Dear Reader,

I received the following table from the private banking division of one of the major U.S. banks. It jumped out at me as a stark reminder of why the regional banking sector is in so much trouble, and why those troubles have been caused by the Federal Reserve.

Imagine having $100,000 on deposit at a bank. At the above deposit rates, that would earn a measly $250 per year in interest. And that’s normal for all banks. The national average is 0.24% a year for deposits.

Deposit rates like these seem counterintuitive. After all, the Fed Funds rate is now at 5%. And 3-month U.S. Treasuries are now yielding 4.8375%. This is the rate at which banks can purchase U.S. Treasuries and earn a yield on assets held at the bank (i.e. depositors’ capital).

Shouldn’t the banks be offering 3.5% or 4% deposit rates to its customers?

Yes, they should, but they’re not able to do that right now. As we learned in the collapse of Silicon Valley Bank (SVB), banks were incentivized to purchase safe U.S. Treasuries over the course of the last couple of years. Most opted for longer duration Treasuries in order to capture higher yields in a low interest rate environment. Treasuries are the safest asset in the world, right?

The problem, as we now know, is that the Federal Reserve kept hiking interest rates way above expected levels in the shortest period of time in history. It wasn’t necessarily the magnitude of the hikes that caused the problem, it was the speed at which they happened.

This is what caused the liquidity problem and saw the Fed and U.S. Treasury step in and provide liquidity through the Bank Term Funding Program (BTFP). The implementation of this program literally saved a countless number of regional banks from collapsing due to the same liquidity problems that SVB experienced.

The BTFP allows these regional banks to swap their long-duration U.S. Treasuries for cash. This provides these banks the liquidity that they need to deal with the capital outflows that have been happening in real time.

That should solve the problem, right? Actually, no. The banks are having to use their newfound liquidity to keep depositors whole and return the deposits to those that want to leave the bank. The banks can’t afford to pay higher deposit rates. They need the capital for operating expenses. And technically, the banks need to “pay back” the cash loans that they received through the BTFP and get their long-duration U.S. Treasuries back on their books within a year’s time. That’s something that we’ll be revisiting later this year as it will become very problematic for many banks…

In the meantime, this dynamic has grossly distorted the market. After all, we’re in an inflationary environment where the consumer price index (CPI) is coming in at 6%. That means that deposits are actually losing money throughout the year. And the reality is that real inflation, the kind that we feel every month for goods and services that we need, is much higher than 6%.

And it goes without saying that even those very limited few that have $25 million in deposits are only given a 3% deposit rate. The reality is that even at 3%, that’s not enough incentive to keep them around.

Which is why capital is fleeing the banking industry and exacerbating the liquidity problem, which will cause even more trouble for the banking sector. Or said another way, it will be the catalyst for even more support and stimulus from the U.S. government to keep the whole thing from collapsing.

Stick around tomorrow to find out where all the money is running to….

A few weeks ago, Amazon revealed that it is licensing its Amazon One palm-scanning system to popular fast-casual restaurant Panera Bread. This is the first time Amazon is deploying this technology outside of its own businesses. And it won’t be the last.

Longtime readers may remember the Amazon One system. It rolled out back in October 2020.

Amazon One is biometric identification tech. It links a consumer’s palm print to their Amazon account, a credit card, and a mobile phone number. This allows consumers to access a storefront and make purchases simply by scanning their palm.

Amazon has been using this technology at Amazon Go stores and certain Whole Foods locations. These are businesses owned by Amazon. And now the palm-scanning tech is coming to Panera Bread.

Amazon plans to implement this tech in 10-20 Panera stores this year. They will start in St. Louis and then expand to Seattle.

And the technology isn’t going to be exclusively for payments. Panera will integrate its customer loyalty program into the palm-scanning system as well.

Panera envisions scanning a consumer’s palm as soon as they walk in the store. That way when consumers get up to the cash register, the order-taker can address them by their first name. The order-taker will also be able to ask if the consumer would like to order the same thing they got last time. That adds a personalized touch.

From there, Panera Bread could start making special offers and upsells based on each consumer’s order history. With enough data, the system could produce customized recommendations for each customer.

This would be a convenience for customers, but it makes me wonder if Amazon has another motive…

As we’ve discussed before, advertising has become a multibillion-dollar business for Amazon. That’s happened in just the last three years.

If we go back to 2018, Amazon had nearly zero advertising revenue. Today, advertising accounts for 7% of the company’s overall revenue. Last year, that equated to $37 billion in ad revenue.

This makes me wonder if there’s a bigger play here. After all, what’s Amazon’s incentive to license out this technology rather than keep it in-house?

Well, an obvious answer is that Amazon would immediately see what its customers are buying “offline” at places like Panera Bread. That data could be used to strengthen Amazon’s data profile on each customer. Amazon will literally be able to track the purchase history of every consumer at locations where Amazon One has been deployed.

So it’s very likely a two-way street. Amazon provides the data it has on consumers to Amazon One licensees. And in return, it also gets to see what consumers buy from the companies who use its Amazon One technology.

If I’m right about this, Amazon is set to become a major player in the payments space. And I expect we’ll see a rash of new deals just like this one in the coming months.

I understand the business motivation for this. But on the other hand, I’m disappointed to see Amazon moving in this direction.

Years ago, I looked at Amazon as one of the few “good guys” that could simply design great services without collecting mountains of data on its customers for targeted ads and profiling. In that way, Amazon differentiated itself from the likes of Google and Facebook.

But the temptation was too strong to resist for long. Amazon might not be as intrusive as Facebook or Google, but I’m still disappointed that the company felt it had to resort to data-collecting practices to grow its business.

With all that said, if Amazon can build its payments business into something with the scale of Apple Pay or Google Pay, it could be in an even better competitive position as the largest online retailer, combined with the largest database of offline transactions. That would obviously be great for Amazon’s bottom line.

Big news on the space exploration front. Scientists just finished analyzing the asteroid samples brought back from the Hayabusa2 mission two years ago.

As a reminder, this was a Japanese mission to the asteroid Ryugu. It’s about 180 million miles away from Earth.

The idea here is that Ryugu was around during our solar system’s formation. So doing a deep analysis on material from the asteroid could give us insight into what the solar system’s original chemical composition looked like.

That’s why the Hayabusa2 mission was to autonomously collect samples from the asteroid and return them to Earth:

Source: NewScientist

Scientists conducted various tests and found that this sample contains uracil and some amino acids. Uracil is a building block for RNA, and amino acids are the building blocks for peptides and proteins. These are foundations for life.

This is absolutely a breakthrough. Up to this point, we’ve never been able to analyze a pure sample from an asteroid or meteorite.

We have analyzed crash sites where asteroids and meteorites collided with Earth… but those findings were always tainted. That’s because it’s impossible to know if materials from the Earth mixed in with materials from the extraterrestrial object.

We don’t have that same problem with this mission.

So the Ryugu sample provides strong evidence of a theory known as panspermia, which posits that the seeds of life arrived on Earth, and potentially other hospitable planets, through the arrival of these building blocks contained with asteroids and meteorites.

This is an incredible development, and there is more exciting news coming later this year…

NASA’s OSIRIS-REX mission is on track to land back on Earth in September. It is bringing home a sample from a 4.5 billion-year-old asteroid named Bennu.

Scientists will analyze that sample, just as they did the one from Ryugu. Comparing the two will give us even greater insights into what may be the origins of life in our universe.

We’ll wrap up today with an update on Elon Musk’s Boring Company.

For the sake of newer readers, The Boring Company’s focus is on building underground transportation systems beneath major metropolitan areas. And the first major project of the company has been under Las Vegas.

The Boring Company completed a 1.7-mile loop underneath the Las Vegas Convention Center about two years ago. It consists of two tunnels and three stations capable of reducing a 45-minute walk down to just two minutes.

And get this – The Boring Company just completed its one millionth ride in this underground tunnel dubbed the Vegas Loop. That’s an incredible milestone.

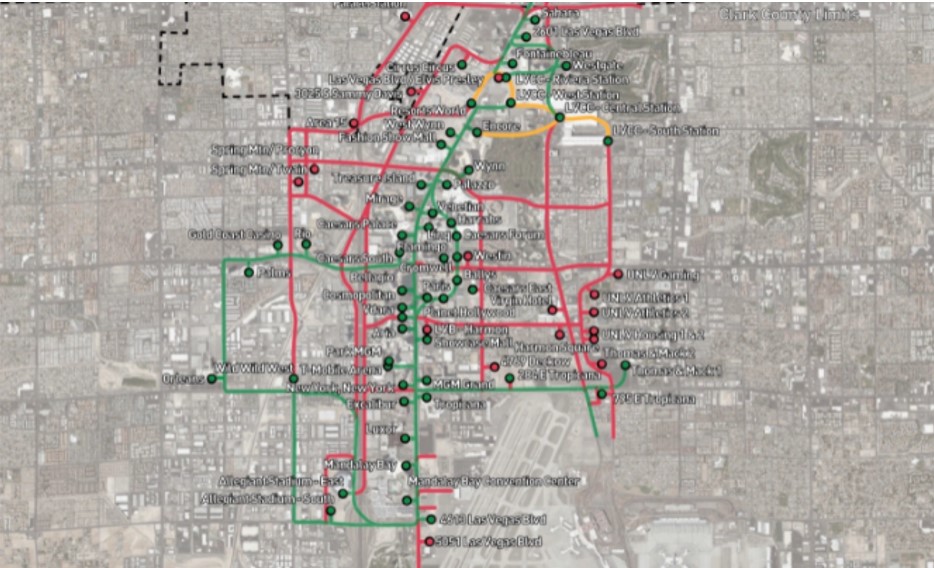

What’s more, The Boring Company plans to leverage this success into a much larger underground network. It just filed a new proposal to expand the Vegas tunnel system at far greater scale. Here it is:

Source: The Boring Company

The green routes we see here have already been approved by Las Vegas. The red routes are the proposed expansion.

The above image shows what could become 65 miles of tunnelling. And what jumps out at me is that these red routes would make the Vegas Loop accessible to a large part of the city’s population.

Talk about convenient. The expanded Loop would connect all the city’s major attractions, hotels, the University of Las Vegas, and of course, the airport. If approved, anyone in Vegas could navigate the city very quickly using the Loop.

And judging by some of the feedback from residents, the city badly needs a solution like this. With its many hotels and casinos, Las Vegas has always been a congested city. But with the introduction of an NFL team, an NHL team, and a flood of new residents from California in recent years, traffic is becoming unbearable.

It has been decades since there has been any innovation in transportation in the U.S. The Boring Company’s innovative boring technology has demonstrated the ability to bore tunnels in record time, and at a fraction of the cost of what typically happens in the construction industry. That’s why the approach is so appealing.

With the early success in Las Vegas, The Boring Company has already made several similar proposals in major metropolitan areas around the world.

Last April, The Boring Company raised $675 million in its Series C funding round at a $5.7 billion valuation. The company is cashed up and has the capital to build a large number of boring machines that will enable it to take on a number of projects. I’m excited to see which cities are next.

Regards,

Jeff Brown

Editor, The Bleeding Edge

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.

The Bleeding Edge is the only free newsletter that delivers daily insights and information from the high-tech world as well as topics and trends relevant to investments.