I recently told you that I think we’re about to witness fierce growth and wealth creation like we haven’t seen in 100 years.

The 1920s saw us emerge from the Spanish flu pandemic and economic hardship. The pent-up demand and economic repression caused by the pandemic paved the way for the glorious industrial expansion that propelled the twenties.

And now it’s about to happen again.

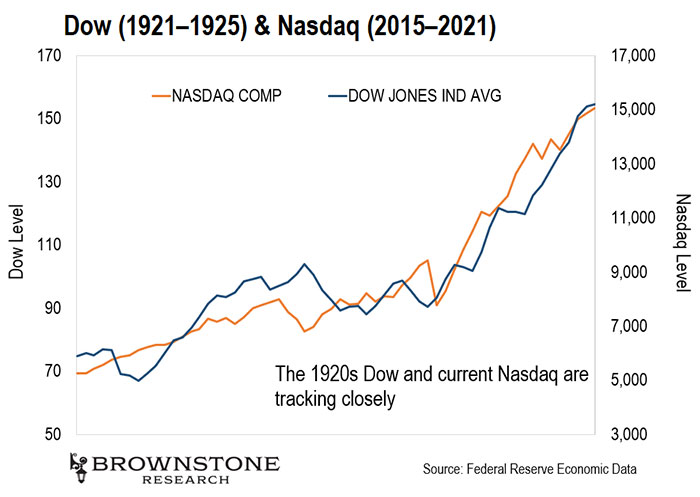

As I shared, the Dow Jones rose 46% from 1921 until 1925. This was because the index was filled with the engines of growth. The Dow Jones was the Nasdaq of today.

When we compare the Dow Jones from January 1921 to December 1925 with the Nasdaq from October 2015 until now, they track eerily similarly:

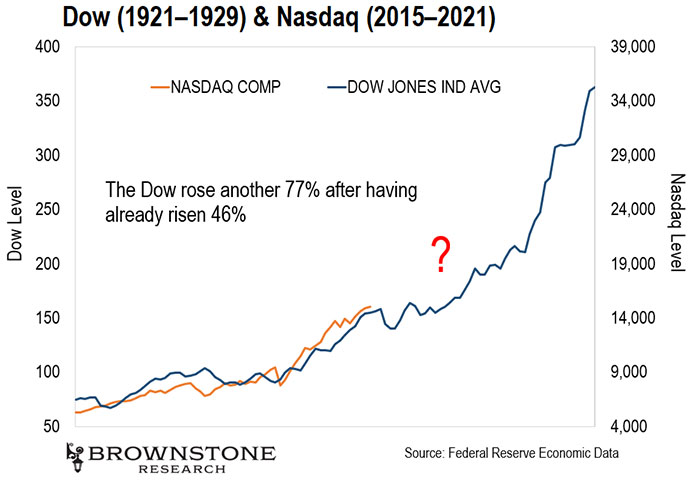

But if you think you’ve missed the boat, I’m here to tell you we’ve only just begun.

After the Dow had its 46% run-up from 1921–1925, it went on to rally 77% until its peak in 1929:

As I said last Saturday, you could buy Invesco QQQ Trust Series 1 (QQQ), an ETF that tracks the Nasdaq, and be in a great position to ride the coming tsunami of growth.

But there’s a more laser-focused way to win. But before I explain, I need to introduce you to an essential concept.

Hi, I’m Jason Bodner, and I’m the editor of Outlier Investor here at Brownstone Research. I work alongside Jeff Brown to find the kind of life-changing gains that are normally hard for normal investors to find in the market.

I do that by locating high-quality companies that Big Money is starting to pile into.

My nearly 20 years working on the Street has helped give me insight into how markets move… and how we can profit. That’s why I’m so excited by the next Roaring ’20s that we’re moving into. I plan to show readers how to make the most of it.

And as I mentioned above, there’s one key concept that we should keep in mind as we prepare for the coming boom…

I call it: stealth tech.

We all know there are great tech companies out there. The steady giants automatically come to mind… like Facebook, Apple, Netflix, Google, Microsoft, and Amazon.

Investing in those companies is a fine way to go. But investing in stealth tech is different. It may not be obvious, but it’s easier than you think.

Stealth tech companies wear a disguise. On the outside, these companies look like boring, tired has-beens that have nothing to do with technology.

But if you peel back a layer or two, you suddenly realize you’re dealing with a cutting-edge tech company.

Here’s an unexpected example: pizza.

The next time you order a Domino’s pizza, I hope you enjoy it. But don’t fool yourself into thinking you’re dealing with a normal pizza company. Domino’s is a tech company that sells pizzas.

Former CEO Patrick Doyle said this for years. He used tech to help Domino’s smoke the competition. The company has exhibited phenomenal sales and earnings growth. Sales in 2017 were $2.8 billion, and it has grown each year… to a projected $4.12 billion this year.

But the company doesn’t credit selling pizzas as the driver of that growth. It credits its investment in technological innovation, which allows it to separate itself from the pack.

Phone orders are taken and managed through an artificial intelligence (AI) assistant called DOM. The chatbot handles incoming calls with customers who want to make or check on their orders.

The company has also invested heavily in driverless delivery vehicles alongside a company that regular Bleeding Edge readers will be familiar with – Nuro.

Domino’s Self-Driving Delivery Vehicle

Source: Domino’s

And its reliance on cutting-edge software is growing.

Earlier this year, Domino’s partnered with AI company Datatron to help it develop its automation, improve in-store operations, streamline delivery routes, and even identify possible new store locations.

It may not be what you think of when hot cheese slaps your chin. But that’s stealth tech for you!

And when it sinks in that pizza can be a tech business, you begin to realize that many businesses out there are stealth tech companies…

We’ll explore many of these interesting stealth tech plays inside Outlier Investor.

Because not just pizza can be stealth tech… Trucking support companies such as FleetCor (FLT) offer cloud-based tech with its automated payments platform that uses machine learning to remove manual data entry.

And health care companies can be stealth tech too. Intuitive Surgical (ISRG), for example, is building sophisticated robots that can perform minimally invasive surgery.

These are just a few examples. When we look for “stealth tech,” the world starts to appear completely different.

So what do pizzas, trucking, and robots have to do with the next Roaring ’20s?

Well, all these companies have one crucial thing in common – one thing that drives these companies far ahead of their industry peers.

It’s software.

Almost every company you can think of relies on software. Software is in our cars, our phones, our smartwatches, our appliances, and our computers. It runs our subways, airlines, global shipping, and so much more.

We could fill pages with examples of companies that rely on software.

And the next years of growth will all be powered by bleeding-edge software. All of the innovations yet to be seen will run on software.

So while we could just buy QQQ and focus purely on tech… I believe we should also focus on tech’s rocket fuel.

One great way to gain general exposure to software companies is to buy the iShares Goldman Sachs Software Index Fund ETF (IGV). It holds 122 software companies powering our everyday lives.

But if readers are looking for the specific companies coming across my radar, then I recommend joining us at Outlier Investor as we explore the top companies of the next Roaring ’20s. You can learn more about that right here.

And the next time you order Domino’s, just think – you bought a pizza from a stealth tech firm.

The next Roaring ’20s is here. It’s only just begun. And stealth tech is one of the exciting ways that we’ll play this trend.

Talk soon,

Jason Bodner

Editor, Outlier Investor

*Note: The author holds a long position in Domino’s Pizza (DPZ).

Like what you’re reading? Send your thoughts to feedback@brownstoneresearch.com

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.