, we have to talk about a heartwarming story.

Just a few weeks ago, a hospital in London used CRISPR base-editing technology to treat a 13-year-old girl with advanced leukemia. This was something of a last-ditch effort, as no other therapies had worked to slow the advance of her cancer.

As a reminder, CRISPR base-editing is a powerful technology that can swap out a particular DNA base pair for a different one. This tool can “fix” genetic mutations without cutting any DNA strands.

So, the clinicians in London used CRISPR base-editing to modify the girl’s T-cells. They were genetically enhanced to go out and destroy the cancerous cells in her body.

And sure enough, the girl was in remission just 28 days after receiving the CRISPR treatment. It appears that base-editing very well may have cured her leukemia.

This is absolutely remarkable. Leukemia has always been an incredibly difficult cancer to treat… yet CRISPR base-editing knocked it out almost immediately.

That shows just how powerful this technology is.

That said, it’s important to mention that this therapy was a one-off, personalized therapy conducted by a team at a medical institution. It wasn’t a clinical trial. Fortunately, the U.K. had approved these kinds of personalized genetic-editing therapies under the national health plan.

This application of CRISPR base-editing now needs to advance through the clinical trial process to treat a number of leukemia patients using a similar technique. The team in London showed that it can be done, and now it’s up to the biotech industry.

This is very bullish for those companies that are advancing base-editing therapies into clinical trials. Beam Therapeutics and Verve Therapeutics are two of the most prominent biotech companies that come to mind.

So this is the year that we’ll finally see the power of CRISPR base-editing on display in the clinic. And I expect base editing therapies to have a very fast track to regulatory approval.

For certain kinds of diseases, base-editing will be a better therapeutic approach than CRISPR-Cas9, prime editing, or other approaches built upon CRISPR. This is another groundbreaking trend for this year that I’m excited about.

Microsoft just announced that it’s buying 4% of the London Stock Exchange (LSE). The total investment? Two billion dollars.

This raises the obvious question: Why would a tech company buy such a large portion of a stock exchange? That doesn’t make much sense.

Well, it seems Microsoft is back to its old tactics of buying cloud business. That’s what this is about.

Regular readers may remember when Microsoft invested $1 billion into OpenAI. That was back in 2019.

It turns out that deal came with strings attached. It required OpenAI to use Microsoft Azure as its cloud services provider. And that, of course, meant that OpenAI had to turn around and give some of the money right back to Microsoft.

These kinds of deals aren’t very interesting. They’re just buying the business. Microsoft gives LSE $2 billion, and then over time it gets back $2.8 billion in revenue. Leaving out the value in the equity, the $2.8 billion won’t generate $2 billion in free cash flow for Microsoft.

The reason that a deal like this is done is to make it look like Microsoft’s cloud business is growing organically. But it’s just a gimmick. Microsoft is simply taking money from one part of its business and using it to boost the cloud-services numbers.

Of course, this raises an important issue. How can smaller cloud service providers compete if the big players like Amazon, Google, and Microsoft can simply write multibillion-dollar checks to buy cloud business?

This is certainly distorting the market in favor of the big players. To compete, smaller cloud service providers need to offer services that are differentiated from what the dominant players are providing.

They need to be targeted toward advanced cloud-computing architectures and be more performant compared to what Amazon and Google are doing. This will eventually make them an acquisition target.

Regards,

Jeff Brown

Editor, The Bleeding Edge

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.